Of late, companies have been releasing their results for the first half of FY2020. Amidst the highly uncertain times, many companies have managed to register fair financial performance while there have been some downgrades as well.

Many businesses have remained unaffected while some have taken a hit by the unprecedented risks in the business environment. ASX-listed stocks from various sectors have also shown strong performance in recent times.

Let us discuss three diversified stocks listed on ASX that have recently released their half-year results and ended today’s trade in the green zone.

ELMO Software to Acquire Vocam; 1H FY20 ARR Up 42.8%

Cloud-based HR & payroll software provider, ELMO Software Limited (ASX:ELO) announced the execution of a binding sale agreement to purchase 100% of the shares in a leading provider of cloud-based HR and safety video content, Vocam group entities, for a total consideration of $3.5 million. The deal would be funded by a mix of $2.5 million in cash and $1 million in scrip, subject to a 12-month voluntary escrow.

The strategic acquisition is expected to provide ELMO access to cutting-edge video production and post-production facilities in Melbourne and the Philippines, further enabling ELMO to expand and update video content according to changing customer and industry requirements.

The growth strategy of ELMO comprises of

- Delivering strong organic growth

- Disciplined and selective complementary acquisitions

In line with the above, the acquisition offers more than 150 valuable customers across Australia, New Zealand and the UK to whom ELMO looks forward to cross-selling its suite of HR and Payroll modules and an additional revenue stream.

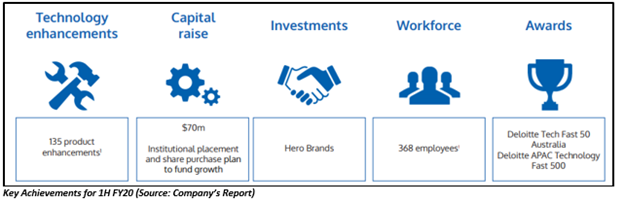

Highlights from the Company’s results for the half-year ended 31 December 2019 are:

- Annual Recurring Revenue increased to $52.0 million, up 42.8%, primarily driven by a combination of

- New customers to ELMO

- The cross-sell of existing modules to existing ELMO customers

- Contribution from the acquisitions of HROnboard and BoxSuite

- Statutory revenue stood at $23.6 million, indicating an increase of 33.9% from 1H FY19, driven by

- Increased investment into sales & marketing and new & existing modules

- High customer retention rate of 92.9%

- Enhanced brand awareness and reputation of ELMO and its product offering

- Contribution from acquisitions completed during FY19

- Loss before income tax, finance expenses, depreciation and amortisation stood at $2.6 million (1H19: loss $2.0 million)

During the day’s trade on 12 February 2020, the ELO stock settled at a price of $7.700, up 4.62% intraday, with a market capitalisation of $551.49 million.

Let us now discuss a health care sector player.

Good Read: Are There Any Hot Stocks with Exciting Growth in Cannabis Space?

CSL Close to 52-Weeks High Post Announcing Strong Profit Growth in H1 FY20

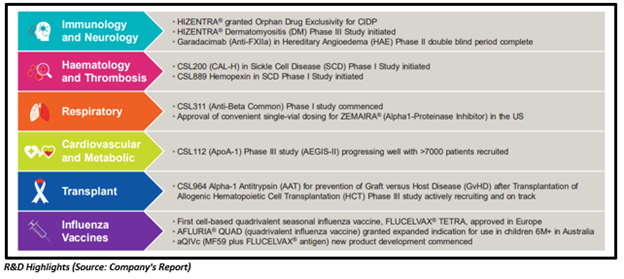

Along with being named in the Top 500 companies for Diversity in the US by Forbes, CSL Limited (ASX:CSL) had a strong half-year with revenue up 11% year on year to $4.98 million and net profit after tax of $1,248 million, up 11%, showing:

- Strong growth in immunoglobulin portfolio

- Transition to own distribution model in China progressing well

- Continued evolution of the haemophilia portfolio

- Strong performance from Seqirus

Earnings per share were recorded at $2.75, up 11% at constant currency (CC) with interim dividend of approximately $1.42 per share, up 18%.

The Company’s strong results are an indicator of:

- Focused execution of its strategy

- Robust demand for differentiated medicines and

- Deep, inherent passion for meeting the evolving needs of patients

CSL witnessed an exceptional performance of the immunoglobulin portfolio with PRIVIGEN® sales growing 28% and HIZENTRA® sales up 37%, propelled by continued strong patient demand together with an expanded label claim for both PRIVIGEN® and HIZENTRA® to now include CIDP.

The Company believes that it is well-positioned for sustainable growth, and exceptional demand continues for its differentiated therapies.

CSL looks forward to again outpace the market in expanding plasma collections, and its objective to open 40 new collection centres this financial year seems on track.

The Company now expects the full year NPAT to be in the range of $2,110 million to $2,170 million at CC, representing an increase of around 10-13% over FY19.

The CSL stock settled at a price of $328.250, up 0.774%, with a market capitalisation of $147.84 billion. The 52-weeks high price of the stock was noted at $335.990.

You might be interested to read: Tale of This Digital Manufacturing Solutions Player– Titomic

TGR Surges 11.893%

Consumer staples player Tassal Group Limited (ASX: TGR) ended the day’s trade in green zone, gaining 11.893% to settle at $4.610.

During the half-year ended 31 December 2019, the Company:

- Delivered on its core salmon operational strategy

- Progressed its prawn growth strategy

- Strongly positioned itself for continued growth in earnings and returns in FY20 and beyond

The Company reported a decline of 15.8% in revenue, which stood at $274.49 million during 1HFY20 and an increase of 3.4% on the pcp in its operating EBITDA reaching $66.46 million.

Moreover, the Company reported a decline of 3.4% on the pcp in its operating NPAT, which stood at $30.64 million and interim dividend was held at 9 cents per share, in line with 2019, franked at 25%.

Tassal believes that projection for the sales growth from 2H20 onwards is highly supported by the increased salmon biomass as on 31 December 2019. Moreover, the Company expects additional salmon harvest biomass to be available for 2H20 [vs 2H19] and FY21.

Also, the Company looks forward to commencing prawn harvest and sales tonnage in the second half of FY20. With the anticipation of prawn earnings starting to flow in 2H FY20, the Company is believed to be on track to deliver a planned approximately 2,400 tonnes in FY20.

The positive market dynamics that the Company has experienced for salmon are expected to continue, and the retail salmon agreements that underpin current strong domestic pricing levels are expected to remain in place.

Moreover, the SGARA value of $15.4 million at 31 December 2019 effectively represents prawn earnings for 2H FY20 since this stock is scheduled to be harvested and sold before 30 June 2020.

Strong growth outlook for Tassal is expected to be driven by positive market dynamics, growth in salmon biomass and size, and the prawn ramp-up, resulting in increased FY20 earnings and beyond.

The Company sees no change in the existing trends continuing into FY21 and expects to deliver further growth in the amount of its prawn harvest, which shall underpin continuous growth in prawn earnings.