Publicly traded companies lay great emphasis on their respective share price, which mirrors their overall financial health. Analysts, media houses and industry experts vigilantly gauge at the stocks riding high on stock exchanges. Typically, the higher a stock price is, the healthier a companyâs prospect tends to be.

Stock prices are dynamic and volatile in nature. They change on the rhythm of market forces (supply and demand). When investors wish to buy a stock (demand exceeds supply), the price moves up, and vice-versa. Earnings are another major factor of fluctuations in stock prices. The companyâs growth, progress and plans also catch the investor eye which causes the stock price to change.

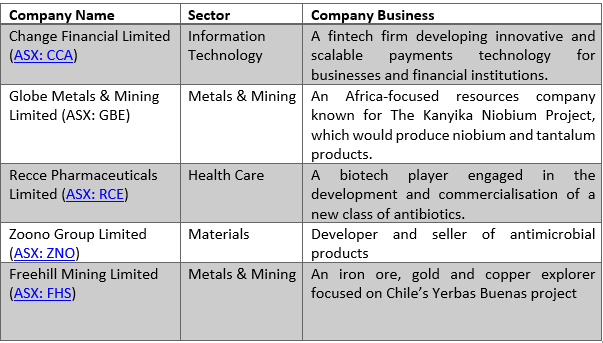

In this article, we would examine 5 high performing stocks on the ASX (in the past 5 days), which have been gaining investor and media traction of-late. Let us dive right in-

Companies in discussion

Change Financial Accomplishes Major Milestones in Payments and Card Issuing Platform

What might have triggered the CCA stock to soar as high as 332% after the market close on 30 September 2019 was the companyâs update, unveiling that it had successfully concluded the development of its innovative payments and card issuing platform. Moreover, the company had obtained the PCI DSS certification.

An icing on the cake was the notification that the Central Bank of Kansas City, CCAâs US banking partner had finally formally registered CCA as a Mastercard payments processor. The company became the first Mastercard certified processor in the last 5 years and second (after US based Marqeta Inc.) in the last 20 years.

CCAâs current focus involves commercialising the platform, with the onboarding of the first customer commencing in October 2019. Post this, the Board would formulate a broader go-to-market strategy to capitalise on US market opportunities.

The company would target over 7,000 FDIC banks, 6,000 credit unions and several innovative players across the US with innovative mobile banking services. The company notified that the addressable market in the US was ~US $ 50 billion in 2019 (likely to grow by 25% by 2025).

Globe Metals & Miningâs Annual Report

On 27 September 2019, GBE released its Annual Report, wherein Chairperson Alice Wong notified that the company had maintained momentum on advancing the Kanyika Development Agreement, which was nearing finalisation with the Government of Malawi. The Agreement was circulated amongst government departments for final comment and GBE was looking forward to the execution of the Development Agreement in the short term.

RC Drilling at Kanyika (Source: GBEâs Website)

Moreover, technical components of the feasibility study, technical designs and development plans for the Project had been recently finalised. Post execution of the Agreement, GBE would move forward with project funding and off-take arrangements, and the Board and management was optimistic about moving forward with project funding and off-take arrangements.

Whatâs steering the Project is the anticipated growth of the global steel demand, as reported by the World Steel Association, which directly lifts the need for niobium (5.9% in 2019).

Recce Pharmaceuticalsâ Annual Report

As per RCEâs Board, 2019 has been a year of achievement and progress for the company, with several key development milestones having been met. Few of which are:

- In a Placement update, RCE raised approximately $1.8 million from sophisticated and institutional investors;

- It received $679,624 from the Australian Government R&D Tax Incentive Rebate;

- Received positive preliminary feedback from FDA on RECCE® 327's Chemistry, Manufacturing and Controls;

- RCEâs product, RECCE® 327 was cleared for use under Therapeutic Goods Administration (TGA) Special Access Scheme â Category A;

- The company achieved scale-up quantities of patented synthesis of RECCE® 327;

- Australian Patent Office granted 34 claims for AUS patent, covering RCEâs broad spectrum antibiotic compounds;

- Throughout the year, RCE presented across several media platforms, conferences and investor events.

RCEâs product (Source: RCE Website)

Zoono Groupâs Distribution Agreement Spree

The global biotech player has been on a roll by signing 3 new Distribution Agreements and expanding its global distribution network, at par with revitalising its global distribution strategy that had been laid down more than a year ago.

In China, ZNO recently signed a new Sales and Distribution Agreement with Guangzhou Sanchengyun, a privately-owned firm, pertaining to the sale of the companyâs branded products in China (virtually). Besides this, Agreements have been signed with:

- TEH D.O.O (Bosnia-Herzegovina);

- International Nutrition and Sport SA (Pty) Ltd (South Africa);

- ASH Group FZE LLC. (Middle East).

For these Agreements, the company has the right to terminate if the Distributor fails to achieve its minimum annual performance requirements or there is a material change in ownership or control of the Distributor.

Moreover, the company expects to enter into further new sales and Distribution Agreements in the times to come, which would make a significant and on-going contribution to the overall financial performance of ZNO.

ZNOâs Products (Source: ZNOâs Website)

Freehill Miningâs Annual Report

The companyâs focus for 2019 cantered around the completion of its maiden drilling program and delivery of a maiden JORC Resource Estimate, the outcome of which was achieved in May 2019- The JORC Mineral Resource Estimate for YB1 Structure totalling 18.4 million tonnes at 15.1% Fe based on exploration of 9% of Yerbas Buenas Project Area.

Besides this, the geophysics team of FHS had identified a separate and much larger ore body, which was drilled (though not included in the JORC estimate). The three drill holes support FHSâ geophysical interpretation, where one ore body (YB 016) depicted 120 metres of 30% Fe including 16 metres of >61%Fe.

The companyâs existing land area covered 30% of this ore body, and the remaining 70% was on an adjoining allotment. FHS is striving to procure the lease and has managed to acquire the lease for the balance of this ore body, which is a notable achievement.

As outlook, this ore body would be the major focus of the next drilling program, and results are expected in Q1 2020. As an icing on the cake, the company has undertaken a share placement with commitments of $2.6 million to support the second drilling program, which would provide the basis for a prefeasibility study.

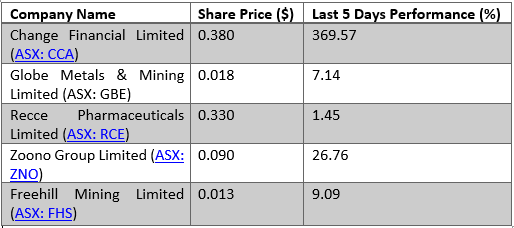

Share Price Information

Let us now look at the share performance of these companies, and the stance of their stock on the ASX in the past 5 days (as on 1 October 2019 at 1:27 PM AEST):

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.