Stocks trading at low prices can provide investors with a chance to gain from accumulations. However, this is not necessary in each case as many times the low prices are results of the underperformance of the company and disbelief of investors in the company’s future performance. Either case, investors must know about stocks that are trading at low prices.

We have screened few stocks which have recently hit their fresh lows on ASX. Let’s take a look at these stocks and their recent updates.

ARG Group Limited (ASX: ARQ)

Digital solutions provider, ARG Group Limited recently signed a binding agreement to sell the Enterprise Services Division to an entity owned by a consortium comprising Quadrant Private Equity and certain members of the Enterprise management team for $35 million on a cash and debt free basis.

The transaction is expected to complete on 2 March 2020 and proceeds of the sale are expected to be applied for reduction of the Company’s debt. Further, the company is of the view that this divestment will allow it to focus more on value maximising options for the SMB Division and stringent cost management.

Recently, the company's lenders have agreed to provide $2.5 million of additional funding to the Company for short term working capital requirements on the basis of certain conditions and amendments to the loan facilities, including the granting of security to the lenders for the entire amount of the facilities.

The company’s FY19 full year guidance is as follows:

- SMB Core underlying EBITDA of between $9.7 million and $10.7 million for the 2019 year

- Revenue for SMB is expected to be between $65.0 million and $70.0 million

- Underlying EBITDA for ES is expected to be in the rang of a loss of $1.0 million to $2 million

- Group underlying EBITDA is expected to be in the range of $13.8 million to $15.8 million

The company will announce its FY19 results on 27 February 2020, at which time it will provide further details of the transaction and update on progress of the Strategic Review.

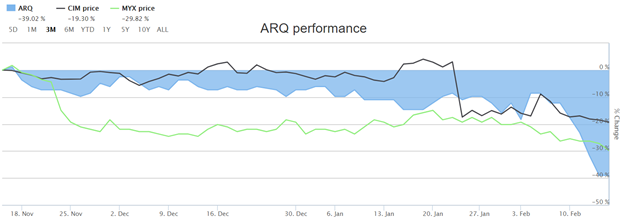

In the past six months, the company’s stock price has declined by 59% on ASX. The company’s stock recently reached its 52 weeks low of $0.235. At market close on 17 February 2020, the stock was trading at a market price of $0.245, up by 2% intraday, with a market cap of $30.53 million.

CIMIC Group Limited (ASX: CIM)

Australia’s leading integrated solutions provider, CIMIC Group Limited recently announced that its services specialist UGL has inked contracts to provide maintenance, turnarounds and project services for its clients in the oil and gas sector, demonstrating strength of UGL’s solid client relationships and its position as a market leader in the delivery of maintenance and mechanical, electrical and instrumentation services to the oil and gas industry.

Few days back, the company’s construction business CPB Contractors was selected to deliver upgrades to two major regional highway projects which worth a total of $164 million in revenue to CPB Contractors.

The projects are:

- Mackay Northern Access Upgrade at Mackay Queensland

- South Gippsland Highway Upgrade between Koonwarra and Meeniyan in Victoria

In 2019, the company’s underlying operations performed well, with growth in NPAT (excluding BICC), solid operating cash flow, stable revenue and diversified work in hand. The company’s results include:

- Statutory NPAT of $(1.0) billion; NPAT (excluding BICC) of $800 million, up 3% YOY;

- Revenue of $14.7 billion; stable operating profit, PBT and NPAT margins of 8.4%, 7.5% and 5.4% respectively (excluding BICC)

- Operating cash flow of $1.7 billion, no variation in factoring

CIMIC FY20 Guidance

- FY20 NPAT expected to be in the range of $810 million to $850 million, subject to market conditions

- Guidance supported by strong level of work in hand and positive outlook across the Group’s core markets

- Disciplined focus on sustaining a strong balance sheet, generating cash, and a rigorous approach to tendering and project delivery.

CIMIC’s strategy has the following key elements:

- to be an engineering-led, industry-leading group with a balanced portfolio diversified by market sector, activity, geography, type of client, contract type, volume and duration;

- to offer integrated solutions through a complementary suite of capabilities for the entire life-cycle of assets – from development and financing to engineering, construction, mining, and operations and maintenance;

- to selectively export the Group’s capabilities and expand into other markets which meet its governance, risk, and return requirements, either organically or through acquisition; and

- to utilise common systems and processes to facilitate the sharing of innovation and knowledge.

It is to be noted that in the past three months, the company’s stock price has declined by 16.97%. The stock recently reached its 52 weeks low price of $27.270. At market close on 17 February 2020, the stock was trading at a price of $27.580 with a market cap of around $8.87 billion.

Mayne Pharma Group Limited (ASX: MYX)

Specialty pharmaceutical company Mayne Pharma Group Limited (ASX:MYX) has a significant product portfolio and pipeline, global reach through distribution partners in Europe, Asia, Australia and North America.

The company continues to realign its generic business focusing investment activities in the core therapeutic categories of women’s health and dermatology as it has licensed 3 dermatology products last year in order to leverage the unique sales and distribution capability it has established.

The company believes that going forward, its Generic Products performance will depend on many factors including timing of FDA approvals, competitor launches and withdrawals on key products while its specialty brands are expected to benefit from product launches of TOLSURA® and LEXETTE®, and from E4/DRSP in FY22. In the financial year 2020, the group operating expenses are expected to be lower as compared to FY19.

In the past three months, MYX stock price declined by 29.82% on ASX. The stock recently touched its 52 weeks low price of $0.385. At market close on 17 February 2020, MYX stock was trading at a market price of $0.382.

Three Months price Chart of ARQ, CIM and MYX (Source: ASX)