Investors with less risk appetite look for dividend stocks for regular return. Some of the important stocks with a dividend yield of more than 4% are Crown Resorts Limited (ASX:CWN), Coca-Cola Amatil Limited (ASX:CCL), and Westpac Banking Corporation (ASX:WBC). Let's see how these companies are performing based on their recent updates and stock performance.

Crown Resorts Limited (ASX:CWN)

Crown Resorts Limited (ASX: CWN) is the largest Australian entertainment group, which owns and operates two of the leading integrated resorts in Australia (Crown Melbourne and Crown Perth). Overseas, the company operates and manages Crown Aspinalls in London. CWN has interests in various digital businesses, such as DGN Games (85%), Chill Gaming (50%), and Betfair Australasia (100%). The group holds an equity stake in the United Kingdom based Nobu (20%) and Aspers Group (50%). The company recently announced that all the confidential discussions with Wynn Resorts Limited (Wynn) in relation to a potential change of control transaction following approaches by Wynn to Crown, has been terminated. In its H1 FY19 results, the group reported a decrease in revenue from continuing operations by 7.3% pcp to $1,478 million. CWNâs net profit (NPAT) for the period attributable to members of the parent decreased by 26.7% to $174.9 million.

On the stock information front, the stock of Crown Resorts was trading at $13.32, up 0.604% with a market capitalisation of ~$8.97 billion as on 3rd May 2019. Its current PE multiple stands at 18.36x, and its last EPS was noted at A$0.721. Its annual dividend yield has been noted at 4.53%. Its 52 weeks high price stands at $14.59 and 52 weeks low at $11.23, with an average volume of 1,854,828. Its absolute return for the past five years, one year, six months, and three months are -11.33%, 2.55%, 6.15%, and 11.49%, respectively.

Coca-Cola Amatil Limited (ASX:CCL)

Coca-Cola Amatil Limited (ASX: CCL) is one of the famous distributor and bottler of alcoholic and non-alcoholic ready-to-drink beverages in the geographic region of Asia Pacific. It operates across 6 countries, such as New Zealand, Australia, Papua New Guinea, Indonesia, Samoa, and Fiji. The group employs more than 12K people to cater to the need of 270 million potential consumers. It operates through 45 warehouse facilities and 35 production facilities. The company recently announced its annual report for 2018, where it reported underlying NPAT of $388.3 million, underlying EBIT of $634.5 million, underlying EPS of 53.6 cents, and total 2018 dividend of 47 cps.

On the stock information front, the stock of Coca-Cola Amatil was trading at $8.940, up marginally at 0.562% with a market capitalisation of $6.44 billion as on 3rd May 2019. Its current PE multiple stands at 23.090x, and its last EPS was noted at A$0.385. Its annual dividend yield has been noted at 5.29%. Its 52 weeks high price stands at $10.500 and 52-weeks low price at $7.875, with an average volume of 2,019,665. Its absolute return for the past five years, one year, six months, and three months are -1.88%, -3.47%, -11.72%, and 5.96%, respectively.

Westpac Banking Corporation (ASX:WBC)

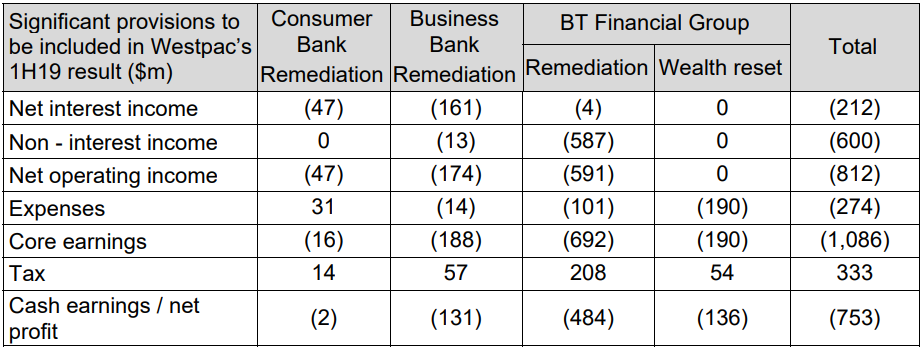

Westpac Banking Corporation (ASX: WBC) is engaged in providing financial services such as deposit taking, lending services, investment portfolio management, payments services, superannuation and funds management, leasing finance, insurance services, general finance, foreign exchange and interest rate risk management services. In relation to certain ongoing advice service fees of the authorised representatives, the company released an update on the accounting provisions for the remediation. On 25th March 2019, the company indicated that the assessments were underway in relation to authorised representatives and as well announced an increase in the provisions for its salaried planners.

Impact for the H1FY19 of significant provisions (Source: Company Reports)

Impact for the H1FY19 of significant provisions (Source: Company Reports)

H1FY19 result report of the group will be released on 6th May 2019.

On the stock information front, the stock of Westpac Banking was trading at $27.44, up 0.109% with a market capitalisation of $94.5 billion. Its current PE multiple stands at 11.54x, and its last EPS was noted at A$2.375. Its annual dividend yield has been noted at 6.86%. Its 52 weeks high price stands at $30.44 and 52-weeks low price at $23.30, with an average volume of 6,224,150. Its absolute return for the past five years, one year, six months, and three months are -20.96%, -5.97%, 3.43%, and 10.21%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.