As a technology platform, Tinybeans Group Limited (ASX: TNY), operates to connect parents with the highly dependable digital tools and resources to help every family thrive. The user base of Tinybeans has touched 3.55 million members mark with more than 1.28 million monthly active users spread in over 200 countries/territories.

Based in Australia, TNY is known for operating a mobile and Web-based platform, called Tinybeans, which facilitates its users to record innumerable moments and milestones of their family and friends. Since its inception in March 2012, Tinybeans reached its 2 million user base milestone during November 2017.

Letâs throw some more light on TNYâs recent performance.

TNYâs revenue up by 91%

Tinybeans recently announced results for its September Quarter (Q1 FY20). During the quarter, the companyâs registered users hit 3.55 million mark, representing growth of over 210,000 new users in the last three months. The major highlights for Q1 FY20 are as follows:

- Revenue up by 91% on Q1-FY19 to an amount of $1.12 million for the quarter;

- Monthly active users grew to over 1.28 million, up by 50,000 as compared to the previous quarter and 27% on Q1-FY19;

- Brand Partnerships pipeline has grown to USD $3.4 million, up over 60% on Q1-FY19, with the average deal size growing 111% to USD $70,000;

- Premium revenue for Q1-FY20 was a record $229,000, up by 41% on Q1-FY19 with total paid subscriptions hitting over 17,300;

- Successfully raised $5 million in an oversubscribed placement at $1 per share;

- Cash burn for Q1-FY20 of $651,000, comprised of $82,000 one off costs (largely capital raise related), $366,000 core product related, and $203,000 product invest related;

Tinybeans Chief Executive Officer Eddie Geller Commented:

âWeâre pleased to deliver a solid start to FY20 by nearly doubling the revenues on the same period 12 months earlier. Also encouraging is that we achieved solid growth in all key metrics while beginning to make more longer-term investments with the proceeds from the capital raiseâ

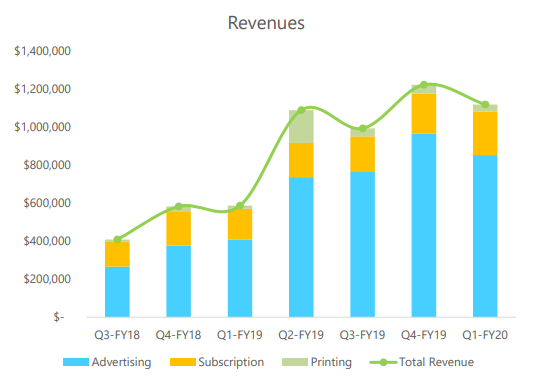

The major part of TNYâs revenue was composed of the revenue from advertising. Moreover, revenue from increasing TNYâs premium subscription also witnessed growth during the quarter, with new users committing towards TNY.

TNY Revenue Growth (Source: Company's Report)

TNYâs advertising sales channel grossed over USD 3 million

As a significant investment in the brand partnership and advertising teams during the quarter, TNY made hires with each having over 20+ yearsâ experience in media and data. Being far-sighted, Tinybeans anticipates gaining leverage through the expertise and associates of the hires over the coming years.

Over the quarter, TNYâ strategy of partnering with larger brands has fuelled its growth in increasing the advertising sales channel. As a matter of fact, the channel has grossed to over USD 3 million, doubling within the past two months.

Setting higher benchmarks, Tinybeans anticipates deeper and long-term partnerships with a greater number of larger brands over the year.

TNYâs Cash balance stands at $5.15 million

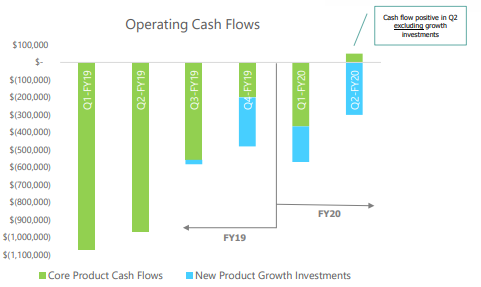

During the quarter, TNYâs cash burn amounted to $651,000, which did not include the one-off costs of $82,000 (mainly related to raising capital). The operating cash burn for the quarter of $ 569,000 (excluding one-off costs), was up by $169,000 than previously indicated.

Figure 2 Operating Cash Flows (Source: Company's Reports)

TNY managed to sustain a cash balance of $5.15 million as at 30 Sept 2019.

According to the TNY reports, the operating cash burn was largely determined by the following:

- Q1 advertising quarter a softer quarter than anticipated, with several key deals delayed into subsequent quarters

- Accelerating hiring led to an increase in recruitment and hiring costs across the brand partnerships team

- Shift to building scale with a growing pipeline of new, larger advertising partners â leveraging Lego success â extends sales and payment cycles

The company is now aiming for bigger advertising partnerships. As an implication of the above, Tinybeans assumes to become cash flow positive by the next quarter of the FY20 for the core product.

Moving steadily upwards, Tinybeans forecasts growth in revenue during Q2 versus Q1, with gross margin at around 91%.

Product changes for TNY

With its 12-month retention currently standing at 75%, TNYâs culture provides a committed and budding environment for innovation and experimenting with different strategies with an attempt to increase the conversion of signed-up users to active users and ultimately to long term retained users.

TNYâs core product changes during the Q1 are as follows:

- App-based feed recomposition to drive more time spent in-app and overall engagement

- Enhanced user onboarding to driving better conversion and retention

- Updates to support iOS13 release

- Created the âSign in with Tinybeansâ feature which is the foundation for the marketplace strategy

- Many enhancements to ad loading to drive performance, viewability and in turn revenues

- New Android image editor to enhance the Android user experience.

TNYâs AGM date announced

The Annual General Meeting of Tinybeans is scheduled to be held on 13 November 2019. As per company reports, TNY looks forward to inculcating technology demonstrations, providing business priority updates and access to the directors for the investors, in an attempt to make the AGM innovative for its investors.

With its global expansion, TNY looks forward to developing brand deals in the regions of mid-west and the west coast of the U.S. Moreover, TNY is currently executing its strategy to make careful investments for providing continued growth and generate diversified revenues.

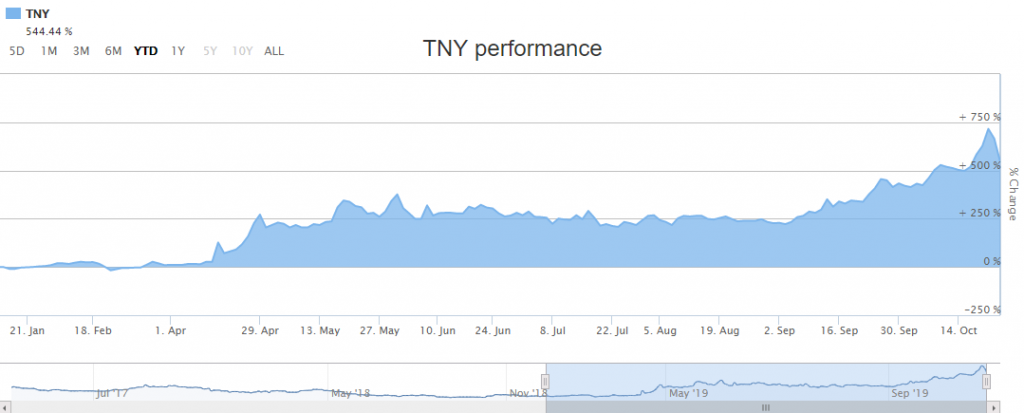

TNY Stock provided 544.44% return in YTD period

On 23 October 2019, TNY stock was trading at a price of $ 2.040, surging up by 10.345 percent (at AEST 1:14 PM), with a daily volume of ~ 41,943 and a market capitalisation of approximately $77.23 million.

TNY Stockâs YTD Return (Source: ASX)

Over a period of last six months, TNY stock has increased by 196.35% as on 23 October 2019. Moreover, on a year to date basis, TNY stock has increased by 544.44 % as on 23 October 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.