Mayne Pharma Group Limited

Mayne Pharma Group Limited (ASX:MYX) is a specialty pharmaceutical company which develops and globally commercializes branded and generic pharmaceutical products from its facilities located in Greenville, USA and Salisbury, Australia. With a market capitalisation of AUD 894.36 million, the MYX stock settled the dayâs trading at a price of AUD 0.555, down 1.77% by AUD 0.010 on 15th May 2019.

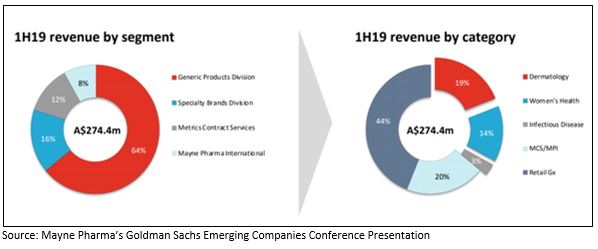

Recently, the company published its Market Update for the 10-month period to April 30th, 2019. Accordingly, the Group reported a total revenue of ~$ 154 million for the first four months of the calendar year 2019 and a gross profit of ~ $ 79 million. Of all the business segments, the Specialty Brands Division performed the best with sales of $ 28 million, up 53% on the prior corresponding period (pcp). Besides, the Metrics Contract Services recorded $ 25 million (+21% pcp) of revenue and the Mayne Pharma Internationalâs revenue amounted to $ 12 million (+8%pcp). The Generic Products Division witnessed a 32% decline in its revenue to $ 89 million.

The Group is actively rebalancing the portfolio towards high-growth therapeutic segment:

Source: Mayne Pharmaâs Goldman Sachs Emerging Companies Conference Presentation

Costa Group Holdings Limited

Costa Group Holdings Limited (ASX:CGC), established in 1888 and based in Ravenhall, Australia, is a horticulture company that produces, packs, and markets fruits and vegetables to food retailers and FMCG companies in Australia. The consumer staples company has a market capitalisation of around AUD 1.61 billion and approximately 320.55 million outstanding shares. On 15th May 2019, the CGC stock closed the market trading at AUD 4.960, dipping 1.39% by AUD 0.070 with ~ 4.07 million shares traded.

Recently, the Commonwealth Bank of Australia increased its voting power in the company from 3.37% to 4.27% upon purchase of additional fully Paid ordinary shares.

The Group released its Annual report for the six months financial period from July to December 2018 (FP2018) whereby Costa delivered $ 8.5 million of underlying net profit after tax and its total revenue was ~ $ 477.6 million (FY2018: $ 1,002 million). Its three reportable segments include- Produce (five core categories including berries, mushrooms, citrus, glasshouse-grown tomatoes and avocados); International (licensing of proprietary blueberry varieties and expansion of berry farming in Morocco and China); and lastly Costa Farms and Logistics (CF&L) (logistics, wholesale and marketing operations).

Source: Companyâs Annual Report FP2018

Washington H Soul Pattinson & Company Limited

Washington H. Soul Pattinson and Company Limited (ASX: SOL) is based in Sydney and operates primarily as an energy sector company and engaged in a plethora of activities including coal mining, gold and copper mining & refining, ownership of shares and property, retailing of pharmaceutical product as well as business consulting. With a market capitalisation of around AUD 5.45 billion and ~ 239.4 million outstanding shares, the SOL stock dropped to the low of AUD 22.220 during the day before settling the dayâs trading at AUD 22.800.

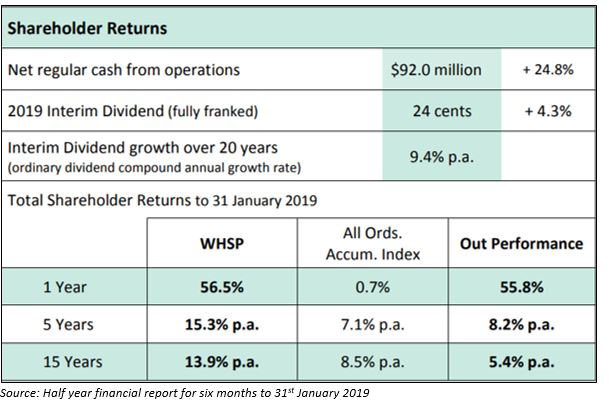

The company closed the half-year to 31st January 2018 with a record high regular profit after tax of $ 186.7 million, which is 12.2% higher on the first half of 2018. Besides, the net regular cash from operations amounted to around $ 92.0 million (24.8% up on 1H 2018). Some of the other key highlights for the period are as follows:

Source: Half year financial report for six months to 31st January 2019

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.