On 9 December 2019, the Australian benchmark index S&P/ASX200 last traded at 6730 points, up by 0.3% from its last close. In this article we would be discussing about the two stocks- MP1, from information technology sector, which has recently concluded capital raising and BUB from consumer staples sector, which concluded $30 million placement and SPP.

Letâs now go through the recent updates of both the stocks in detail:

Megaport Ltd

Successfully Raised approximately $62 million through placement of shares:

Megaport Ltd (ASX: MP1) that uses Software Defined Networking (SDN) platform to easily connect their network to other services, successfully completed the raising of approximately $62 million fund through the placement of shares to institutional, sophisticated and professional investors.

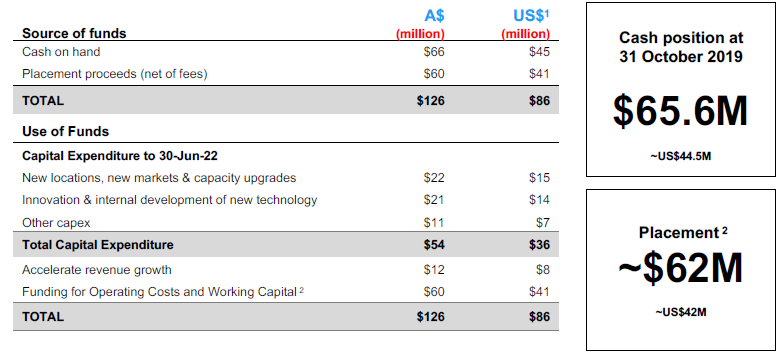

As a result, the company will have to issue 7.1 million fully paid common shares of MP1. The company will issue these new shares at the issue price of $8.70 per share, which reflects the discount of 4.8% to MP1âs closing price of $9.14 per Share on 4 December 2019. The company will use the funds raised to increase the pace of expansion to new locations, core and new markets, increase the revenue growth and market share through workforce alignment, upgradation of the capacity, funding of innovation in products suite and for developing new technology like Megaport Cloud Router, to fund costs from operating activities to reach EBITDA breakeven and to meet the general working capital requirements. MP1 intends to expand markets in North America, Europe and Asia Pacific and a new market, Japan.

The company plans to align its employees and program resourcing to take advantage of the rapidly increasing cloud adoption and direct interconnection models. The funds raised will also be used for the growth of Megaport Interconnection Platform, that incorporates MCR into more places and more markets worldwide. The company plans to expand target addressable market with its data centre and network partners and to take advantage of being first mover. The company has received strong response from new and existing investors, along with the strong demand from offshore institutional investors.

Revenue rose by 78% IN FY19 results

Additionally, for FY 19 results, the company had reported 78% rise in the revenue to $35.1M and 166% rise in the profit after direct network costs to $11.9M. The company has posted the net loss of $33.6M for FY 19 compared to net loss of $24.5M for FY 18. In FY 19, the company had successfully raised capital of $60M and had generated the cash of $74.9M at the end of FY 19.

Use of Proceeds (Source: Companyâs Report)

Meanwhile, MP1 stock has risen 22.03% in last one-month duration, as on December 6th, 2019. The companyâs stock was placed in the trading halt at the request of MP1, on 5 November 2019, as the company had to announce about fund raising, but the halt was lifted on 6 December. The company has planned to settle the placement of shares on 10 December and would allot the shares on 11 December.

On 9 December 2019, MP1 last traded at $9.580, falling by 0.622 percent from its last close.

Bubs Australia Ltd

Raised $30 million through placement of shares & will now raise fund through SPP:

Bubs Australia Ltd (ASX: BUB) produces & sells infant milk formula, organic infant food products, cereals for children, etc. The company has successfully raised $30 million before costs through the placement of shares to institutional, professional, and sophisticated investors. The company is offering shares at the issue price of 95 cents per share, which reflects an 11.8% discount to the five-day VWAP of $1.08 & 14.4% discount to the thirty-day VWAP of $1.11.

The company will be issuing new common shares at the equal to the existing common shares. The company intends to raise $5 million through the Share Purchase Plan (SPP) by issuing $30,000 fully paid common shares at the issue price of 95 cents per share. SPP offer will open on 9 December 2019 and will close on 20 December 2019.The funds raised from the placement of shares & Share Purchase Plan will be used for the improvement of the Companyâs financial flexibility to take advantage of future growth opportunities, increase the customer acquisition in existing and new markets, development of new product in advance and meeting the M&A requirements.

Bubs has plan to derive benefit from the increased data related marketing initiatives throughout e-commerce and O2O channels and to grow in key markets. Further, the company plans to develop an innovation pipeline for entering beyond infant formula and toddler nutritionals to new segments like the reach into $1 billion per annum Chinese junior 4 to 7 year-old nutritionals markets, and expansion of goat dairy brands to cater for the market that is growing for adult formulation.

The proceeds of the fund raising will be used to invest to get the raw materials for specific SAMR China label infant formula, which reflects the investment of around $3 million for Supply Chain. The company has plan to use $5.5 million for marketing in China, $5 million for expansion in Asia to increase the market share in Vietnam, entering the Hong Kong market and other emerging Asian markets and $15 million for mergers and acquisitions.

Moreover, the proceeds of the funds raised will help to develop more its existing operational momentum that comprised of the companyâs joint venture with Beingmate and launching of its organic cow's milk infant formula. The company has expanded its business through the cross-border e-commerce collaboration with Alibaba Group's Centralised Import Procurement unit, and The Land, which will help BUB to develop the companyâs 020 (online to offline) capability.

The company plans to launch Alibaba eCommerce platforms in South East Asia like Lazada & RedMart. The company in partnership with the Alibaba had already launched multiple innovative Deloraine branded adult goat milk formulations, which is required for specialised dietary and health requirements.

Use of Funds (Source: Companyâs Report)

Meanwhile, BUB stock has fallen 17.01% in the past three months as on December 6th, 2019. On 9 December 2019. BUB last traded at $1.005, marginally up by 0.5 percent from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.