On 2 January 2020, the Australian benchmark index i.e. S&P/ASX 200 was trading at 6705.6 points, with a rise of 0.3 percent (at AEDT 2:25 PM). In the below article we will be having a glance at three stocks, whose prices were under spotlight such as Pro Medicus Limited, which experienced a good growth in all three of its jurisdictions in FY19. Also, TechnologyOne Limited has experienced decent growth in profit while Altium Limited is committed to meet its 2025 targets.

Let’s have a look at the three companies with their recent updates.

Pro Medicus Limited (ASX: PME)

Pro Medicus Limited (ASX: PME) is engaged in the supply as well as development of software and IT solutions to the public and private healthcare sector. Recently, the wholly owned subsidiary of the company Visage Imaging, Inc., has inked a five-year, multi-million-dollar contract with Nines, which is based out of Palo Alto.

The company added that the offering based on Visage 7 technology, would be hosted in Google Cloud Platform. This contract is expected to result in base revenue of more than $6 million to PME over the life of the contract along with the potential for major upside.

Strong Rise in Revenue

The company during the FY19 experienced a good growth in all three of its jurisdictions. The company also witnessed a significant rise in revenues in the US, which was resulted from a greater number of transactions flowed from customers including Mayo and Yale.

· PME reported full-year after-tax profit amounting to $19.1 million, reflecting a rise of 91.9% as compared to pcp.

· When it comes to revenues, the company witnessed a rise of 42.2%, 102.3% and 30.2% in North America, Europe and Australia, respectively. This combinedly led to a rise of 47.9% to $50.1 million for the group.

The stock of PME was trading at $22.610 per share on 2 January 2020, with a rise of 1.163% (at AEDT 1:40 PM). The company has a market capitalisation of $2.32 billion as on 2 January 2020. The total outstanding shares of the company stood at 103.95 million, and its 52-week low and high is $10.863 and $38.390, respectively. The company has given a total return of -23.80% and -12.01% in the time period of three months and six months, respectively.

TechnologyOne Limited (ASX: TNE)

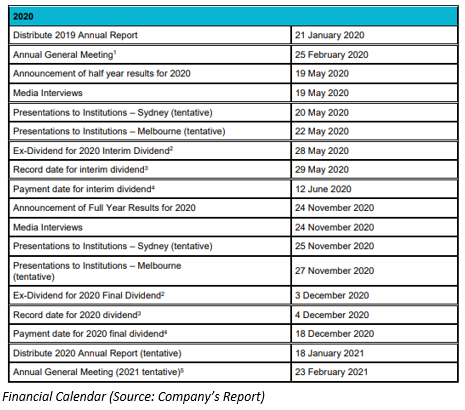

TechnologyOne Limited (ASX: TNE) is a Software as a Service (SaaS) company, which is involved in the development, marketing, sales, implementation as well as support of fully integrated enterprise business software solutions. The company through a release dated 16th December 2019 announced that it has appointed Mr Paul Jobbins for the role of a secondary Company Secretary. The following picture provides an overview of the financial calendar 2020:

Robust Rise in Profit

The company recently updated the market with the results for the financial year ended 30th September 2019, and outlined the following:

· TNE witnessed a rise of 208% in net profit after tax and the figure stood at $76.4 million, which was supported by the continuing fast growth of the TechnologyOne SaaS ERP solution.

· There was a rise of 40% in profit of APAC region, which was supported by strong SaaS growth from its market leading enterprise SaaS offering. The company has continued to invest strongly in the UK and its result has witnessed an improvement of 64%.

· With respect to R&D, the company has invested more than $60 million and also, it continues to invest in new exciting ideas as well as innovation, which include Artificial Intelligence and Machine Learning.

The stock of TNE was trading flat at $8.290 per share on 2 January 2020 (at AEDT 1:56 PM). The company has a market capitalisation of $2.64 billion as on 2 January 2020. The total outstanding shares of the company stood at 318.52 million, and its 52-week low and high is $5.950 and $9.400, respectively. The company has given a total return of 8.37% and 2.47% in the time period of three months and six months, respectively.

Altium Limited (ASX: ALU)

Altium Limited (ASX: ALU) is involved with the activities like development and selling off of computer software for the design of electronic goods. The company recently announced that Mitsubishi UFJ Financial Group, Inc. has ceased to become a substantial holder in the company from 15th November 2019.

Committed to Achieve 2025 Targets

· For the financial year ended 30th June 2019, the company reported a rise of 23% in revenue and 41% in net profit against FY18. FY19 has been proved as 8th consecutive year, where the company has reported a growth of double-digit in revenue and has expanded its EBITDA profit margin. The company would increase the efficiency of its transactional sales model with business intelligence, analytics, and automation.

· The company has cemented the foundation in order to rise the efficiency as well as reach of its direct transactional sales model. The company made investment in its new cloud platform Altium 365, which it has commenced to launch. In addition, these initiatives would help the company to drive to market supremacy and the accomplishment of its 2025 targets.

· On the outlook front, for FY20, the company is expecting revenue in the ambit of US$205 million to US$215 million and EBITDA margin of between 37% to 38%. The company also added that the creation of electronics via the rise of smart connected devices, which would be driving growth for its business for the near future. The company is pledged to reach 100,000 subscribers and revenue of US$500 million in 2025.

The stock of ALU was trading at $34.370 per share on 2 January 2020, with a fall of 1.008% (at AEDT 2:17 PM). The company has a market capitalisation of $4.55 billion as on 2 January 2020. The total outstanding shares of the company stood at 130.97 million, and its 52-week low and high is $20.550 and $38.490, respectively. The company has given a total return of 1.76% and -2.31% in the time period of three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)