Sonic Healthcare Limited (ASX: SHL)

Headquartered in Sydney, Australia, Sonic Healthcare Limited (ASX:SHL) is a global healthcare service provider that is listed on ASX since 1987. The company is focused on providing laboratory, imaging and primary medical care services to doctors, hospitals, community health services, and patients.

| Sonic Healthcare operates two businesses: |

|

Laboratory Segment Involves |

Imaging Segment |

|

|

|

|

SHL to Raise USD 550 Million

Share prices of Sonic healthcare Limited came under the radar post an announcement on 10 October 2019, related to long-term debt funding. It has been updated to the market that the company has priced USD 550 million of notes in the US private placement market. Further, informing on the closing of the transaction, which is expected in January 2020, upon completion of the final investor due diligence and documentation. The tenor of this funding would be for-

- Ten years- USD300 million

- Twelve years- USD150 million

- Fifteen years- USD100 million

The company believes that this move would extend its debt maturity profile with the weighted average fixed coupon for the notes will be 3.07%.

Post this announcement, the companyâs share prices went slightly up by 0.17% to $28.7 from the previous close price of $28.6 (as on 10 October). On 14 October 2019, SHL stock last traded at $28.65, up by 0.07 percent from its previous close. The market capitalisation of SHL stood at $13.59 billion, with 474.8 million outstanding shares.

The 52 weeks high and low prices were noted at $29.93 and $21.26 respectively with an average (year) volume of 1,082,867. The P/E ratio was recorded at 23.37x and EPS at $1.225 with an annual dividend yield of 2.93%. The SHL stock has provided a return of 31.33 percent in year-to-date period.

Key Highlights of SHLâs Annual Report for FY2019

On 25 September 2019, Sonic Healthcare Limited released annual report for the year ended 30 June 2019. SHL achieved a record financial results in FY2019 period, which were in line with its guidance. Some of the highlights of the same are as follows:

- Generated revenues of $6.2 billion, growth by 11.6%.

- Net profit noted at $550 million, appreciated 15.6%.

- An increase in earnings per share of 8.8% amounting to $1.22.

- Declared total dividends of $0.51 per share, appreciated 4% on the previous year.

- Full-year dividend rose by 3.7% to $0.84.

- A growth in EBITDA of 13.3% amounting to $1.1 billion.

- Reached a significant milestone of exceeding $1 billion of EBITDA for the first time, a magnificent achievement for the Sonic Healthcare and its employees.

- Completed in January 2019, the acquisition of Aurora Diagnostics in the United States stood as a standout event, paving the way to the worldâs largest laboratory medicine market.

- In June 2019, the company accomplished the strategic divestment of its non-core GLP system.

- Completed institutional equity placement of $600 million in December 2018 and the related Share Purchase Plan (âSPPâ) for retail shareholders was completed in February 2019, raising $328 million, taken together, these represented the largest equity raising the company has ever undertaken.

- Net debt, after payments for acquisitions and dividends, valued $184 million has been reduced.

- Return on Invested Capital (âROICâ) augmented from 8.6% to 8.7%.

- Sonic Healthcare observed strong momentum laying the foundation for major opportunities in future.

Guidance for FY 2020

The guidance provided by Sonic Healthcare for the year 2020, excluded the impact of new lease accounting standard AASB 16.

- EBITDA growth of 6-8% over the underlying EBITDA of FY 2019 of $1,052 million on a constant currency basis is expected by the Company.

- It is expected that interest expense would increase by approximately 3% (constant currency).

- Around 25 percent of effective tax rate is anticipated.

- The company is anticipating having a significantly lower capital expenditure in FY 2020.

Considreantions on Key Guidance

- FY2020 excludes forthcoming acquisitions.

- Includes reduction in PAMA fee (USA) which is equivalent to approximately 2% of total group EBITDA.

- No further regulatory variations presumed.

- It is presumed that current interest rates would continue to prevail.

- EBITDA guidance to upsurge by an additional ~3%.

Effect of AASB 15 (revenue accounting standard) would be measured in FY 2020, changing base from $1,061 to $1,052.

Dividend

Dated 19 August 2019, the company provided details of the bonuses in respect of the year ended 30 June 2019 and the previous corresponding year.

- A final dividend of 51 cents per ordinary share, franked to 30% in respect of the year ended 30 June 2019 was declared and paid on 25 September 2019 and recorded on 11 September 2019.

- Further, on 26 March 2019, an interim dividend of 33 cents per ordinary share was announced, franked to 20%.

- In respect to the year ended June 2018, SHL declared a final dividend of 49 cents per ordinary share that was payable on 27 September 2018, and the interim dividend of 32 cents per ordinary share was paid on 10 April 2018.

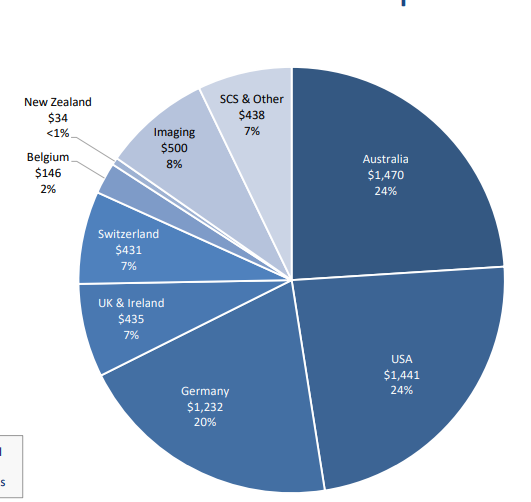

FY 2019 Revenue Split

Source: Companyâs Presentation

Sonicâs Laboratory division had seen strong revenue growth of 8% in FY2019 (on a Constant Currency basis), with approximately 4% organic revenue growth.

In Australia, the company recorded market share gains with strong organic revenue growth of 5%, which included revenue generated from the national bowel screening contract won by the company effective 1 January 2018, with the earnings growth and margin accretion being in the pipeline. SHL also reported substantial savings resulted from acquisitions.

In the United States of America, SHL recognised revenue growth of 18% on a constant currency basis, which was enhanced by the acquisition of Aurora Diagnostics on 30 January 2019. SHLâs revenue decreased by $33 million due to the merger of Sonicâs division in US Mid-west into its collaborative project with ProMedica Health System, Inc. dated 1 September 2018. Further, Medicare (PAMA) fee cuts with effect from 1 January 2018 and 1 January 2019 also impacted the US revenue and earnings. Moreover, organic revenue grew by 5% (on a constant currency basis).

In Germany, SHL generated growth in revenue by 3.5% (on a constant currency basis). Revenue and margins were impacted by the regulatory changes taken place in April 2018 however, in the recent months, organic revenue growth and margins have been trending stronger. German growth was improved by the procurement of Pathologie Trier in July 2018.

In UK and Ireland, the company achieved organic revenue growth of 9% (on a constant currency basis), boosted by the completion of one year of Barnet / Chase Farm hospital contract that began in October 2017.

In Switzerland, the company reported organic revenue growth by 4% with strong earnings and margin growth.

Sonic Imaging

Sonicâs Imaging organic revenue growth of 6% has been reported, which was in accordance with the market growth. Also, with margin accretion, 7% earnings growth was reported.

Sonic Imaging- Operational review

- During the recent Government allocation, the company received three full MRI licences.

- Continued national synergies for Sonicâs projects.

- Opportunities including Greenfield and new modality resulted in Companyâs expansion.

- Improved workflow efficiency by investing in technologies.

- Stable regulatory environment and;

- SHL introduced fee indexation effective from July 2020, which affected nearly 80% of Medicare imaging schedule.

Sonic Clinical Services (SCS)

Medical centres (IPN), and occupational health businesses (Sonic HealthPlus) comprises Sonic Clinical Services. It is Australiaâs largest primary care and occupational health provider with 233 centres and approximately 2,400 GPs. The current period revenue was reduced by $9.3 million because of the new revenue accounting standard AASB 15, which came into effect from 1 July 2018.

Outlook

Additionally, the companyâs progress is backed by stable, qualified and dynamic global management teams, with its innovative technology driving efficiencies, initiative leading to acquisitions and other collaborations delivering ongoing benefits.

Overall, Sonic Healthcare has a global team of more than 1000 pathologists, beyond 200 radiologists and thousands of qualified technical staff supporting Sonicâs Medical Leadership culture.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.