As per the announcements on ASX, all the six stocks have released updates on changes in directorsâ interest, appointment/resignation/retirement from the Board and changes in the shareholding.

Let us now have a detailed look at the updates for each of the stocks:

Magellan Financial Group Limited

Magellan Financial Group Limited (ASX: MFG) is primarily engaged in funds management.

The company recently released updates on the change in few of the MFGâs directorsâ interest, effective 29 July 2019.

- John Eales acquired 4,837 Units in Magellan Global Trust (ASX: MGG) for a consideration of $1.7628 per unit. Currently, he holds 77,616 ordinary shares in MFG and total 289,136 units in Magellan Global Trust.

- Karen Phin acquired 1,444 Units in Magellan Global Trust for a consideration of $1.7628 per unit. Currently, he holds 89,312 ordinary shares in MFG, 86,277 units in Magellan Global Trust and 19,049.0704 units in Airlie Australian Share Fund.

- Hamish McLennan acquired 1,441 units on 29 July 2019, for the consideration of $1.7628 per unit and now holds 100,248 ordinary shares in MFG and 86,088 units in MGG.

- Paul Lewis and Robert Fraser acquired 1,277 units and 3,250 units for the consideration of $1.7628 per unit in the Magellan Global Trust, respectively.

- Brett Peter Cairns acquired 1,240 units in Magellan Global Equities Fund at a consideration of $3.7672 per unit, 309 units in Magellan Global Equity Fund (Currency Hedged) at a consideration of $3.4174 per unit and 1,444 units in Magellan Global Trust at a consideration of $1.7628 per unit.

- Hamish Douglass acquired 319 units in MGE at a consideration of $3.7672 per unit, 277 units in MHG at a consideration of $3.4174 per unit and 247,052 units in MGG at a consideration of $1.7628 per unit.

Shareholding: The company also updated that it became a substantial shareholder for Spark Infrastructure Group, on 29 July 2019 with 5% of the voting power.

As per the companyâs release on 31 July 2019, it would publish the full year report ending 30 June 2019 on 13 August this year.

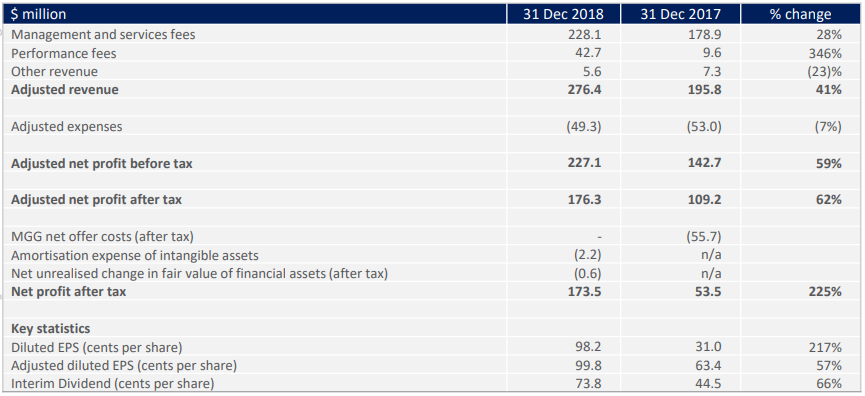

During the first half period ended 31 December 2018, the company reported adjusted revenue amounting to $276.4 million, up 41% on pcp. Net profit after tax for the period stood at $173.5 million, up 225% on prior corresponding period.

Financial Summary (Source: Companyâs Presentation)

The stock of MFG, last traded at a market price of A$61.25, down by 1.018% from its previous close on 01 August 2019.

Rural Funds Group

Rural Funds Group (ASX: RFF) is involved with leasing of properties and equipment related to agriculture.

Change in Directorâs Interest: The company recently updated that Michael Carroll, one of the Directors, on 31 July 2019 acquired 317 ordinary units under the Distribution Reinvestment Plan and currently holds a total of 27,940 units.

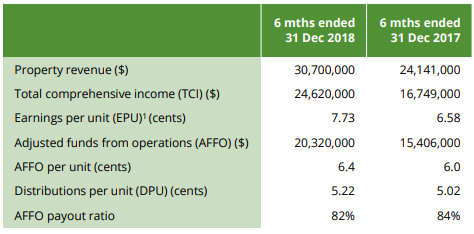

1HFY19 Highlights: During the six months period ended 31 December 2018, the company reported property revenue amounting to $30.70 million, up 27% in comparison to pcp revenue of $24.14 million. Adjusted funds from operations per unit, stood at 6.4 cents as compared to 6.0 cents in prior corresponding period. AFFO per unit is forecasted to be higher in the second half of the year owing to additional property revenue from acquisitions and lower expenses.

Key Metrics (Source: Companyâs Presentation)

Forecasts: The company has forecasted FY19 AFFO of 13.2 cents per units, FY19 distributions per unit of 10.43 cents and FY20 distributions per unit of 10.85 cents.

The stock of the company, last traded at a market price of A$2.35, up 1.732% from its prior close on 01 August 2019.

AdAlta Limited

AdAlta Limited (ASX: 1AD) is engaged in the development of protein therapeutics called i-bodies.

Non-executive Directorâs appointed: The company recently updated that Dr Rosalind Wilson has been appointed as a Non-Executive Director on 1 August 2019. The non-executive director holds more than two decades of experience in leading international pharmaceutical companies and smaller bio-techs. Most recently, she was the CEO of Factor Therapeutics (ASX: FTT).

Shareholding: In another announcement dated 29 July 2019, the company updated that CityCastle Pty Ltd ceased to be a substantial shareholder, with a reduction in percentage holding from 5.31% to 3.68%. Earlier in July 2019, UBS Group AG became a substantial shareholder with 5.12% of the voting power. The company had also updated on the change in shareholding of Yuuwa Capital LP and Platinum Investment Management Limited on 3 July 2019. Yuuwaâs voting power reduced from 39.40% to 32.90%. While, Platinum Investmentâs voting power reduced from 9.81% to 8.52%.

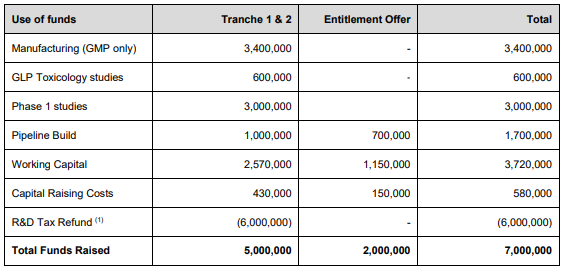

The company has proposed to raise funds through placement and offers, with the aim to utilise the funds for manufacturing of AD-214, pre-clinical studies and phase 1 trial of AD-214 and other general purposes.

Use of Funds (Source: Companyâs Prospectus)

The stock of the company, last traded at A$0.22, up by 7.317% from its previous closing price on 01 August 2019.

Janus Henderson Group Plc

Janus Henderson Group Plc (ASX:JHG) is an independent global asset manager.

Change in Directorsâ interest: The company recently updated that Kevin Dolan, Non-Executive Director of the company, on 29 July 2019, acquired 3,318 ordinary shares as a part of fee. Another director, Richard Gillingwater on the day mentioned before acquired 3,920 ordinary shares as part of Non-Executive Directorâs fee.

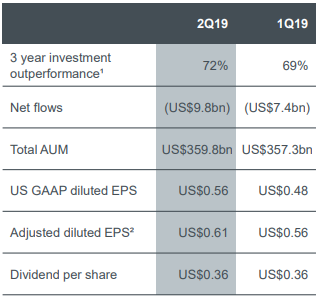

2HFY19 Highlights: Further, on 31 July 2019, JHG released 2Q19 results for the six months period ended 30 June 2019, wherein the company reported Assets Under Management amounting to US$359.8 million, reflecting the impact of stronger markets partially offset by net outflows during the quarter. Adjusted diluted EPS for the period stood at US$0.61. During the period, the company declared per share dividend of US$0.36.

Key Metrics (Source: Companyâs Presentation)

The stock of the company, last traded at a market price of A$27.93, down 12.197 % from the last close on 01 August 2019.

Kathmandu Holdings Limited

Kathmandu Holdings Limited (ASX: KMD) is into designing, marketing and retailing of apparel and equipment for outdoor and more.

Directorsâ Retirement/Appointment: The Board of the company recently, on 1 August 2019 appointed Andrea Martens as an independent director of Kathmandu Holdings. Also, Sandra McPhee would retire as a Director on the Board during September 2019.

Shareholding: The company notified the exchange that Accident Compensation Corporation became a substantial shareholder with 5.029% of holding.

1HFY19 Highlights: During the first half results released on 27 March 2019, the company reported group sales amounting to NZ$232.0 million, up 13.3% on prior corresponding period. Normalised EBIT was reported at $19.8 million, up 10% on pcp and normalised NPAT was reported at $13.2 million, up 7.3% on pcp. Sales to North America amounted to $28.7 million and EBIT stood at $3.7 million.

1HFY19 Results Summary (Source: Companyâs Presentation)

The stock of the company, last traded at a market price of A$2.03, down by 1.932% from its last close on 01 August 2019.

Funtastic Limited

Funtastic Limited (ASX: FUN) is an international distributor of toys, sporting, confectionery and lifestyle goods.

Board Changes: Shane Francis Tanner stepped down from the position of Chairman from 31 July 2019, after serving a tenure of 10 years. The company recently updated that Bernard Joseph Brookes will move in as the new Chairman from 01 August 2019, with ratification of appointment by the shareholders on 18 November 2019. David Jackson was appointed as the new CEO of the company from 02 May 2019.

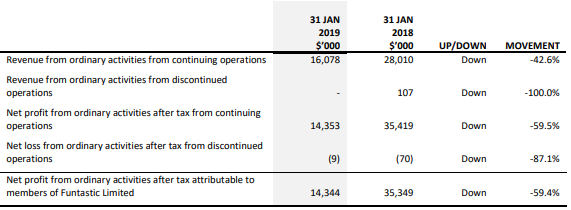

Financial Update: On 31 March 2019, the company announced its financial results for the six months ended 31 January 2019. During the period, the company generated revenue amounting to $16.1 million. EBITDA loss during the period was reported at $0.8 million. Net profit after tax for the six months stood at $14.3 million, majorly driven by NAB bank restructure in September 2018.

Financial Highlights (Source: Companyâs Report)

Outlook: The company expects revenues and margins during the second half to be lower than the original expectation due to delays in initiatives such as floral beads launch, toy story 4 launch, re-launch of new Pillow Pets range etc. The initiative, earlier planned for 2HFY19, have now been delayed until the first half of FY20. Therefore, the company is expecting to remain in operating losses in the second half of the year.

The stock of the company, last traded at a market price of A$0.067, up by 3.077 percent from the prior closing price on 01 August 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.