Recently, there have been several crucial developments among some ASX-listed companies across various sectors. Some of these stocks saw a surge in their prices following their respective announcements. Let’s uncover some of them.

Tech - 5GN gets another boost in the wake of strong Q4 cash flow numbers

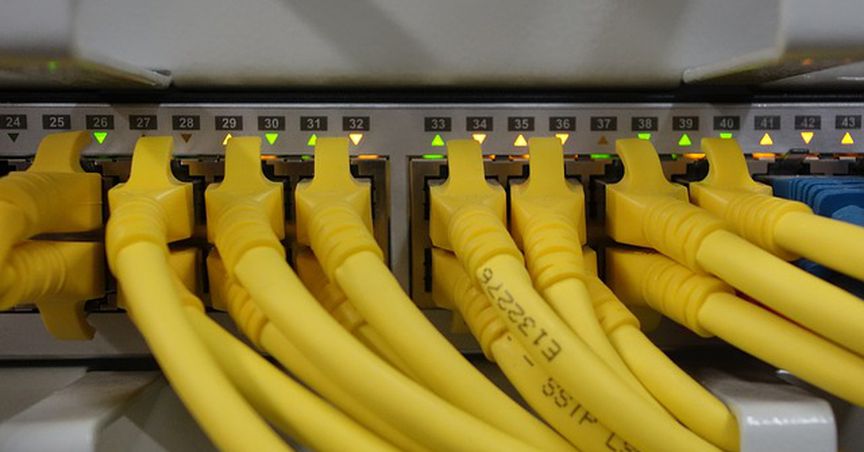

Being a licenced telecommunications carrier operating across Australia, 5G Networks (ASX:5GN) owns and operates its own nationwide high-speed data network with points of presence in all major Australian capital cities with a vision to lead the market for seamless access to an extensive range of digital business solutions.

Over the years, the company has seen significant growth as well as expansion and has generated cash efficiently. Recently, during the quarter ended December 2019, the Company achieved a record positive operating cash flow of $2 million principally fuelled by the shift of customers to high margin annuity services and synergy implementation.

Moreover, 5GN signed an indirect channel agreement with Servers Australia (one of Australia’s largest hosting providers) enabling 5GN to offer capacity across its city-based data centres with an initial 2-year term and a minimum spend of $750,000.

More highlights from the Company’s performance during the quarter are:

- Year to date operating cashflow of $3.3 million (including $586,000 of interest costs) is 58% higher than same period last year;

- Consistent cash receipts of $14.6 million; half year cash receipts of $28.1 million, a 19% increase on the same period last year;

- $4.6 million of new and re-signed revenue secured in the half demonstrates continued customer commitment and expansion of services with more than 80% of revenue contracted;

- Substantial cash balance of $2.8 million and an additional $2.2 million of available debt for funding targeted acquisitions;

- Investment in cloud network infrastructure and fibre roll out to Sydney CBD and St Kilda Road in Melbourne resulted in capital expenditure of $843,000;

- Distributed a maiden one cent fully franked dividend $580,000;

In addition to the above, 5GN successfully launched the indirect channel for faster penetration into new markets with several channel partner signing the same such as Servers Australia.

Under the agreement with 5G Networks, Servers Australia shall be reselling the 5GN Cloud solution together with high-speed fibre networking. This service securely connects diverse data centres to a national network footprint (high-speed).

The 5GN stock closed the day’s trade on 14 January 2020 at a price of $1.02, up by 22.15% intraday, with a market capitalisation of $54.76 million.

Infant Formula - Wattle Health ditches founders, makes pitch to get back trading

Wattle Health Australia Limited (ASX:WHA) was founded in 2011 and is committed to traceable and sustainable production to deliver Australia’s first vertically integrated organic dairy supply chain. WHA envisions to become a globally recognised company as a producer of sustainable certified organic premium products made in Australia that promote health and wellness at all stages of life.

Recently, while making changes to its Board, the Company appointed Dr Tony McKenna as the Group Chief Executive Officer and Managing Director effective from 13 January 2020. Concurrently, the CEO and Co-Founder Mr Karasavvidis agreed to step down from his role as CEO and resigned from the Board of the Company.

As a CEO for both Corio Bay Dairy Group (CBDG) and WHA, Dr Tony McKenna is entitled to a total package of $500,000 per annum including superannuation. Moreover, Dr McKenna’s current employment contract with CBDG entitles him a total package of $450,000 per annum, where the term of the contract is ongoing and subject to a 3 months termination notice.

Other resignations that followed were the resignation of:

- The Company’s ASEAN Sales Director and Co-Founder Mr Martin Glenister, and

- Ms Georgia Sotiropoulos from the Company as Executive Director (but remains as a key employee within the Company).

The Company expects a total saving of circa $3 million per annum on corporate overheads, administration, wages and marketing costs with the effect of the operational changes made to the staffing arrangement at WHA, the Board changes and other efficiency initiatives in place.

The Company is hopeful to leverage on the synergies created with CBDG and Blend & Pack (subject to the completion of the transaction) to accelerate a pathway to profitability and looks for opportunities to further improve efficiency of the Group operations.

The WHA stock last traded at a price of $ 0.530 (27 September 2019).

Cannabis - MMJ drops $2.2m on North American Harvest One

As a global cannabis investment company, MMJ Group Holdings Limited (ASX:MMJ) specialises in managing a portfolio of investments along the cannabis value-chain and owns a portfolio of minority investments. The Company aims to invest in the diverse space of emerging cannabis-related segments.

On 14 January 2020, MMJ and Harvest One Cannabis Inc. entered into a secured loan agreement of CAD 2 million issued on January 13, 2020 at an interest rate of 15% per annum and the principal and accrued interest on the loan payable in arrears within 60 days of the Issue Date, subject to certain exceptions.

Under the terms of the loan, HVT shall grant MMJ a security interest in all current and after acquired property of HVT and its subsidiaries, subject to certain permitted liens, and utilise the proceeds from the loan for general corporate purposes.

CEO of Harvest One, Grant Froese said:

MMJ is the largest shareholder of HVT holding 26% (2 MMJ holds 55,557,994 HVT shares as at 27 November 2019) of HVT which is one of the largest investments within the MMJ cannabis and hemp portfolio.

The MMJ stock closed the day’s trade on 14 January 2020 at a price of $0.160, up by 10.34% intraday, with a market capitalisation of $32.54 million.

Resource - Acquisition of the Historical High-Grade Antler Copper Mine

ASX-Listed Company, New World Resources Limited (ASX:NWC) is an Australian company focused on the exploration and development of mineral resources projects in North America. The Company has a portfolio of highly prospective mineral resources projects in North America, namely,

- the Tererro Copper-Gold-Zinc VMS Project in New Mexico, USA;

- the Colson Cobalt-Copper Project in Idaho, USA;

- the Goodsprings Copper-Cobalt Project in Nevada, USA;

NWC has recently secured the right to acquire a 100% interest in the high?grade Antler Copper Deposit in the mining?friendly state of Arizona, USA which is an advanced VMS deposit where around 70,000 tonnes of high?grade ore was mined between 1916 and 1970.

The new addition to the Company’s portfolio provides the Company potential to develop a low?CAPEX mining operation in the near?term since the Antler comprises of-

- high?grades deposits

- located in a Tier 1 mining jurisdiction with streamlined permitting protocols, with

- good infrastructure, and

- advanced stage of exploration and development

Results from previous drilling to test for the immediate down?dip extensions of the historically mined ore include:

- 66m @ 3.57% Cu, 6.63% Zn, 0.82% Pb, 34.4 g/t Ag and 0.34 g/t Au;

- 62m @ 2.80% Cu, 7.29% Zn, 1.61% Pb, 43.4 g/t Ag and 0.54 g/t Au;

- 18m @ 2.90% Cu, 12.58% Zn, 2.08% Pb, 63.1 g/t Ag and 0.42 g/t Au;

- 62m @ 2.47% Cu, 3.52% Zn, 2.81% Pb, 64.5 g/t Ag and 0.46 g/t Au; and

- 40m @ 1.51% Cu, 10.69% Zn, 1.95% Pb, 52.1 g/t Ag and 0.29 g/t Au.

The Company is optimistic about the excellent opportunity at a time when global markets have a very positive view on copper and looks forward to fast track the high?grade copper deposit, in a very supportive jurisdiction, back to production.

Moreover, the Company anticipate commencing initial mine design work shortly after the rapid access for drilling, which is scheduled to commence later this quarter, given the Antler Project offers a streamlined permitting framework.

The NWC stock closed the day’s trade on 14 January 2020 at a price of $0.017, up by 21.429% intraday, with a market capitalisation of $12.22 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.