Medibank, a health insurance stock is all set for turnaround following the recent updates viz. decent FY 19 results, higher health premiums expected in FY2020 along with various measures taken by the management to improve business efficiency.

Medibank Private Limited (ASX: MPL)

Medibank Private Limited is a private health insurer which provides underwriting and distribution of private health insurance policies under its two brands ahm and Medibank. The company is also a provider of health-related services through the Medibank Health businesses, which capitalise on Medibankâs expertise and experience, and support the Health Insurance business. To broaden the provision of health-related services, the company acquired Home Support Services Pty Ltd in August 2018.

Medibank to revise premium from 1 April 2020

Amidst rising household budgets, affording a private health insurance is one of the biggest challenges which Australian consumers are facing. Health insurance premiums are set to witness an upside starting April 2020 as the government approved an average premium hike of ~2.92% across industry, which is the lowest hike in last 19 years. Following this Medibank got an approval to raise the average health premium for both ahm and Medibank by ~3.27% which is still lower than the hospital services inflation of ~3.8%.

The companyâs chief customer officer said in a release that the company will continue to work on delivering great value to its customers by reducing unnecessary cost and making business more efficient. Last year, Medibank delivered benefits amounting to ~$5.4 Billion which includes ~500,000 surgical procedures, ~1.3 million hospital admissions and ~24.3 million extras services.

Other Key Highlights during the year are as follows:

- The company started a preventative health program âLive Betterâ. This will assist consumers in saving ~ $200 on their premiums;

- To improve the health support, MPL arranged treatment at home for its customers and arranged ~1.5 million personalised health interactions;

- It introduced a new 24/7 mental health phone support line for its hospital policyholders;

- Offered a new premium discount to all 150,000 young adult customers.

FY19 result highlights

FY 19 was a good year for both the company and its shareholders. Medibank recorded a strong net profit after tax of $458.7 million and distributed ~80% of this in terms of a fully franked dividend of 13.10 cps to its shareholders. This payout ratio was on the higher side of targeted range.

Effective 2020, MPL has revised its dividend policy and is expected to distribute dividend in the range of 75% - 85% of underlying NPAT. During the year, the company was able to increase its market share by 5 basis points (first time in last ten years) along with very high levels of Service Net Promoter Scores across the segments.

During FY19, the company recorded ~1.3% annual increase in its Health Insurance operating profit to $542.5 million. Also, the companyâs net profit after tax increased 3.2% annually to $437.7 million and operating profit grew ~1.9% annually to $528.5 million. MPL is continuously focusing on managing cost as they delivered a productivity savings of ~ $40.4 million over the past 2 years. Going forward, the group is expected to save additional $50 million sin next 3 years out of which ~$20 million will be in this financial year.

Outlook for FY20

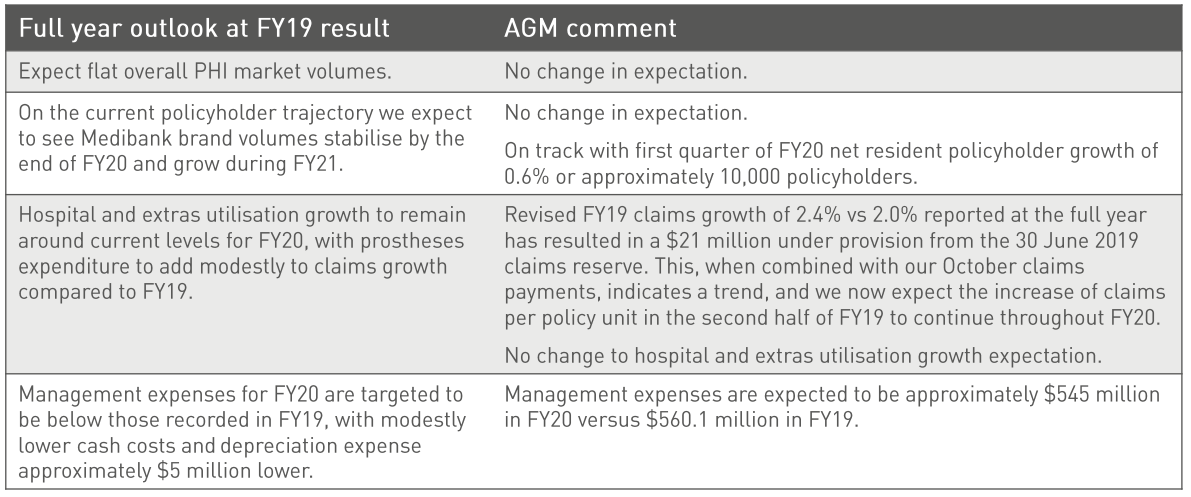

MPL has confirmed that claims were higher than expected which resulted in a $21 million under provision in claims reserve from 30 June 2019. As a result, underlying claims growth per policy unit increased to 2.4% against 2.0% reported earlier. Following higher prosthesis costs and higher hospital payments, claims per policy are expected to remain higher throughout FY20.

Amidst challenging industry dynamics, MPL is expected to focus on increasing policyholder numbers. During the first three months of FY20, the group recorded ~0.6% growth in its net resident policyholders, ~2x compared to 1QFY19 numbers.

The group is expecting that policyholder volume for Mediabank brand will stabilise by the end of FY20 and will grow in FY21. Further, the group is expected to portfolio management and payment integrity along with cost management. Following these, FY20 management expense is expected to be ~$545 million.

Outlook for FY20 (Source: Companyâs Report)

Stock Performance

The stock of MPL closed the dayâs trading at $3.255 per share on 11 December 2019, up by 0.463% from its previous closing price. The company has a market capitalisation of $8.92 billion as on 11 December 2019, with an annual dividend yield of 4.04%. The total outstanding shares of the company stood at 2.75 billion, and its 52-week low and high is $2.274 and $3.654, respectively. The stock has given a total return of -4.99% and â3.75% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.