The ocean of business regularly experiences the tides, which sometimes uplifts the company on top of mountain and sometimes provides a lower level of graveyard. In the below article, we will be discussing four companies operating in diversified sectors, with their recent developments, owing to which these companies are shining in the eyes of investors. On 23rd October 2019, the benchmark index S&P/ASX 200 closed trading at 6,673.1 points with a rise of 0.01%.

Letâs have a look at these four companies with their recent updates:

G Medical Innovations Holdings Limited (ASX: GMV)

G Medical Innovations Holdings Limited (ASX: GMV) is specialised in innovative next generation mobile and e-health solutions and services.

Suspension of Trading Halt - As per an ASX release dated 22nd October 2019, the securities of G Medical Innovations Holdings Limited commenced trading after a trading halt, as the company updated the market with response to an ASX query dated 16 October 2019 and its responses dated 8 October 2019 to the previous queries.

Food and Drug Authority Approvals

- Recently, the company, through a release, announced that the G Medical Proprietary Patch, which is granted regulatory approved CE Mark for the European territory, is continuing to start the process of its separate filing to FDA.

- GMV considered the opportunity as well as vision to add further features. extended Holter with Auto Detect Auto Send as a second-generation type G Medical Patch, in order to meet newly established requirements as an extended holter monitor for the US territory.

- The following design and features are being expected to be approved by the FDA during Q1 2020:

- Protection circuit for defibrillator compatibility

- Mechanical design alterations

- Algorithm upgrades

- Testing and submission

- FDA approval.

On the stockâs performance front, G Medical Innovations Holdings Limited last traded at a price of $0.110 per share, down 8.333% on the trading session of 23rd October 2019. It experienced a fall of 63.08% in the time frame of last six months.

NVOI Limited (ASX: NVO)

NVOI Limited (ASX: NVO) is involved in the continued development of an advanced âtalent-on-demandâ platform, which is a cloud-based software-as-a-service (SaaS) platform. The company recently announced that Philip David Crutchfield, one of its directors, purchased 61 million fully paid ordinary shares and 8,800,00 unlisted options, exercise price $0.0034 with expiry date of 30th November 2024.

Strategic Review Completion

- As per a release dated 18th October 2019, the company wrapped up a strategic review of its operations and the implementation of its new strategy to fuel growth.

- The company stated that besides focusing purely on the niche contractor segment of the market, it would be expanding its current footprint to full human resource management.

- NVOI would be leveraging its platformâs core functionality in order to handle employee onboarding, which primarily include ID and resume verification and contract management, as well as time sheeting, rostering, payroll.

- With respect to capital raising, the company is pleased with the commitment received for a capital raising of $4.6 million with institutional and sophisticated investors.

- The capital raising will result in the placement of a total of around 461 million new fully paid ordinary shares at an average issue price of $0.01 per new share.

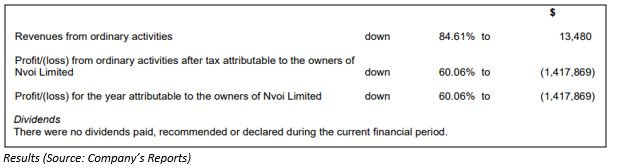

The below image provides an overview of the companyâs performance during the year ended 30th June 2019:

On the stockâs performance front, the stock of NVOI Limited closed at a price of $0.013 per share on 23rd October 2019. It experienced a rise of 225.00% in the time frame of last six months.

Change Financial Limited (ASX: CCA)

Change Financial Limited (ASX: CCA) is a fintech company, engaged in the development of innovative and scalable payments technology. It provides mobile banking services via its mobile application. The company recently announced that Avatar Industries Pty Ltd ceased to be a substantial holder in CAA on 10th October 2019.

Major Milestones

- The company through a release dated 30th September 2019 announced that it has achieved a major milestone, as it has successfully wrapped up the development of its innovative payments and card issuing platform. In addition, the company has been provided PCI DSS certification.

- The company has been registered as a Mastercard payments processor by Central Bank of Kansas City, which is the US banking partner of Change.

- Some of the features of the innovative payments and card issuing platform of the company are program dashboard, data insights dashboard, API connectivity, dynamic controls, banking as a service and Mastercard

Issue of Bonds

- In early September 2019, the company issued 19,105,122 convertible notes at an issue price/face value of $0.10 each note.

- The bonds have been issued for the repayment of all outstanding monies owed to 31 August 2019 under the debt facility provided by Altor Capital.

At the end of the June 2019 quarter, the cash balance of the company stood at around ~US$1.5 million.

On the stockâs performance front, the stock of Change Financial Limited last traded at a price of $0.220 per share with a rise of 2.326% on the trading session of 23rd October 2019. It experienced a rise of 514.29% in the time frame of last six months.

Metals X Limited (ASX: MLX)

Metals X Limited (ASX: MLX) operates tin and copper mines in Australia. It is also engaged in the development and exploration of base metal projects in Australia.

What is new with the substantial holdings?

The company recently made an announcement, wherein changes to substantial holdings was mentioned. MLX stated that L1 Capital Pty Ltd made a change to its substantial holding in the company on 21st October 2019 and the current voting power of L1 Capital Pty Ltd stands at 15.05% as compared to the previous voting power of 9.93%.

Warning on APAC Resources

- As per a release dated 18th October 2019, the companyâs Board is deeply concerned about some of the tactics being taken by APAC Resources Limited, an activist shareholder.

- The company stated that a marketing entity, which is working on behalf of APAC Resources, has made calls to shareholders of MLX in relation to the upcoming Annual General Meeting, claiming to call on behalf of MXL, which is a false and misleading statement and could cause significant confusion.

Issue of Securities

- The company recently issued 103,359,076, 60,922,130 and 53,924,352 fully paid ordinary shares pursuant to the Placement, Institutional Entitlement Offer and Retail Entitlement Offer, respectively.

- The issue price of securities stood at $0.15 per share.

On the stockâs performance front, the stock of MLX last traded at a price of $0.200 per share, down 4.762% on the trading session of 23rd October 2019. It experienced a decline of 22.67% in the time frame of last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.