These four stocks were the headline makers in the small cap space on the first working day in markets for 2020. These companies fall under the materials, energy, and consumer staples sectors.

The announcements from these companies include drilling update, commercialisation plans, agreement extensions and a proposed acquisition. Let’s talk about the updates by these companies.

Australian Vanadium Limited (ASX: AVL)

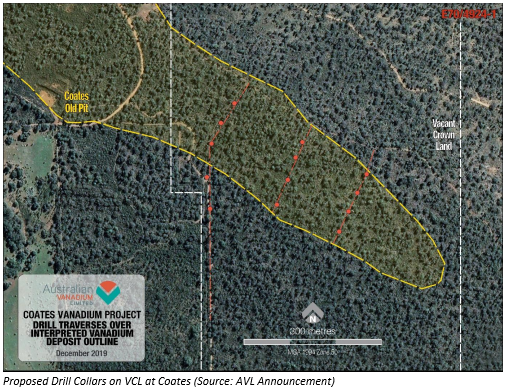

AVL has provided an update on Coates Vanadium Drilling Programme under its Joint Venture (JV) with Ultra Power Systems Pty Ltd. The company reported that the Department of Mines, Industry Regulation and Safety (Western Australia) has approved application for a Programme of Works on E70/4924-I at the Coates Vanadium deposit.

The company intends to drill a maximum of fifteen diamond core holes at the deposit, particularly on the Vacant Crown Land (VCL) area of the tenement. Also, the diamond drill cores would be prepared in Perth, which would be sent to Montreal for metallurgical testing.

Under the JV, Ultra Power would invest $50k in exploration in the initial year and $150k in the initial two-year period. The drill programme would assess the deposit’s aptness as a low-cost feed for a proposed full commercial scale processing plant, and it would be used to estimate resources.

AVL noted that surface sampling in previous years (2018 and 2019) confirmed the vanadium content with values up to 1.59% V2O5. Also, ten out of eleven samples provide vanadium values over 0.7% V2O5. The latest sampling results support previous samples and historical data, and for some samples, the average grade is 1.15% V2O5.

In the historical pit area, the variability of vanadium grades from four samples was 0.74% to 1.58% V2O5. The samples also depicted titanium values while there were high values for aluminium.

On 3 January 2020 (AEDT 12:49 PM), AVL was trading at $0.010, down by 9.091 per cent from the previous close. Over the YTD period, AVL has delivered a return of 10 per cent. The market cap of the company stands at $28.08 million.

Global Energy Ventures Limited (ASX: GEV)

On 2 January 2020, the company announced that a Letter of Intent, to build CNG Optimum 200 ships, with Yantai CIMC Raffles Offshore, has been extended. It was noted that the extension is for six months to 30 June 2020.

Under the LOI, the order is for four 200MMscf Compressed Natural Gas ships, and the company has an option to order up to four more ships. It was reported that the purpose of LOI is to enter a shipbuilding engineering, procurement and construction contract, utilising the CNG Optimum design of GEV.

Brazil Commercialisation Plan

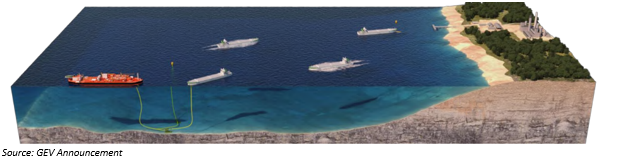

In December 2019, the company reported the commencement of its initial CNG Commercialisation Plan in Brazil. It was reported that technical and commercial teams started working during December, and the work is expected to commence in the first week of January 2020 to deliver the project by March 2020. GEV believes that this plan would jointly validate the CNG opportunity present with a suitable technical viability and commercial value.

Below figure depicts proposed CNG Gas Transport Project up to 350km for onshore gas markets, less than a day’s sailing distance.

CNG Optimum Launch in the US

In October 2019, the company reported on the proposal for US export through CNG Optimum to transport CNG to the regional markets, and due diligence continues to progress, while technical due diligence has confirmed the favourable site for the facility. Further, the company expects to report more updates in the March 2020 quarter.

GEV last traded at $0.135 on 2 January 2020. Over the last six-month period, GEV has delivered a negative return of over 30 per cent. The market cap of the company stands at $52.14 million.

Wattle Health Australia Limited (ASX: WHA)

Right Issue Update

On 2 January 2020, the company provided an update on its Right Issue launched in November 2019, and it was noted that subscriptions worth around $11.67 million were received from the existing shareholders.

As a result, the shortfall to the minimum subscription was approximately $50.57 million, and out of total issue size, $20 million was underwritten. WHA also held various investor roadshows during the period to meet the shortfall amount. However, the company could not secure $55 million, which was the minimum amount under the offer. Consequently, the underwriting agreement lapsed.

Blend and Pack Acquisition

For the Blend and Pack (B&P) transaction, the company and Mason Financial Holdings have agreed, under the share purchase agreement, to extend the last date for the proposal to acquire 75 per cent of B&P. This allows both parties to negotiate the purchase agreement, considering the result of rights issue offer. Also, there is no guarantee that the proposal to acquire B&P would materialise.

In addition, it was reported that the company is undertaking a major operational overhaul, and more information would be provided in due course. Further, the shares of WHA would remain suspended for additional announcements.

SciDev Limited (ASX: SDV)

On 2 January 2020, the company reported that a binding heads of agreement was executed to acquire Highland Fluid Technology Inc., which is a US-based private company providing chemicals and services to the oil & gas industry.

Strategic Rationale

- Opportunity to access the USD 2.5 billion onshore oil & gas market in the US through Highland’s customer base.

- SDV could improve the business margins of the target through its existing supply chain.

- It provides footprint in the North American market that could be leveraged to tap business development opportunities in the region.

- The acquisition would help to diversify the revenue streams of the business across geography and industry.

- SDV’s chemical supply would improve growth trajectory of the target company and drive revenue along with margins.

- The transaction would add skilled human capital in the North American market to improve business pipeline for the company.

It was noted that the transaction would add to positive cashflow and profitability of the company from the date of the acquisition, and it is anticipated that the acquisition would be EPS accretive in FY 2021 after full-first year of the integration.

Transaction Consideration

According to the release, the consideration for the transaction is USD 6 million, which includes USD 5 million in scrip, and further USD 1 million on specific milestones. The initial consideration of USD 5 million would result in an issue of 11.9 million shares (which may change due to net asset position).

Also, the transaction is dependent on completion of due diligence, and actual settlement is expected on or around 31 January 2020 with a financial settlement from 1 January 2020.

Further, the secondary USD 1 million consideration is dependent on the target achieving revenue of no less than USD 20 million in CY 2020, among other clauses.

On 3 January 2020 (AEDT 01:21 PM), SDV was trading at $0.710, up by 1.429% from the previous close. Over the YTD period, SDV has delivered a return of 11.11 per cent. And, in the last one-month period, the return has been +38.61 per cent. The market cap of the company stands at $90.14 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)