We will be discussing four banking stocks which have delivered positive returns during the last five trading sessions. We will be looking at the recent operating activities of these banks along with price movement during the last one week. Letâs have a look at the four major banking stocks which have a prominent presence in Australia along with decent balance-sheets. These stocks have paid healthy dividends to their investors and have decent dividend yields.

Commonwealth Bank of Australia (ASX:CBA)

Commonwealth Bank of Australia (ASX:CBA) is engaged in providing integrated financial services and specializes in retail and commercial banking in several geographies like Australia, New Zealand, United Kingdom, United States, China, Japan, Singapore etc. On 14th November 2019, CBA proposes to issue subordinated, unsecured notes named CommBank PERLS XII Capital Notes (âPERLS XIIâ) of approximately 7,500,000 units.

Tepid Macro Scenario to affect Profitability

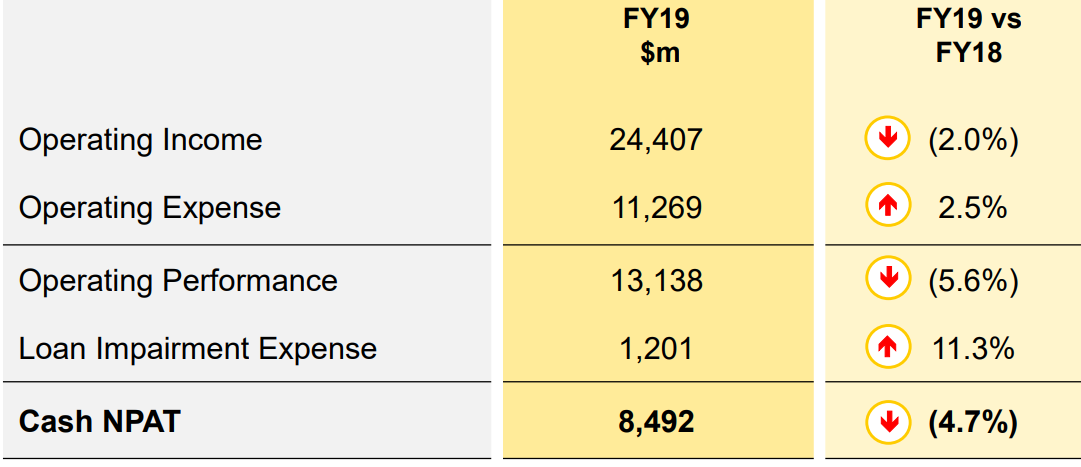

- For FY 2019, the bank posted operating income at $24,407 million down by 2% on y-o-y basis while cash NPAT came in at 4.7% lower at $8,492 million on y-o-y basis. The company reported subdued contribution from its CommInsure Life segment on account of loss recognition, higher claims and lower premiums.

- Transaction deposit balances, during the year, grew at 9% on y-o-y basis at $169,648 million.

- During the year, Net interest income declined by 1.2% as volume growth was offset by lower home loan margins and higher funding costs due to elevated basis risk.

- The Bank reported 4% growth in Business lending aided by growth in diverse sectors, particularly business services and transport.

FY19 Financial Highlights (Source: Companyâs Report)

Outlook: The Management highlighted a tepid macro environment scenario while expects improvement in the housing market with improved clearance rates, stabilization of prices across Sydney and Melbourne, and marginally higher housing credit growth.

Stock Update: The stock of CBA closed at $78.770 as on 11 October 2019. The stock has a market capitalization of $138.26 billion. The stock has delivered -2.24% and -3.87% returns during the last one-month and three-months, respectively. The stock has gained 0.66% during the last five trading sessions. The stock has a dividend yield ratio of 5.52% on an annualized basis.

Australia and New Zealand Banking Group Limited (ASX:ANZ)

Australia and New Zealand Banking Group Limited (ASX:ANZ) provides a cluster of financial services like retail and corporate banking services followed by insurance and financial advisory services. The bank carries out its operations across Australia, New Zealand, UK and in the Asia Pacific.

Higher provisioning likely to affect FY19 profitability:

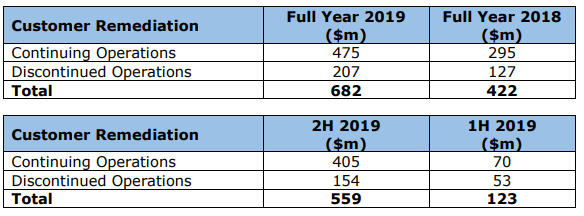

- On 08 October 2019, the Bank cited that the profitability in the second half of 2019 will be affected by $559 million due to higher provisioning related to customer remediation. The bank further cited that within continuing operations, remediation charges recognized during the second half of FY19 is likely to be $405 million after-tax ($485 million before tax). The remediation charges were primarily due to product reviews in Australia Retail & Commercial for a fee and interest calculation and related matters

- For the discontinued segment, the Bank is expected to recognize remediation charges at around $154 million after-tax ($166 million before tax) in the second half of 2019. The charges are primarily related to the advice remediation program and customer compensation charges for other Wealth products.

- During H1FY19, Australia and New Zealand Banking Group Limited reported statutory profit after tax at $3,173 million, down 5% over prior corresponding period while customer deposits stood at $493.4 million, up 4% y-o-y while Gross Loans and Advances increased by 3% on y-o-y and stood at $613.8 million as on 31 March 2019. Cash profit on a continuing basis during the first-half year came in at $3,564 million, higher by 2% from H1FY18. The business reported a return on equity at 12% during the first half of 2019.

FY19 Estimated impact on ANZâs Profits (Source: Companyâs report)

Outlook: The management commentary they highlighted that the Bank is well aware of the impact of the reduced profitability during the second half of the financial year 2019 and will focus on fixing the issues in coming quarters. The Bank has entrusted 500 specialists to get any money which is due to customers sent back on priority.

Stock Update: The stock of ANZ closed at $27.490 with a market capitalization of $77.04 billion as on 11 October 2019. The stock has delivered -1.27% and 5.84% returns during the last three-months and six-months, respectively. The stock has gained 0.04% during the last five trading sessions. The stock has a dividend yield ratio of 5.89% on an annualized basis.

National Australia Bank Limited (ASX:NAB):

National Australia Bank Limited (ASX:NAB) is engaged in banking activities across Australia, New Zealand, Asia, UK and the US. The Business focuses on a wide range of financial products like banking, loans, credit and debit card services, investment banking, wealth management, leasing, housing and general finance, funds management etc.

Additional Expenses to impact FY19 Bottom-line:

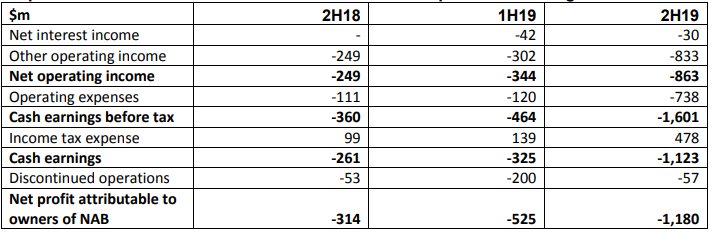

- Recently, the Bank cited that Business will be impacted by an additional expense of $1,180 million after-tax ($1,683 million before tax). As per the Management commentary the Bank has incurred higher provisions for customer-related remediation and a change to the application of the software capitalization policy. The above methodology is likely to reduce 2H19 cash earnings by approximately $1,123 million after tax and earnings from discontinued operations by an estimated $57 million after tax.

- The 2H19 result will include expenses of $832 million after tax. The primary driver of these additional charges is inclusion of a provision for potential customer refunds of adviser service fees paid to self-employed advisers.

- The company has made provisions relating to the allowance for the customer refunds based on total ongoing advice fees of approximately $1.3 billion received between 2009-2018. The refund rate was assumed at 36% or approximately 55% including interest costs.

- The Bank has executed Consumer Credit Insurance sales through certain Business channels which were related to a previously disclosed remediation program arising from an ASIC industry-wide review. Higher Provisions reflect higher refund rates based on experience to date.

- Non-compliant advice provided to Wealth customers is being addressed as part of the businessâs ongoing wealth advice review. Provisions have been increased mainly to cover higher expected costs and a higher assumed refund rate for the program.

- During H1FY19, the Bank posted $2,694 million of statutory net profit along with Group Common Equity Tier1 (CET1) ratio at 10.4%. The Board of Directors announced a fully franked dividend of 83 cents during the first half of financial year 2019. The Annualized dividend yield of the stock stands at 6.5%.

Impact of customer-related remediation and software capitalization (Source: Companyâs Reports)

Stock update: The stock of NAB closed at $28.200, up by 0.642% as on 11 October 2019. The market capitalization of the stock stands at $80.78 billion and the stock is available at a price to earnings multiple of 13.66x. The stock has generated positive returns of 4.32% and 13.76% during the last three-months and six-months, respectively. The stock has generated 0.61% returns during the last five trading sessions. The stock has an annualized dividend yield of 6.5%.

Macquarie Group Limited (ASX:MQG)

Macquarie Group Limited (ASX:MQG) operates in banking, financial, advisory, investment and funds management services across Australia, Asia Pacific, Europe, Middle East and America. Recently the company has informed that it has received more than 53,000 applications for its share purchase plan (SPP) continued from 28 August 2019 to 20 September 2019. The company issued approximately 5.7 million fully paid ordinary shares for $679 million at a price consideration of $120 per share.

Current Financial Position Came above minimum requirements:

The Company provided Q1FY20 (quarter ended 30 June 2019) operating highlights, the snapshot of which is listed below.

- The Management highlighted that the operating group net profit during the quarter came broadly in line with 1Q19 and slightly down on 4Q19.

- During the quarter, the Bank reported the groupâs capital surplus at $5 billion, Bank CET1 ratio at 12%, Leverage Ratio at 5.4%, LCR at 166% and NSFR at 111%.

Outlook: The Management is expecting FY20 operating performance marginally below FY19âs operating results. The management further expects the impact of foreign exchange, potential regulatory changes and tax uncertainties.

Stock update: The stock of MQG closed at $129.39, up by 2.18% as on 11 October 2019. The market capitalization of the stock stands at $44.87 billion and the stock is available at a price to earnings multiples of 14.34x. The stock has corrected by 1.08% and 3.03% during the last three-months and six-months, respectively. The stock has generated 0.15% return during the last five trading sessions. Current dividend yield of the stock stands at 4.54%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.