BNPL Companies Release New Code of Conduct for the Betterment of Customers.

The quickly expanding Buy Now Pay Later marketplace would begin public discussion in mid-January, for enactment in mid-2020, a Code of Practice for BNPL suppliers. It is anticipated around 30% of Australians who have attained adulthood (5.8 million) currently use BNPL services for mainly making minor retail payments and purchases.

- BNPL Code of Practice improves consumer protections for customers who use BNPL facility, while offering customers choices to make payments and purchases in a way that satisfies their needs;

- The BNPL Code ensures customers have strong protection in place that assists them better know the product and their rights.

The key parts of the code are:

- Evaluate customer profile to make sure the product will suit them before offering it, as well as provide additional controls for customers identified as potentially more vulnerable through this process of evaluation;

- Make sure customers have entry to internal complaints handling, so complaints are resolved quickly and fairly, and if they cannot be resolved, can be transitioned to AFCA;

- Provide hardship assistance to customers that experience financial difficulties;

- Ensure vendors and merchants act consistently within BNPL service provider guideline.

Let’s look at three BNPL stocks and what are their outlook for FY20

Afterpay Touch Group Limited

Afterpay Touch Group Limited (ASX:APT) provides technology-driven payments solutions for consumers and businesses through its Afterpay and Pay Now services and businesses.

Afterpay Records Sale of $1 Billion in the Month of November

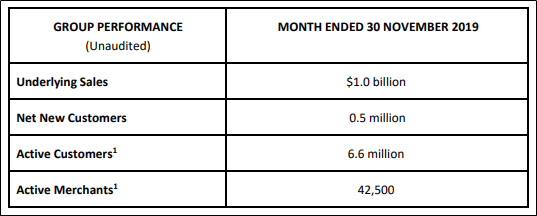

Afterpay Limited reported underlying sales of $1 billion for the month of November 2019. This is an important milestone achieved by the company since the beginning and it contributed materially to total underlying sales of $3.7 billion achieved in the first 5 months of FY20.

- The company added 0.5 million net new customers, taking the total number of active customers to 6.6 million;

- On an average, 22,000 new customers per day were added in the month of November 2019.

November Sales Performance (Source: Company Reports)

Company’s Future: The company is targeting underlying sales of more than $20 billion and a net transaction margin (NTM) of 2% by the end of FY22. It successfully raised $317 million of equity in June 2019 to support the execution of its mid-term strategy. The company will execute its mid-term strategy to grow its platform in key markets.

Stock Performance

The stock of APT closed the day’s trading at $38.090 per share on 3 February 2020, down by 1.193% from its previous closing price. The company has a market capitalisation of $10.2 billion as on 3 February 2020. The total outstanding shares of the company stood at 264.6 million, and its 52-week low and high is $15.640 and $38.690, respectively. The stock has given a total return of 33.58% and 44.17% in the time period of 3 months and 6 months, respectively.

Splitit Payments Limited

Splitit Payments Limited (ASX: SPT) is a technology company that provides cross-border credit card-based instalment solutions to businesses and retailers.

Splitit Reports Double Digit Growth in Merchant Sales Volume

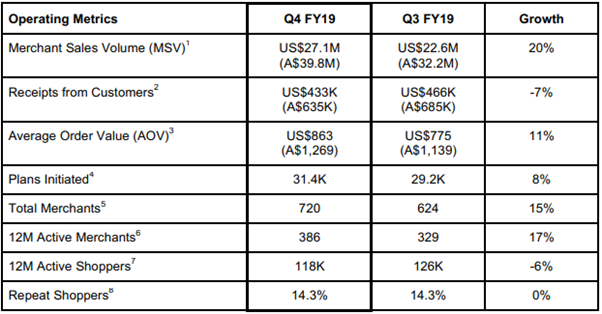

Splitit Payments Ltd has provided an outline of its quarterly activities for the three-month period to 31 December 2019. Q4FY19 was a record quarter for the company, with Merchant Sales Volume (MSV) of more than US$27 million (A$39M), driven by strong holiday sales and new merchants signing up to Splitit’s solution.

- Revenue declined by 7% to US$433K with an additional US$71K of revenue from Q4 MSV from funded plans to be recognised in Q1FY20;

- 12 Month Active Merchants reached 386, an increase of 17% on previous quarter, mainly due to strategic focus on merchants with higher Average Order Value with a stronger product-market fit.

Quarterly Performance Metrics (Source: Company Reports)

Splitit Registers with AUSTRAC to Provide Factoring Services

A leading global monthly instalment payments solution business, Splitit Payments Ltd has registered with AUSTRAC to provide factoring services to merchants and grow its funded merchant model in Australia. The company has also utilised half its interim financing facility with Shaked Partners due to rapid growth.

- The company has depleted about US$4 million from its interim financing facility as it continues to grow its funded merchant business model;

- By registering with AUSTRAC the company will directly provide funded model to merchants in Australia after pre-requisite vetting and underwriting.

Outlook: Splitit is the only instalment payment solution giving consumers the power to use their credit on their terms. Merchant sales volume, revenue and 12-month Active Merchants are expected to increase speed in FY20 as crucial foundational pillars, such as simplified onboarding and new credit facilities unlock growth opportunities, particularly in the second half of the year. Repeat shoppers are also likely to grow as merchant acceptance accelerates. This will allow the company to take advantage of growing demand from merchants, especially via its partner platforms and its unique position in the market as the only provider of instalments on any credit card at the point of sale.

Stock Performance

The stock of SPT closed the day’s trading at $0.570 per share on 3 February 2020, down by 7.317% from its previous closing price. The company has a market capitalisation of $191.59 million as on 3 February 2020. The total outstanding shares of the company stood at 311.53 million, and its 52-week low and high is $0.305 and $2.000, respectively. The stock has given a total return of -37.24% and 9.82% in the time period of 3 months and 6 months, respectively.

FlexiGroup Limited

FlexiGroup Limited (ASX:FXL) provides a diverse range of finance solutions to consumers and business through a network of retail and business partners. This includes credit cards, Buy Now Pay Later products and consumer and business leasing.

The company announced the pricing of $265m asset-backed securities (ABS), supported by a pool of unsecured; consumer receivables originated in Australia under its rebranded Buy Now Pay Later offering-humm.

The company is a regular issuer of ABS and has been implementing securitisations of its BNPL receivables as part of the Flexi ABS programme ever since 2011. After relaunching BNPL services in April 2019, the company has seen great drive across humm’s target verticals with total retail partners rising more than 18,000 and solid volume increase throughout these key verticals. In FY20, it has roped in over 132,000 additional customers to the humm platform and experienced a 35% rise in the amount of transactions vs. the previous comparable period.

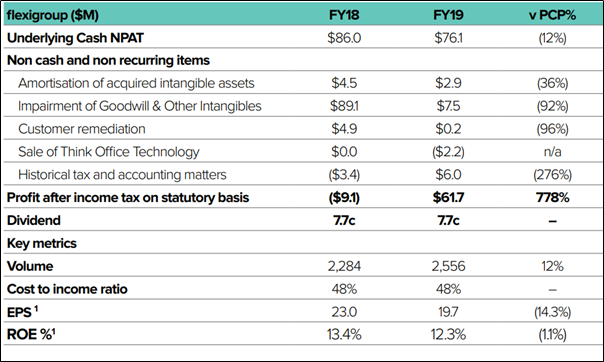

Highlights of AGM: In FY19, the company attracted 226,000 new customers and now has an active customer base of 1.7 million. The company has also added 5,000 new retail partners to its network and lifted partnership with retailers across Australia and New Zealand to 65,000. The company delivered cash NPAT of $76.1 million, which was in line with its revised guidance. In April 2019, the company launched its BNPL product humm after consolidating two Australian legacy platforms.

The total volumes of the company’s Australian card business grew by 10% YoY and in New Zealand card business achieved volume growth of 16%, well ahead of the market.

The company declared fully franked dividends of 7.7 cents per share for FY19, which are equivalent to last year and in line with the stated payout ratio of 30 to 40% cash NPAT.

Company’s Financials (Source: Company Reports)

Outlook: In FY20, the company expects the volume to grow by at least 15% driven by new product launches, audience extension and new partnership. The company expects to increase the course of volume growth as the year progresses. The company will also seek to balance margin with growth and maintain a double-digit ROE.

Stock Performance

The stock of FXL closed the day’s trading at $1.870 per share on 3 February 2020, down by 10.952% from its previous closing price. The company has a market capitalisation of $828.22 million as on 3 February 2020. The total outstanding shares of the company stood at 394.39 million, and its 52-week low and high is $0.975 and $2.710, respectively. The stock has given a total return of 7.69% and 15.07% in the time period of 3 months and 6 months, respectively.