Fonterra Shareholders Fund (ASX:FSF) is a fund under Fonterra Co-operative Group Limited. It is a global dairy nutrition company and is based in New Zealand. Owned by 10,000 farmers and their families, the fund focusses on delivering global dairy nutrition. Sustainability is their core strategy. Across four continents, the fund provides its brands, farming and processing operations.

Few of the most loved brands of the fund include Anchor, Tip toe, De winkel, and Primo. Today, the company announced that in a bittersweet moment, its classic ice cream company Tip toe was purchased by global ice cream giant Froneri. Due to settle on 31 May 2019, the sale for $380 million represents a gain of around $100 million, which would have a positive six cents per share impact on earnings.

Froneri is the worldâs 3rd largest ice cream producer. It caters to 20 countries with ice cream brands. The acquisition is another feather in their cap with the aim to become the world leader in the ice cream business.

Fonterra owned Tip Toe since 2011 and it remained intact as New Zealandâs lead player in the ice cream business. An average of three hundred and forty serves of Tip Top is consumed every minute of every day. In its 80-year history, various international brands have owned Tip Top. Froneri joined the tribe with this announcement.

CEO Miles Hurrell remained obliged to the ever-supporting New Zealanders who made the company maintain the top position. The brand requires continuous investment and focused ownership for the brand to remain sustainable for generations to come, and the company is currently not able to undertake.

Tip Top and K?piti use fresh cream and milk procured from New Zealand cows nurtured on grass. This is one of the major draw points for Froneri. Further, To ensure the participation of Fonterra farmers, the company has made an agreement with Froneri that these farmers would continue to supply milk to Froneri.

Along with this, the Fonterra cheese isnât going elsewhere! The company would continue to possess the global ownership of the K?piti brand. Hence, a license and not the ownership would be provided for ice cream to Froneri.

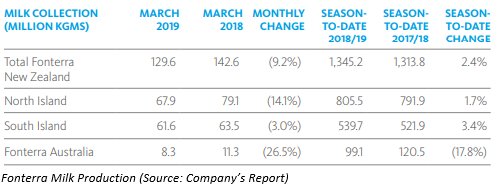

The company, in its global dairy update for April 2019 outlined the milk production across the continents:

- New Zealand had a production dip of 8%, in March compared to pcp, though exports went up 4%.

- Australia underwent a production dip of 13% in February 2019 compared to pcp. Export was up 7%.

- European Union had no change from last year whereas exports witnessed a slight up movement of 1%.

- The US milk production went down 0.4% and exports were up 6%.

Below is a table which shows Fonterraâs milk solids collected in New Zealand and Australia compared to the previous season:

Share Price Information:

On the technical front, the market cap of the company is A$426.68m. It closed at A$4.060, up 0.744% as on May 13th, 2019. It has generated a YTD yield of -7.36%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.