S&P/ASX 200 Trading Lower

At around 12:55 PM AEST, on 18 October 2019, the S&P/ASX 200 Index was trading lower by 0.6% or 41.4 points at 6,643.3 relative to the last close.

Major banks of the country were trading lower â Westpac Banking Corporation (ASX: WBC) down by 1.1%, National Australia Bank Limited (ASX: NAB) down by 0.8%, Commonwealth Bank Of Australia (ASX: CBA) down by 1%, Australia And New Zealand Banking Group Limited (ASX: ANZ) down by 1.18%.

Among other heavyweights, Rio Tinto Limited (ASX: RIO) was up by 0.94%, BHP Group Limited (ASX: BHP) was down by 0.14%, Woolworths Group Limited (ASX: WOW) down by 1.48%, Wesfarmers Limited (ASX: WES) was down by 0.87%, Macquarie Group Limited (ASX: MQG) was up by 0.16%, and Transurban Group (ASX: TCL) was down by 1.2%.

Meanwhile, IOOF Holding Limited (ASX: IFL) was shining brighter, trading up by 5%. IFL has reported that APRA would not appeal at the Federal Court against IFLâs entities. On 17 October 2019, IFL had reported on the revised price of an acquisition that was down from the previous price.

Some other names with gains included â Bravura Solutions Limited (ASX: BVS) was up 4.52%, Southern Cross Media Group Limited (ASX: SXL) was up 3.12%, AMP Limited (ASX: AMP) was up 2.94%, and Steadfast Group Limited (ASX: SDF) was up 2.78%.

On 17 October 2019, WiseTech Global (ASX: WTC) closed the session, marking the largest loss in the benchmark index. WTC was down 10.18% or $3.4 to close at $30, and the stock was placed on a trading halt. In a note to the exchange, WiseTech said that the trading halt would allow the company to respond to the allegations contained in a research report. Media quoted J Capital Research had accused the company of overstating financials.

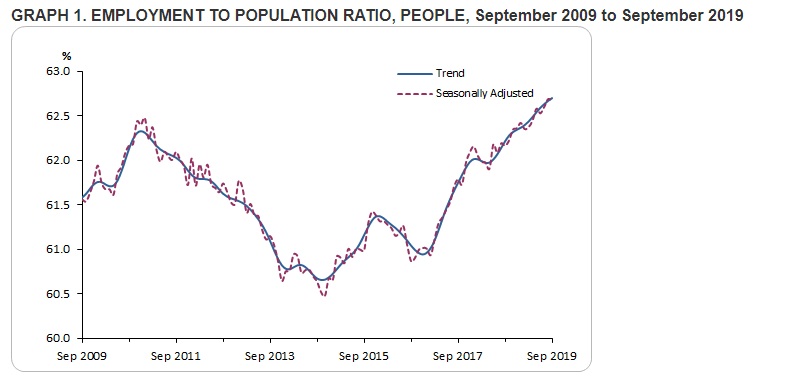

Labour Force Data

The Australian Bureau of Statistics (ABS) released the Labour Force data for September 2019. The data for the previous month suggests a pick-up in employment, increasing by 14.7k on a seasonally adjusted basis from August 2019.

Seasonally Adjusted Estimates

On a seasonally adjusted basis, unemployment decreased by 11.4k, and the unemployment rate decreased by 0.1 percentage points (pts) to 5.2% compared to 5.3% in August 2019. The participation rate was down by 0.01 pts to 66.1% from 66.2% in August 2019. However, in all job, the monthly working hours were up by 4.1 million hours, reaching ~1.787 billion hours compared to ~1.783 billion hours in August 2019.

Further, it was said that there was a minor disruption to the data sampling activities due to bushfires in New South Wales & Queensland. However, there was no impact on the labour data numbers.

In September 2019, the data suggest that 26.2k people joined the workforce on a full-time basis, and part-time numbers were down by 11.4k people.

Over the year to September 2019, 191.7k people took full-time employment, while employment in part-time increased by 119.9k people. The unemployment rate increased 0.2% in the same period.

In seasonally adjusted terms, the state data suggest unemployment came down in each state except New South Wales. South Australia witnessed a major drop in the unemployment rate to 6.3% against 7.3% a month ago. However, the unemployment rate in New South Wales rose by 0.2 pts to 4.5% from 4.3% a month ago.

Trend Estimates

In September 2019, the trend estimates suggested employment increased by 20.2k to ~12.94 million people over August 2019, consisting of an increase of 9k people in full-time employment, and an addition of 11.3k people to the part-time workforce. Over the year to September 2019, the number of employed people increased 2.4%.

The y-o-y increase in the number of employed was better than the historical average annual growth rate of 2%

The number of people unemployed increased by 1.6k to 718k on trend estimates basis, representing an increase of 1.6% over the previous month, and an increase of 4.7% over the year. Further, the participation rate was flat at 66.2% over the previous month. Over the year to September 2019, the participation rates increased by 0.6 pts.

Housing Demand to Outstrip Supply?

Recently, the Deputy Governor of RBA â Guy Debelle spoke in an industry event. The data from RBA suggest that the dwelling supply has been falling in the mainland states since 2018. Mr Debelle said a shortfall in housing supply is likely in the future that might result in substantial changes in prices.

He expects the demand for housing to grow, and construction slowdown is prevalent while housing investment would fall over the next year. The population growth would drive demand in the housing sector.

Tighter lending conditions on constructors might result in more shortfall in supply, and the slowdown in the residential construction space might adversely impact the GDP by 1 pts, as the dwelling have a 6% share in the GDP. There would be a wider impact on lending to small business due to the extensive use of the property as collateral by small business loans.

He said that a primary indicator for small business income â gross mixed income has declined by 3.8% over the past year, contributing to historically low growth in household income. RBA estimates that it is the reason in the recent consumption slowdown, and a slowdown in credit is more of demand-side impact rather than supply.

On rate cuts, it was said that the slowdown in the housing construction had resulted in low inflation readings, leading to rate cuts as rents and dwelling purchases are a major component in CPI baskets.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)