What took CCV into news?

A recent announcement from Cash Converters International Limited (ASX: CCV) informs about the settlement of class action that commenced against subsidiaries of Cash Converters by Sean Lynch (Lynch v Cash Converters Personal Finance Pty Ltd & Another NSD 900 of 2015).

As per the company reports, the parties exchanged a deed of settlement to the litigation on 21 October 2019. Moreover, the settlement is subject to the approval of the court of its terms upon which the settlement is based.

Under the settlement, Cash Converters is to pay the amount of $42.5 million into a fund for distribution to members of the class and the payment is to be made in two tranches. As the initial tranche, an amount of $32.5 million is to be paid within 21 days of execution of the deed of settlement. CCV anticipates meeting this compensation from available cash.

The payment for the second tranche, amounting to $10 million, is to be made on or before 30 September 2020. The class members, to be compensated, including the borrowers in Queensland who took out consumer credit loans from Cash Converters subsidiaries between 30 July 2009 and 30 June 2013.

Moreover, Cash Converters shall make the settlement for the class action without any admission of liability.

CCV Stock performance

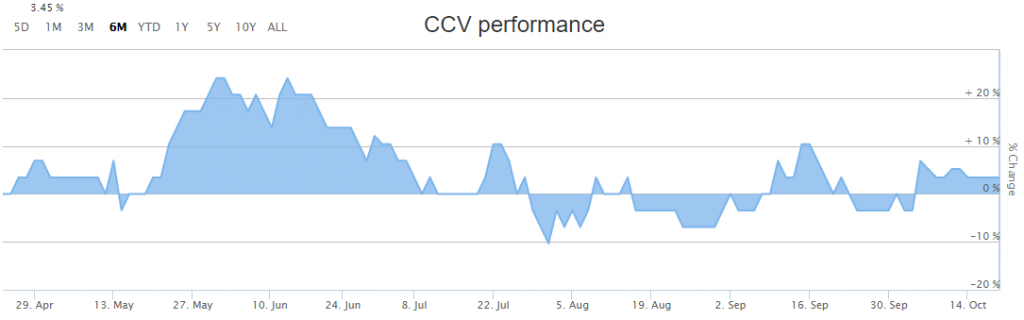

At the time of writing on 22 October 2019 (AEST 12:51 PM), CCV stock was trading at a price of $0.185, down 5.128%, with a daily volume of ~ 528,054 and a market capitalisation of approximately $120.21 million.

Figure 1 CCV Stock Performance (Source: ASX)

The stock has a 52 weeks high price of $0.310 and a 52 weeks low price of $0.120 with an average (year) volume of ~768,423. Over a period of last six months, CCV stock has provided a 34.48% return.

Let us know more about CCVâs business.

About CCV

Being a franchised retail network, Cash Converters International Limited engages in the sale of second-hand goods. Headquartered in Perth (Australia), CCV is known for providing small financial loans across Australia, as well as internationally through franchisees in areas of the US and Canada, New Zealand, South East Asia, Middle East and Western Europe.

With an objective to offer opportunities to franchisees and employees based upon individual initiative, ability and commitment to succeed, Cash Converters group implements contemporary retailing practices, professional management practices and high moral standards to the management of its stores throughout the chain.

Cash Converters aims to achieve high and increasing levels of profitability, enabling Cash Converters to meet its responsibilities to shareholders. Over the years, Cash Converters has been able to establish a profitable market for the company by positioning its outlets as credible retail merchandise stores.

CCV primarily deals in franchising of retail stores which operate as retailers of second-hand goods. The organised implementation of contemporary retailing practices, professional management techniques and high ethical standards to the management of its stores have enabled CCV to alter the consumer perceptions of its industry.

During the course of business, Cash Converters has been able to position its franchised outlets as alternative retail merchandise stores while creating a profitable market for the company.

The company offers a variety of services through its stores around the world. The services offered by CCV are pawn-broking loans available in selected markets, as well as a personal finance business operating in various forms in the micro-lending category worldwide.

Being a global franchisor, CCV is at an advantage of expanding its business quickly and receive the strong managerial commitment of a local franchisee, where in turn, the franchisee, is at an advantage of investing in a successful retailing formula, the prudent product along with a significant reduction in business risk.

Letâs get acquainted with CCVâs recent activities and financial performance over the past year.

Interim CFO Appointed

The company recently appointed, Ms Katrina Grose, a Chartered Accountant and Chartered Secretary, for the role of Chief Financial Officer in an interim capacity effective since 2 September 2019. The appointment was made following the resignation of the companyâs chief financial officer, Mr Martyn Jenkins.

CCV records Revenue growth of 8.2% in FY19

Prior to Mr Jenkins resignation, the company announced its operating and financial performance for FY19 (year ended 30 June 2019). Notable highlights from the FY19 are as follows:

- Revenue growth of 8.2% to $281.565 million as compared to $260.345 million FY18

- Full-year net loss after tax of $1.692 million compared to a prior year profit after tax of $22.503 million

- Gross loan books increase by 27.9% to $220.490 million as compared to $172.339 million in FY18

- Medium Amount Credit Contract (MACC) online loan book increasing by 40.0%

- Small Amount Credit Contract (SACC) loan book comprises only 43.4% of the total loan receivables of the company, down from 49.7% at 30 June 2018

As per CCVâs report, the strong growth lending across the personal finance and vehicle finance businesses has driven the top-line revenue growth for the company.

However, the year has been impacted by an increase in arrears and write-offs of loans coupled with the adoption of AASB 9 âFinancial Instrumentsâ. The effect of the adoption of AASB 9 Financial Instruments increased to the provisions for doubtful debt based on the arrears profile and expected credit loss.

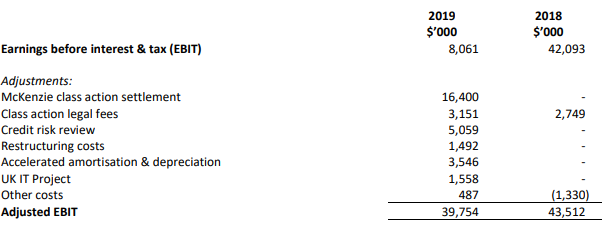

Figure 2 EBIT Adjustment (Source: Company's Report)

Excluding the adjustments (that the Company categorises as outside its normal operating activity), the profit after tax of the company was $20.695 million, and EBIT before adjustments was $39.754 million for FY19 as compared to $43.512 million in FY18.

Looking at the dynamism of the business and the uncertainties in the regulations, CCV has made a significant investment in data analytics to gain deeper insights into the propensity of customers to repay. This further scaled-down the acceptance rates in the second half of the year.

In addition to this, CCV carried out the overhauling of its risk scorecard and product pricing vehicle to ensure a tolerable risk profile as it expands its broker network and progresses to make additions to the loan book.

Settlement of McKenzie class action

As a major development in the FY19, the company was able to make settlement of $16.400 million the McKenzie class action. The legal fees of $3.151 million were incurred during the year in defence of the actions as compared to $2.749 million during the year 2019.

With the expansion of its product portfolio available in stores and online, CCV witnessed continued growth in New Zealandâs operation, especially in its lending business. As a result of the growth, the equity investment contribution to EBITDA of $1.613 million increased from $846 thousand in the prior year, representing a 90.6% increase.

CCV is a globally expanding company with over 650 franchised stores worldwide, including 84 stores in Australia, 195 in the UK and around 380 throughout the rest of the world. The company seeks for opportunities to expand its franchise network, both in Australia as well as worldwide.

Bottomline

CCV believes that the individual franchisees are the strength behind their global network. Moreover, the individual franchisees enthusiastically have faith in the companyâs concept and have an overwhelming commitment to prosper, which provides CCVâs business the strength and underpins the whole ethos of the company.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.