The Uptick in gold prices to their highest level in nine months and consolidation around $1314 is providing respite to investors who participate in the commodity market by investing in mining stocks. One of the most significant problems for gold miners is replacing the reserves they mine, which is difficult to do through exploration and for the same reason gold miners must continuously explore for new reserves and high-grade ore to take the benefit of the high prices. The gold price had hit $1319 a previous week in the spot market amid fears over a slowdown in global growth and U.S-China trade dispute. The Federal reserve had put further interest rate rises on hold, which in turn provides support to gold prices but market participants are majorly eyeing on the global growth stories and developments in U.S-China trade war to take aggressive participation in gold further. Due to this waiting, the spot gold is consolidating in a range of $1314-$1310.

Below are the three most discussed gold stocks:Â

Gold Road Resources Limited (ASX:GOR)

Gold Road Resources has recently exhibited its yearly mineral asset and metal reserve statement within the Gruyere Project Joint Venture (Gruyere JV). The Gruyere JV is an equal joint endeavour between Gold Road Resources Ltd and Gruyere Mining Company Pty Ltd, a member of the Gold Fields Limited group. Gold Road for the sake of the Gruyere JV, deals with all investigation exercises and asset advancement other than the Gruyere Gold Project (Gruyere).

In the ongoing declaration made by the organization, it displayed the 2018 investigation results which went for the investigation of extra higher-level store along the Golden Highway pattern.

Exploration outcomes:

Ore Reserve ($1600/oz) grade in Gruyere deposit increased 5% to 1.24g/t Au and proved ore reserve increased 15% to 604,000 ounces. Apart from that, Additional Ore Reserve of 130,000 ounces has been identified on Golden Highway Deposit which may be available for future mine plans. Gruyere Mineral assets diminished 1.7% or 97,000 ounces and Golden Highway Mineral Resource expanded 17% or 99,3000 ounces. Central Bore Underground Mineral Resource has been added at 13.05g/t Au (101.3K ounces). Â With the Gold Road attributable Ore Reserve currently totals 1.96 million ounces, with a mineral asset of 3.31 million ounces

The company can take advantage of additional ore reserve in its future mine plans and advantage of high gold prices.

GOR settled in red at the close of market trading on 14 February 2019. The closing price was recorded as A$0.795 with 877.5 million outstanding shares. The price of the scrip has soared by 20.30% till date this year.

Regis Resources Limited (ASX:RRL)

In an announcement released on 21st January 2019, the company stated that it has signed a contract with Barminco to provide underground mining services at Rosemont. The contract relates to the development of an underground mining operation beneath Rosemont open pit to exploit the maiden underground mineral resources, estimated to be of 1.4Mt at 5.1g/t for 230Koz of gold.

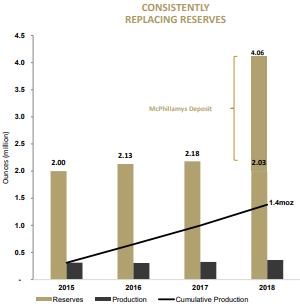

The company has its project in prolific mining regions with various operations such as Moolart Well Operation, Rosemont Operation, Garden Well Operation under Duketon operations with production of 10Mtpa. Â As per the company's latest Corporate update in January it is consistently replacing its reserves, which can help the company over the long run as replenishing the mined ore reserves is very challenging and a healthy step.

Source: RRL Corporate Presentation

As per the report, company is currently holding several projects and working on high-grade ore identification to replenish the reserve within a low-cost environment.

With the close of trading session on 14 February 2019, RRL crashed by 1.48% and settled at A$5.340. The stock has demonstrated impressive performance of 33.50% over last one year and has offered decent YTD return of 14.11% till date to its investors.

Evolution Mining Limited (ASX:EVN)

As per the company Quarterly Report for the period ending 31st December 2018, Cowal region showed excellent drilling results at GRE46 and Dalwhinnie with intersections including 3.2m (2.1m etw) grading 29.11g/t Au and 18.0m (11.7m etw) grading 6.73g/t Au. The report likewise introduced the FY19 Group production guidance of 720,000 â 770,000 ounces at an All-in supporting expenses (AISC) of A$850-A$900 per ounce.

As per the company report Cowal produced 58,244oz of gold at an AISC of A$ 1,019/oz and Mungari produced 29,992oz of gold at an AISC of A$1,474/oz in the last quarter.

EVN closed the market today (!4 February 2019) at A$3.700, down 2.632% with a market capitalization of A$6.45 billion and 1.7 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.