A leading telecommunications and technology company based in Australia, Telstra Corporation Limited (ASX: TLS), competes in all telecommunications markets and offers a full range of communication services. The company provides retail mobile services, retail fixed bundles, standalone data services and retail fixed standalone voice services.

Telstraâs shares hit a 52-week high of AUD 3.50 this morning, closing at the same level. The share price of the company rose about 1.5 per cent today. Besides, TLS has generated a YTD return of 25.74 per cent. As per market analysts, several factors have contributed to the rise in Telstraâs stock price, one key factor being the decision of the Australian Competition and Consumer Commission (ACCC) to oppose the TPG Telecom (ASX: TPM) and Vodafone Hutchison (ASX: HTA) proposed merger.

Last week, the ACCC rejected the TPG-Vodafone planned merger raising concerns of reduction in competition in the telecom sector with the merger. According to ACCC, the merger would prevent TPG Telecom to join as the 4th mobile network operator in Australia. The ACCC favoured TPG competing actively against Optus, Vodafone and Telstra in the mobile services market rather than entering as a merged entity with Vodafone.

In the wake of ACCCâs decision, the TPG Telecom intended to launch legal action in the Federal Court. The market analysts believe that while TPG Telecom and Vodafone Australia will be appealing the decision in the Federal Court, the decision is likely to be made in favour of ACCC. And if the decision favoured ACCC, Telstra will benefit greatly. According to the analysts, if the ACCCâs decision wins, it will lead to an improved competitive environment.

Recently, offering a 49 per cent stake in its new unlisted property trust, Telstra hired UBS to look for an interested buyer. The trust would consist of 37 strategic telecommunication exchange sites located in Australian capital cities and major metropolitan areas.

The company paid a fully franked interim dividend of 8 cents per share at the end of March including 5 cents per share of ordinary dividend and 3 cents per share of special dividend.

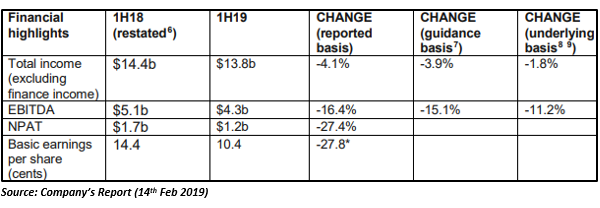

On 14th Feb 2019, Telstra announced its half-year results for FY 2019. The company reported a total income of 13.8 billion dollars and NPAT of 1.2 billion dollars during the period.

The companyâs stock is currently trading at AUD 3.500 (at 3:05 PM on 16th May 2019), up by 1.156 per cent in comparison to the previous closed price. A massive number of shares (18,509,602 shares) are presently trading on the Australian Securities Exchange. The stock is trading at a 52-week high value of AUD 3.500. The market cap of the companyâs stock valued at AUD 41.15 billion at the time of writing the report. From the beginning of this week, the stock remained in the positive territory and closed in green each day.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.