Summary

- Bank stocks on ASX have had been tumbling down since last two days in a row (as on 12 June 2020), getting affected from the negative sentiment flow in the market, due to the bleak outlook for the economy by the US Federal Reserve.

- Amid the challenging scenario, Australia has been making earlier than expected recovery in the COVID-19 situation.

- OECD is of the view that Australia is pioneering in bringing the world out of recession posed by the pandemic.

- Westpac also suggests an improved growth outlook for Australia as things seem to be under control.

The bank stocks are a charmer for many investors, even in the times of crisis posed by the COVID-19. However, after the sharp decline in the S&P/ASX 200 BANKS (INDUSTRY) index by 5.33% on 11 June 2020 and 2.4% on 12 June 2020 (at AEST 12:22 PM), should investors still look at the bank stocks for further value?

On 11 June 2020, the benchmark index S&P/ASX 200 moved down by more than 3% and closed below its 6000 points mark on the back of further deterioration of investor sentiments which were already weakened by the COVID-19 situation. Also, on 12 June 2020, the same index was trading at 5,849 points, down by 1.86% (at AEST 12:26 PM).

The big four bank stocks on ASX tumbled on 11 June 2020 by a minimum of 4%, in line with the worst fall in approximately a month’s time subsequent to the bleak outlook for the economy by the US Federal Reserve that also withered investor confidence.

Reality Check on Price Movement

The changes in the prices of the big four banks in last 2 days (as on 12 June 2020) when ASX ended its seven-day gaining streak, are as follows:

- On 11 June 2020, Australia And New Zealand Banking Group Limited (ASX:ANZ) dropped by 6.214%, while on 12 June 2020, it was trading down by 2.671% (at AEST 12:42 PM).

- On 11 June 2020, Commonwealth Bank Of Australia (ASX:CBA) declined by 4.413%, while on 12 June 2020, it was trading down by 1.636% ( at AEST 12:42 PM).

- On 11 June 2020, National Australia Bank Limited (ASX:NAB) fell by 5.407%, while on 12 June 2020, it was trading down by 2.255% (at AEST 12:42 PM)

- On 11 June 2020, Westpac Banking Corporation (ASX:WBC) declined by 6.091%, while on 12 June 2020, it was trading down by3.784% (at AEST 12:42 PM)

Other than the big four banks, Bank Of Queensland Ltd (ASX:BOQ) dropped by 4.86%, on 11 June and was trading down by 3.096% (on 12 June 2020, at AEST 12:45 PM), as well as Bendigo And Adelaide Bank Limited (ASX:BEN) dropped by 5.138% and was trading down by 4.359% ( on 12 June 2020, at AEST 12:46 PM).

However, till 9 June, the high investor sentiments were reflected by the daily growth in the benchmark index as well as the gains of the bank stocks.

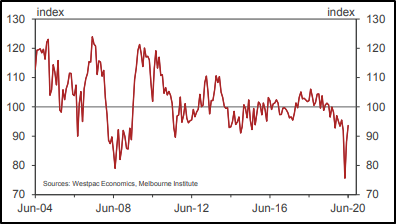

Moreover, the positivity in the investor sentiments was supported by the rebound of 16.4% in the month of May 2020 in the Westpac-Melbourne Institute Index of Consumer Sentiment, bringing the index to 88.1 from the lowest point of 75.6 recorded during April 2020.

Consumer Sentiment Index (Source: Westpac-Mi Consumer Sentiment June)

Consumer confidence was seen coming back to around pre-COVID levels buoyed by Australia’s continued success in bringing coronavirus under control, implying further easing in social restrictions over the previous month.

The bank stocks had been deriving gains from the positive sentiments in the market, which, however, are posed to fresh challenges with Federal Bank’s outlook for the US economy saying the US might have hit the bottom of the pandemic recession, as of now it is not prudent to pull back support for the economy.

Moreover, investor sentiments are reflected by the sharp decline in the market. They are in a state of flux to choose between the value offered by bank stocks, and the likely impact of the challenges that may arise in upcoming times.

Controlled COVID-19 Boosting Investor Confidence

Amid COVID-19, bank stocks had taken a hit due to the economic downturn that resulted from the spread of the virus. The pandemic is charging on in several countries; however, Australia has been able to take control of the situation, lately, and the coronavirus curve in the country has flattened. But what about the impact of the economic downturn on the bank stocks.

The international regulatory bodies marked the entry of global economy into recession, which made things more severe for the banks. Australian Government announced a stimulus package on 12 March 2020 to support the economy and keep people in jobs. However, forecasts for sluggish growth in the economy remained in place with a slight up-down of numbers after the government announced the stimulus package.

Moreover, as Australia started recovering from the economic and health impacts of COVID-19 at a pace faster than the anticipations of the market, investors looked more optimistic about bank stocks. Moreover, the upward shooting optimism in the market set the push for the benchmark index to rise significantly from its lows in March to surpass 6000 points mark in the current week of June 2020.

Early Recovery in Australia

The Organisation for Economic Co-operation and Development (OECD) announced new forecasts of Australian economic recovery, trailing only South Korea, China and Indonesia in economic resilience terms, and expects a contraction of 5% in economic output of Australia.

The stimulus package announced by the government has been a corner piece that has kept the Australian economy resilient in such challenging times. However, recent media reports were divided on whether the government should continue its stimulus package beyond September. The OECD has flagged not to cut short the emergency spending and continue it beyond September and is of the view of additional stimulus to support incomes and maintain employment across the economy.

The OECD also said that the governments must pay heed to the restructuring of tax, regulations, labour markets, as well as competition in order to ensure a constant recovery from the crisis.

Australia in Recession with Growth Outlook

In March quarter of 2020, activity in the Australian economy contracted by 0.3%, slowing annual growth to 1.4% from 2.2%, following which Westpac forecasted a recession in 2020. However, as indications of an earlier than anticipated relaxation in restrictions surface, Westpac has reiterated its forecast growth profile as follows:

- –0.3% in Q1

- –7.0% in Q2

- +1.5% in Q3

- +2.0% in Q4

Moreover, for the third and fourth quarter, Westpac’s growth profile has been amended from -0.6% and +5.2%, respectively, to replicate the earlier than anticipated easing of restrictions. Also, Westpac now predicts a growth of 3% for 2021, indicating the expectation that the economy shall operate lower than the December 2019 capacity.

On the retail sales front, it is expected that the nominal retail sales shall see a double-digit boost on the back of increased credit and debit card usage in May. However, the economy still anticipates operating at approximately 4% below its capacity of December 2019, and the unemployment rate is expected to remain about 8%, as per Westpac.

Bottomline

Although the burden of economic crisis directly impacts the banking ecosystem of Australia, a lot shall depend on how the government plans for the stimulus package as we inch closer to the September month. Interestingly, the big four banks on ASX have been one of the most consistent income streams for the investors over the years through regular dividends, as well as capital gains. Moreover, as the various reports suggest a positive outlook for the Australian economy, it shall be interesting to see how investors respond to these developments.