Financial Services Australia

Australia has a robust financial services industry, and its financial capital â Sydney was ranked at the seventh place in âThe Global Financial Centres Index 24â for the year 2018, as per media reports. Sydney was ranked behind Honk Kong, Singapore, Shanghai & Tokyo among other financial centres from the Asia-Pacific region.

Australiaâs strength in the financial markets is underpinned by strong liquidity, substantial investment management business fuelled by mandatory retirement savings scheme, highly-traded currency, infrastructure financing and structured products.

According to Australian Trade & Investment Commission, the Australian government is committed to building a robust environment, having passed legislation, which led to a reduction in withholding tax rate on specified distributions from managed funds, and commenced a review of the taxation system in the country.

Further, the policymakers in the country have been focusing on simplifying the financial services regulations, and efforts were in place to negotiate mutual recognition agreement with key international markets. The country has already penned agreements with the US, Hong Kong and New Zealand.

Australia is the regional leader in the area of asset-backed securities, hedge funds, over-the-counter derivatives and corporate bonds. Immense opportunities are present in these areas, along with related areas serviced by investment banks.

Status Quo

The calendar year has witnessed Deutsche Bank saying good-bye to the Australian equities business professionals. These businesses are responsible for acting as a service provider to an enormous investment management industry, in the country that serves the savers. Ultra-low rates in the major developed economies are making the life of bankers increasingly difficult, resulting in less investment by bankers.

Jefferies Affair

Jefferies Financial Group Inc. (NYSE:JEF) is a diversified financial services company based in New York, USA. Jefferies is marking the close of its fiscal year on 30 November 2019, and the company has expanded its capabilities to new jurisdictions.

In the fiscal year for the period ended 30 November 2018, the company had recorded net income attributable to common shareholders of USD 1 billion, equating USD 2.90 per diluted share and paid USD 0.45 per share in dividends.

In Australia, the company is expanding its footprint led by Mr Michael Stock, a veteran investment banker. In its 2018 Investor Meeting, the company had mentioned about expanding its capabilities globally, including Australia. It had expanded its Investment Banking business in Australia, Benelux, and expanded its footprint in the UK.

Investment Banking business witnessed Managing Director expansion in the aforementioned regions and capabilities, including industrials, consumer & retail, TMT, financial services, healthcare, financial sponsors, municipal finance. It started offering products in the Equity Capital Markets along with Mergers & Acquisitions.

In early July this year, the company released its half-year results for the period ended 31 May 2019. It was mentioned that the company is working on expanding its footprint by onboarding professionals capable of research, sales & trading in Australia, Japan & Hong Kong.

In half-year 2019, its Investment Banking, Capital Markets & Asset Management business generated a pre-tax income of USD 218 million, and net earnings of USD 156 million. Investment Banking net revenues reached USD 726 million, which were below normal due to market conditions, and shutdown of the US Government.

Recently in September, the company reported results for its third quarter ended 31 August 2019 (Q3), the company recorded pre-tax income of USD 83 million and net earnings of USD 65 million from its Investment Banking, Capital Markets & Asset Management business for Q3 period. Investment Banking net revenues for Q3 was USD 403 million, and Equities & Fixed Income revenues reached USD 342 million.

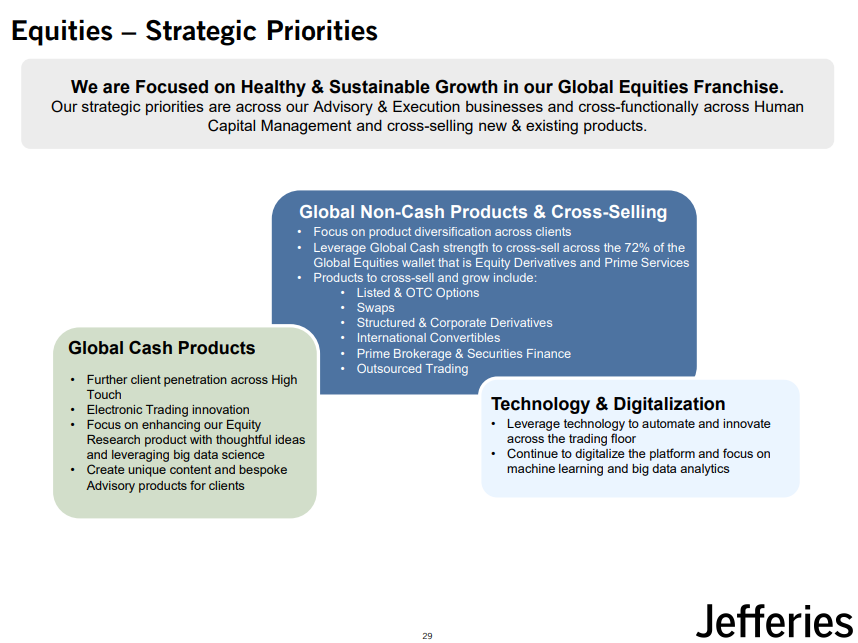

Equities Strategy (Source: Jefferies 2018 Investor Meeting Presentation)

In February 2018, the media had widely reported on Jefferies tapping a senior executive from Credit Suisse, Australia. Accordingly, Mr Michael Stock was hired by the company in a bid to carve out a presence in Australia.

Earlier, Jefferies did not have a presence in the robust Australian capital markets, whereas its peers from the country, and around the globe were operating in Australia. According to sources, Mr Stock was working with UBS Australia prior to joining Credit Suisse, and he was associated with Deutsche Bank in the European business before UBS.

Mr Stock has an experience of over twenty-five years in advisory capabilities, providing strategic advisory to private & public companies, private equity firms in the US, Europe & Australia. He possesses the expertise and valuable experience in public & private mergers & acquisitions, capital raising in primary & secondary markets for equity & debt, recapitalisation & public company defences.

Over the years, Mr Stock has been involved in multi-billion deals across the Australia capital markets. Some of notable transactions includes the merger of Nine Entertainment Co Holdings Limited (ASX: NEC) and Fairfax Media, the transaction between the Australian Government & Telstra Corporation Limited (ASX:TLS), the sale of Consolidated Media Holdings to News Corporation (ASX: NWS), and the merger between Vodafone Australia & Hutchison Australia.

In June this year, Jefferies was again in news for hiring in mass for its equities business, according to media reports. It was cited that the American investment bank has on-boarded close to 30 executives from CLSA in a bid to establish its Australian equities business. Mr Brian Johnson, a well-known banking analyst, is poised to be joining Jefferies Australia from CLSA, reports media.

Media has reported that the US investment bank is looking to start its institutional equities engine in Australia within months in a highly competitive market that saw Commonwealth Bank (ASX: CBA) & Nomura failing to capitalise, following the entry in institutional equities business.

It was noted that the senior executive from CLSA, mentioned that the brokerage has retained talented and experienced professionals across its business verticals. It was also said that the team remains strong, and new hires would be announced soon.

Further, it was said that the executives included senior management, desk staffs, and sector lead analysts. The US investment bank has been expanding its presence in the country aggressively that marked the entry in the Australian markets, with its advisory business within Investment Banking.

Recently, the news also broke through media, citing that the senior officials from RBC Capital Markets are set to join Mr Stock at Jeffries Australia. Sources mentioned that Tim Foy â who was heading the investment bankâs infrastructure capabilities, and Shyamal Chand â a Vice President are believed to be heading to Jefferies.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.