The companies that often pay progressively increasing dividends over time, belong to the class of income stocks which also tend to have high return yields. It is also well known that income stocks are usually less volatile than the stock market as a whole and offer dividend yields that are greater than the market average. Various investors are fond of income stocks as they seek a portion of the corporate profits and can rely on the steady streams of revenue that these companies generate.

Letâs take a look at the following Australian Income stocks.

Transurban Group

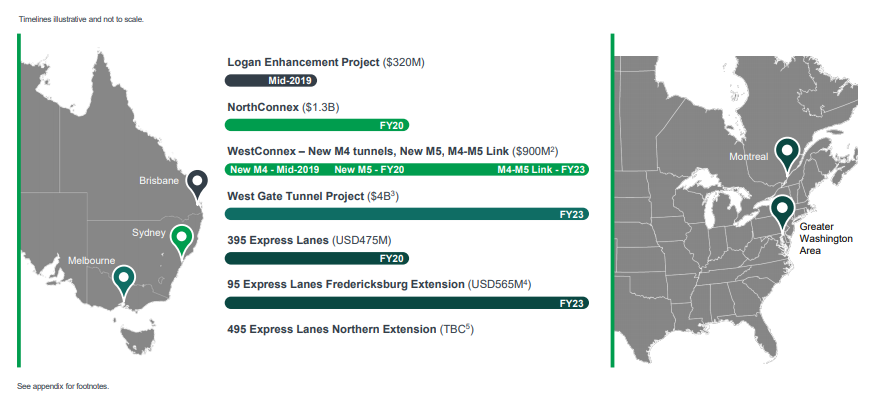

Transurban Group (ASX: TCL), based in Victoria, Australia is an industrials sector company, engaged in developing, operating, managing, maintaining, and financing urban toll road networks across Sydney, Melbourne, and Brisbane, as well as overseas in the Greater Washington area, United States, and Montreal, Canada.

The companyâs market capitalisation stands at around AUD 40.32 billion and the TCL stock was trading at AUD 15.2 (at AEST 1:36 PM) on 24 July 2019, edging up 0.863% by AUD 0.13, with ~3.07 million shares traded. In addition, TCL has generated positive return yields of 26.11% over the last 6 months and 30.48% YTD.

Transurban Groupâs annual dividend yield is around 3.92% to date (as per ASX).

Dividend Distribution â The company announced a partially franked (AUD 0.020 franked per security) dividend of AUD 0.30 on 21 May 2019 for fully paid ordinary shares, as well as units stapled securities with a record date of Friday 28 June 2019 and the payment date of 9 August 2019 with respect to the six month period ended 30 June 2019.

Subsequently, on 19 July 2019, the company announced that security holders representing 3.00% of issued capital have elected to participate in the Distribution Reinvestment Plan (DRP). The DRP issue price is $15.1549 per stapled security, representing a VWAP calculated for the 10-trading day period from 4 July 2019 to 17 July 2019 inclusive.

Private Placement - On 27 June 2019, Transurban Group informed the stakeholders that its financial vehicle, Transurban Finance Company Pty Limited had priced a EUR 350 million private placement of senior secured 15-year notes under the Euro Medium Term Note Programme. The settlement was anticipated to take place on 3 July 2019, subject to regular conditions and the pricing was concluded on 26 June 2019

The proceeds from the Notes (maturity in July 2034) was indicated to be directed towards swapping fixed rate Australian dollars and would be further used for general corporate purposes and to fund the development pipeline.

Earlier on 16 May 2019, Transurban Finance had settled another ⬠600 million worth of senior secured 10-year notes under the same programme.

The companyâs near-term goals include delivering committed projects, maximise operational performance and enhance customer and community offerings.

Source: Investor Day Presentation

Sydney Airport

Sydney Airport (ASX: SYD) operates the Sydney, Australia airport and also develops and maintains the airport infrastructure and leases terminal space to airlines and retailers. SYDâs market cap stands at around AUD 18.35 billion with ~ 2.26 billion shares outstanding. On 24 July 2019, the SYD stock was trading at AUD 8.135, edging up 0.062 percent by AUD 0.005 with ~1.24 million shares traded (as at AEST 1:36 PM).

In addition, SYD has delivered positive return yields of 25.08% in the last six months and 22.26% YTD. Besides, Sydney Airportâs annual dividend yield stands at 4.74% to date (as per ASX).

Dividend Distribution âOn 24 May 2019, Sydney Airport declared a dividend of AUD 0.195 on for fully paid ordinary shares, as well as units stapled securities with a record date of Friday 28 June 2019 and payment date of Thursday, 15 August 2019, relating to the period of six months ended 30 June 2019. Subsequently, on 22 July 2019, the company updated that it also has a Dividend/Distribution Reinvestment Plan (DRP).

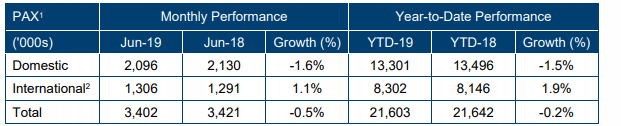

June 2019 Traffic Performance â On 19 July 2019, Sydney Airport disclosed its Traffic Performance for the month of June 2019 as given below-

Source: Companyâs announcement dated 19 July 2019

Evidently, the number of International passengers travelling through the Airport increased by 1.1 per cent to 1.3 million passengers compared to the prior corresponding period and Domestic passengers reduced by 1.6 percent to 2.1 million passengers. According to the Sydney Airport CEO Geoff Culbert, certain capacity reductions along with subdued load factors had probably impacted the domestic passenger figure.

There were more than 3.4 million passengers who passed through the Sydney Airport in the month of June 2019, which is slightly lower (0.5%) on the prior corresponding period (June 2018).

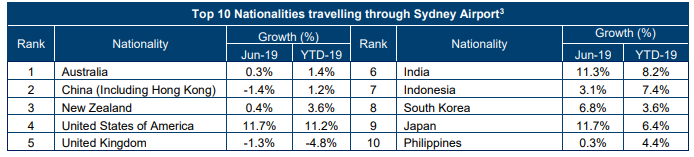

The company also informed that Vietnam, Taiwan, Japan, USA and India had all delivered double-digit growth (relative to June 2018) and thus made it to the top five fastest growing passenger groups. The top ten nationalities travelling through the Sydney Airport as declared by the company are given below-

Source: Companyâs announcement dated 19 July 2019

Company Secretary Appointment â Recently, Sydney Airport also informed the stakeholders that Karen Tompkins had been appointed as company secretary of Sydney Airport Limited and co-company secretary of The Trust Company (Sydney Airport) Limited (TTCSAL) as responsible entity of Sydney Airport Trust. This followed the resignation of Jamie Motum.

Flight Centre Travel Group Limited

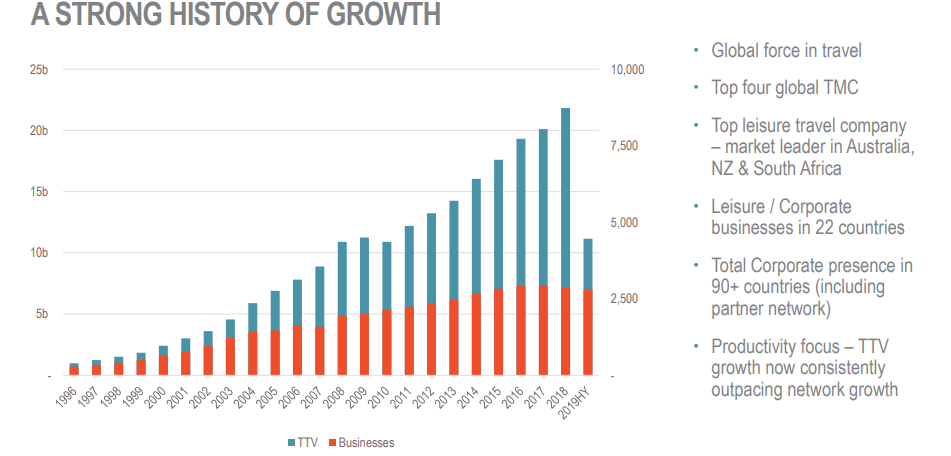

Flight Centre Travel Group Limited (ASX: FLT), headquartered in Brisbane, Australia, provides travel retailing services for the leisure, corporate, and wholesale travel sectors in Australia, New Zealand, and worldwide across Europe, the Middle East, Africa, the Americas and Asia. The companyâs market capitalisation stands at around AUD 4.52 billion with approximately 101.11 million shares outstanding. On 24 July 2019, the FLT stock was trading at AUD 45.34, up 1.454% by AUD 0.65 with ~ 212,399 shares traded.

The company has an annual dividend yield of 3.74%. In addition, the FLT stock has delivered positive return of 8.57% for YTD.

European footprint strengthened - Recently on 1 July 2019, the company announced to have bolstered its global corporate travel network by making further investments in Europe via acquiring the remaining 75% ownership (now 100%) of the 3Mundi corporate travel business in France and Switzerland. The initial 25% stake was obtained in June 2017 while the company was engaged with 3Mundi since 2015, which became part of FLTâs global FCM Travel Solutions corporate travel management network as an independent licensee for the crucial markets of France and Switzerland.

FLTâs corporate travel footprint in the UK and Europe now encompasses the UK, Germany, France and the Netherlands, which all rank among the worldâs 15 largest corporate travel markets; and Ireland, Switzerland and the Nordic countries of Sweden, Norway, Finland and Denmark.

FLT not only has a lab in Barcelona, Spain but also in Boston, Washington DC, Bangkok and Brisbane to develop innovative new products and features for customers globally.

So far, FLTâs corporate businesses have continued to perform strongly worldwide and together generated $4.2 billion in total transaction value (TTV) during the six months to 31 December 2018, about 37% of the groupâs global TTV for the period.

Source: Morgans Roundtable Conference Presentation

Commercial agreement with Upside Travel â On 8 April 2019, the Flight Centre Travel Group announced that it had acted on fast tracking its growth within the small to medium-sized (SME) corporate sector by securing a 25% stake in Washington DC-based Upside Travel Company, a technology-driven business launched in 2017.

The above investment allowed FLT to access Upsideâs travel technology platform as well as its software development resources. These additions are expected to amplify FLTâs current SME offering.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.