Year-end results are an essential component for a company, its employees and investors. These results give a clear picture of the companyâs activities during the year. They help the company in figuring out its next set of goals and understanding its financial position. For employees, the growth of the company is directly proportional to their growth in the organisation. For investors, annual results help them in assessing, whether investing in the company would be a wise decision or not.

In this article, we would discuss three stocks operating in the financial sector that have recently released their full-year results for the period ended 30 June 2019.

K2 Asset Management Holdings Ltd

K2 Asset Management Holdings Ltd (ASX: KAM) is a fund management company listed on the Australian Stock Exchange. The company is focused on managed funds for retail, wholesale and institutional investors. It holds expertise in equity markets.

KAM Media Release on FY2019:

On 16 August 2019, K2 Asset Management Holdings Ltd released its report for FY2019 ended 30 June 2019.

According to the company, for active investment managers, FY2019 remained difficult. In FY2019, passive investment strategies played a leading role for investors. The market players were ready to pay any price for a select set of index stocks during the reported period.

It is the first financial year, for which the company registered a net loss before income tax. The cost base has and is expected to remain right-sized with a reduction expected in expenses by more than 30% in FY2020. K2, which maintains a strong balance sheet position, has currently ~ $ 12.6 million in cash.

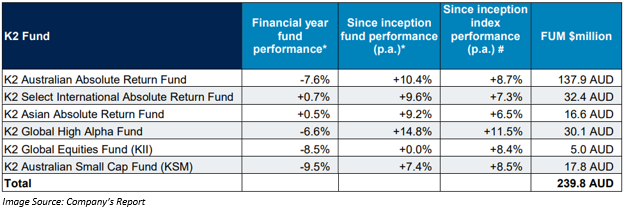

The company also shared the performance of six funds, namely K2 Australian Absolute Return Fund, K2 Select International Absolute Return Fund, K2 Asian Absolute Return Fund, K2 Global High Alpha Fund, K2 Global Equities Fund (KII) and K2 Australian Small Cap Fund (KSM).

In FY2019, K2 Australian Absolute Return Fund gave a negative return of 7.6%, K2 Select International Absolute Return Fund gave a positive 0.7% return, and K2 Asian Absolute Return Fund gave a positive return of 0.5%. K2 Global High Alpha Fund, K2 Global Equities Fund (KII) and K2 Australian Small Cap Fund (KSM) gave a negative return of 6.6%, 8.5% and 9.5%, respectively. The total fund under management of the company was A$ 239.8 million.

The company believes that the outflow is the indication of the final stage of the current growth/ momentum market cycle. The company also made significant progress by entering into a collaboration with Principals Funds Management to access quality participants in the wholesale market. According to K2 Asset Management, there is no requirement of any catalyst to push market participants to return to valuation as well as profit models. Instead, the investors themselves would reach a point where they would easily figure out the gap in pricing between value and growth, as being far too wide and unsustainable.

The focus of the company on absolute investment returns for unitholders remains unchanged. Long term growth remains the core objective of the company, which believes that if it would provide consistent long-term outperformance and simultaneously minimise the risk associated with the funds, the value of its offerings would get rewarded from retail as well as the institutional markets.

Stock Information:

The shares of KAM have generated a negative return of 30.56% in the last six months. KAM stock last traded on 16 August 2019 at A$ 0.050. It has a market cap of A$ 12.05 million and ~ 241.09 million outstanding shares.

London City Equities Limited

London City Equities Limited (ASX: LCE) is an ASX listed company that invests in entities having significant market shares and providing inherent growth.

On 16 August 2019, the company released its preliminary final year results for the period ended 30 June 2019.

FY2019 Performance:

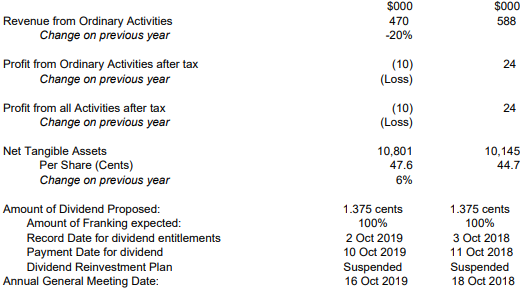

The companyâs total comprehensive income stood at A$ 968,190 for FY19. The company noted a 10% change on net worth as compared to the previous year. Its revenue from ordinary activities declined from A$ 0.588 million in FY18 to A$ 0.470 million in FY19, representing a decline of 20% year-on-year. The company incurred a loss of A$ 0.010 million in FY19. The net tangible assets of the company in FY19 increased by 6% to A$ 10,801. The company proposed a fully franked dividend of 1.375 cents. The record date for the dividend would be 2 October 2019 and payment date would be 10 October 2019.

FY19 Performance (Source: Companyâs Report)

FY2019 remained successful for the company with portfolio uplifts and profit increased net worth 10%. The company was able to maintain its dividend payout at the last yearâs level of 1.375 cents per share. Also, the impressive business performance of Fiducian Group Limited enhanced the companyâs 6.5% shareholding in the group. Since the year end, the company has seen a growth in its portfolio value by approximately $300k.

In addition, the legal action of the company in the Supreme Court of NSW continues against Ernst & Young continued during the financial year 2019. The courtâs judgement was given on 1 August 2019. The directors of the company are reviewing capital management alternatives.

Balance Sheet and Cash Position Highlights:

The total shareholdersâ equity for the year was $ 10,801,361. The company generated $ 105,899 cash through its operating activities. It used $ 351,994 in investing activities and $ 81,233 in its financing activities. The net cash available with LCE at the end of FY2019 was $ 15,566, representing a significant decline when compared with the previous year.

Stock Information:

The shares of LCE traded last on 14 May 2019 at a closing price of A$ 0.450. Its market capitalisation stands at A$ 10.2 million. It has ~ 22.68 million outstanding shares and an annual dividend yield of 3.04%.

Strategic Elements Limited

Strategic Elements Limited (ASX: SOR) is a financial sector player that invests in Australian entities that are operating in rare earths and rare metals mining, processing and materials development sectors.

On 16 August 2019, the company released its full-year results for the period ended 30 June 2019.

Strategic Elements Limited is registered as a Pooled Development Fund (PDF) under the Australian Governmentâs Pooled Development Fund Act 1992 (PDF Act), and it invests in Australian companies that are of small to medium size in order to support in the growth or expansion of the investee company.

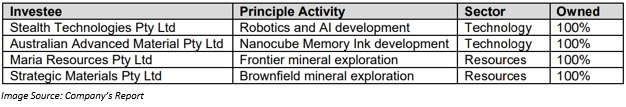

The companyâs investee businesses during the year included the following:

FY2019 Results:

The company reported a 36% decline in its revenue from ordinary activities to $ 0.051 million for FY19. It made a significant loss during the period, with the net loss from ordinary activities attributable to members reaching $ 1.980 million. When compared with FY18, the FY19 loss represented a percentage change of 93%, which was the outcome of increased expenses in project development, employee costs as well as other expenses.

Its balance sheet represents a fall in net assets from $ 4,238,737 in FY2018 to $ 2,303,259 in FY2019. The total shareholdersâ equity for the period was $ 2,303,259. The company used $ 1,886,417 in operating activities and $ 1,927 in its investing activities. The net decrease in the companyâs cash and cash equivalent for the period was $ 1,888,344. The net cash available by the year-end was $ 2,390,475.

Stock Information:

The shares of SOR have generated a decent YTD return of 17.95%. SOR stock opened at a price of A$ 0.046 on 19 August 2019. By the end of the dayâs trading on 19 August 2019, the price of the share was A$ 0.046. Its market capitalisation stands at A$ 11.37 million. SOR has ~ 247.25 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.