Passive investing uses market weighted indices and portfolio to invest funds in order to avoid fees of brokers and other expenses which are common for active investing. This type of Investing minimizes the buying and selling of securities and usually invests in a portfolio which mimics a representative benchmark such as S&P /ASX 200 and holds it over a long-term horizon.

Active Investing vs Passive Investing

Following the right way to invest passively can help:

- Owning markets (not stocks): If a company is well-capitalised and is being represented in an index, the key to passive investing is own it and all of its peers without picking up a specified stock.

- Own Asset classes (not just stocks): A lot of investors pick different stocks to diversify the portfolio, but a strong and powerful portfolio contains different asset classes. Asset classes are the group of financial instruments with similar behaviour and characteristics like public and private bonds, real estate, foreign equity, foreign debt, domestic equity etc.

- Rebalancing (not trading): It is consistently impossible to buy at lower prices and sell at higher prices. Usually the big gains tend to offset the losses incurred, leaving the investors with below market returns. Rebalancing the portfolio can help overcome this problem. Rebalancing refers to realigning the portfolio in order to establish better risk control and ensuring that the return of portfolio is not singularly dependent on a single security or a particular asset class.

- Avoiding emotions and not risks: The key is not to avoid the risk but to take the right kind and right amount of risk. Panicking and selling out when markets lose ground is not smart investing.

- Compounding instead of cashing it all out: It is advisable to rebalance the portfolio into more stable asset classes and compound the earnings instead of cashing out the investments in response to a panic in the market.

When you pay someone to beat the market, it comes with no guarantee of returns. Passive investing, therefore, accepts the market returns, diversifies the portfolio using various asset classes and reduces risks and expenses. Passive investing does not try to beat the market but simply tries to be the market itself. Certain benefits of Passive investing are as follows:

- Minimal Maintenance: Active investment strategies tend to outperform by monitoring, managing, reviewing, buying and selling securities and hence incurring a lot of expenses. Despite fund manager skills and safeguards, it is not risk free and includes the possibility of loss of the principal. Passive investors look for long term appreciation of their funds and attempt to replicate the holdings of established market indices, requiring minimum supervision and resulting in lower fees for the fund manager.

- Avoids Human Bias: The big challenge in active investing is to eliminate individual bias, impacting the fund performance. While adopting rule-based approach, passive investing can overcome this hurdle.

- Trims the tax bill: Index Investments are a great way to reduce taxes on investments. These arenât completely tax free but certainly qualify as the tax efficient investments. It is one of the best utilisations of Index Funds.

- Exhibiting discipline: During market fluctuations, it is easier to maintain market discipline in passive investments as there is a limited incidence of buying and selling.

Passive investing takes the lead in enhancing efficiency and transparency but at the same time it is not a risk-free investment. Some of the major risks in this type of strategy includes:

- Portfolio disconnection: Most of the investors assume that it is all safe and easy to manage the portfolio, neglecting the requirement of reallocation and changes to be made in the investments.

- Chasing Returns: Investor usually runs for the higher returns without having any exit strategy and passive investing is subject to stock market risk, purpose risk, inflation and interest rate risks and risks of taxation. Marketâs high and low can never be completely predicted and hence an investor should always have an exit strategy in mind.

- Mistiming Allocations: Passive investing may not be meant for investors close to retirement as time may not be by their side. Younger investors may want to incline towards equities in passive portfolio to capitalise on the longer time period required to manage volatility.

- Failing to adjust for taxes: Passive investments are usually tax advantaged due to its limited buying and selling, but tax issues are contingent on the types of investments held. Whilst investments may be passive, tax rates vary on each type of investment held and investors may need to be proactive in managing tax liability, the amount of profit generated, and the level of net income earned.

- Investing Emotionally: Humans tend to take actions emotionally. If passive investors all tend to exit the market in panic, then volatility will just happen faster through exchange-traded funds and index funds. Buying and selling at the wrong time may also result in further irrationality and panic.

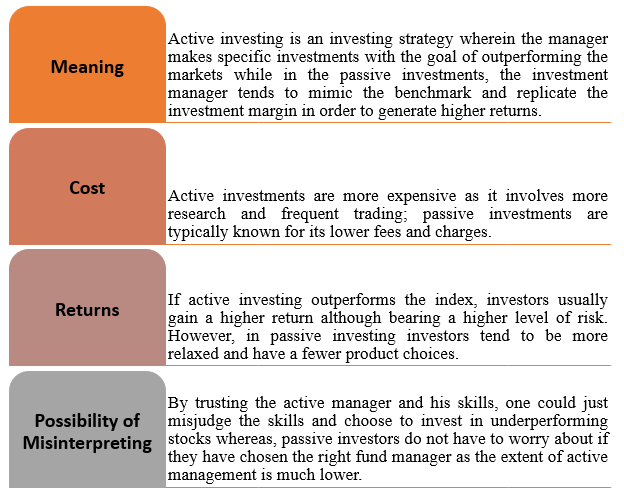

- Mistaking active investments for Passive ones: Investors have two main strategies which are used for generating return from investments, namely Active and Passive Investing. Investors tend to confuse between the strategies. These approaches depend on how the investing managers utilize the securities held with them over time. Whilst the Active manager focuses on outperforming the benchmark, the passive manager aims to replicate the return of the index.

- Equating Low cost with low risk: Passive investments, which are cheap, do not always imply that they less risky. Investors may be more entangled in risk than they think they might be.

- Ignoring global diversification: Even if an investor has an idea of what a 20-30-year portfolio return would be, he should know the path to get there. As per the saying, all the eggs should not be put in one basket. The portfolio should always be diversified. Portfolios which are globally diversified can help control the risks.

Keeping aside the potential benefits and risks for individual investors, high growth of passive investing resulted into the debate of what might happen in the securities market. Some possible implications are as follows:

Distortion of pricing of individual securities: One major concern of passive investing is that it might give rise to distortion of pricing of individual securities and add destabilising price dynamics by multiplying the trading patterns of the investors. Passive investors hence do not seek out the specifics of the individual securities leading to reduction in information embedded in prices of the stocks which further results to mispricing and misallocation of capital.

Alteration of relationship between issuers and investors: Active investors cannot really express their disagreements concerned with the securities included in an Index. A considerable number of passive investors in the marketplace may lead to the alteration of the motivation of corporate and sovereign fund managers to safeguard the interest of their investors.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.