The Australian construction industry has different upcoming trends and has witnessed a robust growth supported by the industry revenue. The wider profit margins throughout the industry will invite divisional profitability and the general building industry is taking steps in line with its economic life cycle. The industry has witnessed four corner growth in some segments in the past five years on the back of the resources boom and subsequent slump of investments in relation to high-density apartment developments. Letâs look at two real estate stocks and how they have performed recently.

Lendlease Group

Lendlease Group (ASX: LLC) is involved in the management of retail property, large scale urban regeneration and greenfield development projects, etc. It is an Australian registered company, officially listed on ASX in 1962. On 3rd May 2019, LLC updated the market via a release that one of its substantial holder, namely The Vanguard Group Inc. has changed its interests in the company from 5.007% to 6.010%.

The company, in its Credit Suisse Asian Investment Conference Presentation, highlighted the operational and financial performance of the company. The companyâs comprehensive strategic review determined that the Engineering business and services is no longer a required part of the Group strategy. The global trends, such as urbanisation, infrastructure, funds growth, among others, have influenced the companyâs strategy. It has been estimated that 60% of the worldâs population will live in urban areas by 2030. LLC has an urbanisation pipeline of $59.3 billion along with 20 urban projects across the ten gateway cities. The global assets under management have been forecasted to increase from US$85 trillion in 2016 to US$145 trillion by 2025. The company has achieved annual growth of 17.8% in funds under management since FY14. In addition, global infrastructure spending is estimated to rise to an average of US$5.1 trillion per year between now and 2035. In parallel, LLC operates as one of the largest Retirement Living businesses in Australia and is seeking ways to establish a scale platform in China. In FY18, the company secured its first senior living project in Shanghai.

LLCâs business model with target EBITDA mix in development, construction and investment are in the range of 40% to 50%, 10% to 20% and 35% to 45%, respectively. The companyâs underlying operating cash flow will be presented to better reflect operating cash generated by the group from its operating business model. Additionally, LLC has reaffirmed its target returns against the previous expectations with Group ROE, Development ROIC, Construction EBITDA, Investments ROIC to be in the range of 10% to 14%, 10% to 13%, 2% to 3% and 8% to 11%, respectively.

Outlook

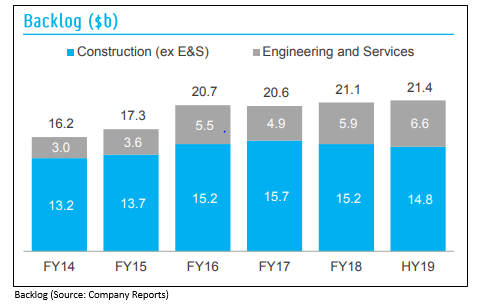

The company is planning to reset its business as well as work towards the development pipeline of $74.5 billion, wherein it has origination and place making capability with regards to the integrated model. The construction backlog revenue of $14.8 billion includes the design and capability of the company for an integrated model, however, there are external backlogs, which have been diversified by sector, geography and client. LLCâs investment segment carries $3.6 billion of investment, with $34.1 billion in funds under management and $26.6 billion in assets under management, which reflects the companyâs investment and funding capability for the concerned integrated model. Furthermore, Lendlease Group is focused on leveraging its competitive advantage through its integrated model, investment platform and urbanisation projects, with a disciplined approach to originate and manage each project and property cycle risk and commitment to health and safety.

LLCâs current ratio was 1.02x in 1H FY19, which reflects no change on a Y-o-Y basis. The asset-to-equity ratio of the company stood at 2.86x in 1H FY19 when compared to the industry median of 3.18x. (Source: Thomson Reuters)

At the time of writing, the stock of LLC was trading at a price of $13.350 per share, up 0.983% during the dayâs trade with a market capitalisation of $7.46 billion as on 12th June 2019, AEST 01:30 PM. The stock has provided returns of -4.55%, and 15.66% in the time span of one month and six months, respectively.

Stockland

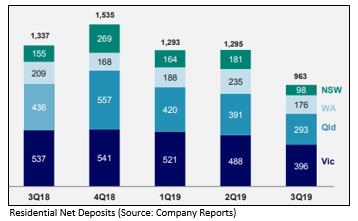

Stockland (ASX: SGP) is an Australia registered company involved in the development and management of a range of assets, which comprises residential communities, office and industrial assets, etc. It was officially listed on ASX in 1987. On 11th June 2019, the company via release stated that SGP completed the on-market buyback and cancellation of stapled securities totaling 2,773,000. SGP concluded 50,117,773 stapled securities on-market buyback and cancelled from the date of commencement of the buyback. Following this cancellation, there were 2,384,351,503 stapled securities on issue. In its Q3 FY19 Presentation, the company reported that the results achieved by the company were in line with its expectations. Moreover, Discount Drug Store showed modest growth, with growth in supermarket sales following the extreme weather conditions in Queensland. In addition, the company is on track to achieve its $400 million target within 12 months, as well as on track to settle more than 6,000 lots in FY19; however, it has witnessed a fall in the residential sales. Subsequent to the quarter end, Stockland secured new long term debt of $551 million at attractive interest rates.

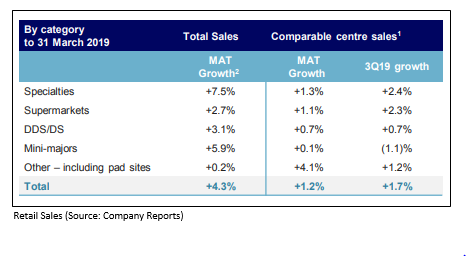

Turning to the retail sales, the company reported a growth of more than 3.8% to $9,253 per square metre for the year to March and witnessed robust growth in homewares and retail services, which was driven by beauty and wellness while apparels continue to be disrupted. The remixing strategy has improved sales per square metre by 2.8% with 30 less stores in the category as compared to last year.

Given the challenging market conditions, SGP anticipates Q4 FY19 sales to stay at or around the current level. There were moderate increases in cancellation rates over the quarter; however, the default rates remained stable at around 3%, with 84% of the sales for the quarter are to owner occupiers. There was a marginal reduction in established sales, which reflected lower volatility of RL market compared to the broader housing market.

The companyâs strategy is to deliver sustainable and growing returns by owning and managing leading retail town centres, growing its workplace and logistics asset base in Sydney, Melbourne and Brisbane and developing sustainable communities.

Outlook

The company has intensified its focus on improving retail operational performance along with concentrated exposure throughout the higher quality assets. SGP is planning to increase workplace and logistics asset allocation via the development pipeline. Furthermore, the company is keen on creating liveable, affordable and connected communities with counter-cyclical acquisitions and is also seeking for a capital partner for retirement living.

Financial Metrics

To throw more light on the financial metrics, the company witnessed improving financials, with gross margins of 47.5% in 1H FY19, reflecting a growth of 4.3% on a Y-o-Y basis. The companyâs liquidity ratio was 0.31x in first half FY19, with a growth of 3.1% on a Y-o-Y basis. This implies that SGP is in a sound position to address its short-term obligations.

At the time of writing on 12 June 2019, AEST 02:00 PM, the stock of SGP was trading at a price of $4.475 per share, down 0.776% during the dayâs trade with a market capitalisation of $10.75 billion. The stock has provided returns of 15.64% and 21.89% in the time span of one month and six months, respectively.

Comparison of LLC and SGP

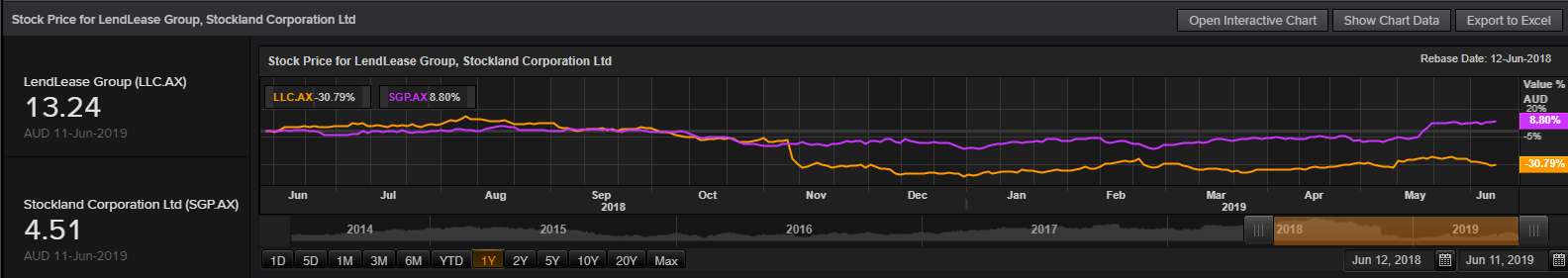

In the time span of one year, LLC and SGP witnessed the return of -30.79% and 8.80%, respectively.

Comparative chart (Source: Thomson Reuters)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.