Australian health care sector, represented as S&P/ASX 200 Health Care index on Australian Stock Exchange and denoted by the code XHJ ended the trade in the green zone at 35,832.4 on 4th October 2019, with a rise in 809.5 points or 2.31% from the previous close.

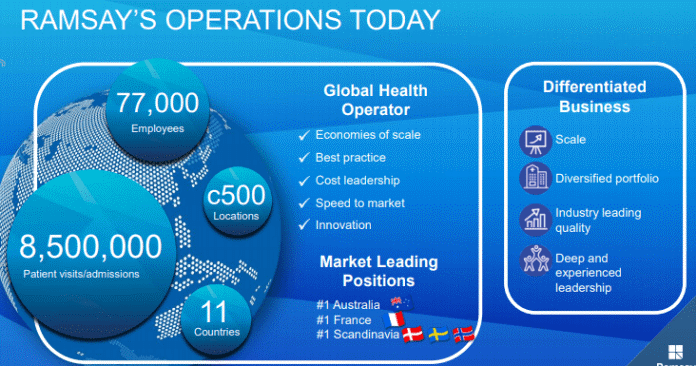

In the article, we will be looking at the Healthcare sector giant, Ramsay Healthcare Limited (ASX: RHC). Ramsay Health Care Limited is a leading health care services provider, headquartered in Sydney, Australia, with a focus on delivering high quality products for patients and ensures long term effectiveness. Ramsay is one most diverse global hospital group that operates in approximately 500 locations across the globe and is well-respected in the industry.

Source: Company Presentation

At the end of the trading session, Ramsayâs stocks traded at $64.5 and witnessed a rise of 0.35% from its previous close price at $64.32. Ramsayâs stocks are under the radar due to the dumping of shares by one of its prominent holders, Paul Ramsay Holdings Pty Limited (PRH). The market capitalization of Ramsay stands at $13 billion with 202.08 million outstanding shares, witnessing a 52 weeks high and low price of $74.12 and $51.9, respectively. Ramsayâs dividend yield stands at 2.36% and the current P/E ratio of the stock stands at 24.280x.

Ceasing to be Substantial Holder Notice

As on 24 September 2019, RHC notified the market that UBS Group AG and its related bodies corporate ceased to be the substantial holder of Ramsay Health Limited effective from 19 September 2019. Likewise, JPMorgan chase & Co. and its affiliates also ceased to be the substantial holder of RHC effective from the same date as mentioned above.

Change of Interests of RHCâs Substantial Holder Paul Ramsay Holding Pty Ltd (PRH)

Prior to this ceasing notice, on 19 September 2019, RHC announced the change of interests of substantial holder of Ramsay Health Care Limited. According to the announcement, there was a change of interest of Paul Ramsay Holding Pty Ltd (PRH) in RHC in accordance with section 127(1) of the Corporations Act 2001.The interests of RHCâs substantial holder PRH before the notice included 64,999,269 ordinary shares with the voting power of 32.16%. The present notice with effect from 19 September 2019 reflects 42,999,269 ordinary shares with the voting power of 21.3%.

Block Trade Agreement- Paul Ramsay Holding Pty Ltd sells 22 million shares

Change in relevant interest has resulted from the Block Trade Agreement settled on 19 September 2019, wherein the Company informed the market that Ramsayâs prominent shareholder, Paul Ramsay Holding Pty Ltd (PRH) successfully sold 22 million ordinary shares in the Company to institutional investors at a price of $61.80 per share.

Post the completion of this block trade, PRH would continue to hold 21% of the issued share capital of RHC.

Highlights from RHCâs Year End Report

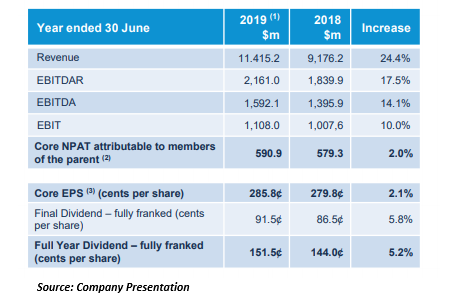

RHCâs year released the financial report for the year ended June 2019 on 29 August 2019, wherein, the company informed about the operational and financial performance for the given year, reporting strong growth.

- Ramsay has adopted a new lease accounting standard on 1 July 2019, i.e. AASB16. It is expected that the consolidated income statement as well as consolidated statement of financial position for the financial year 2020 would significantly create a non-cash effect.

- Specifying further, AASB16 adoption would have no influence on debt covenants, debt facility headroom and net cash flow.

- However, the company envisions a decline in the core net profit after tax of about $40 million-$50 million in FY20.

Group Performance

- The Core Net Profit After Tax (NPAT) for FY 2019 stood at $590.9 million, representing a rise of 2% on the previous corresponding period (pcp).

- NPAT delivered Core Earnings Per Share (EPS) amounting to 285.8 cents, increase of 2.1% on the 279.8 cents reported in the same period a year ago.

- RHCâs statutory net profit after tax of the company rose by 40.5% to $545.5 million, as compared to the previous year.

- Not including the acquisition of Capio, RHCâs NPAT stood at $593.9 million and Core EPS amounted to 287.3 cents, demonstrating a jump of 2.5% and 2.7%, respectively.

- The Companyâs group performance recognized a revenue of $11.4 billion, up by 24.4% while the group EBITDA of the company stood at $1.6 billion, with an increase of 14.1%.

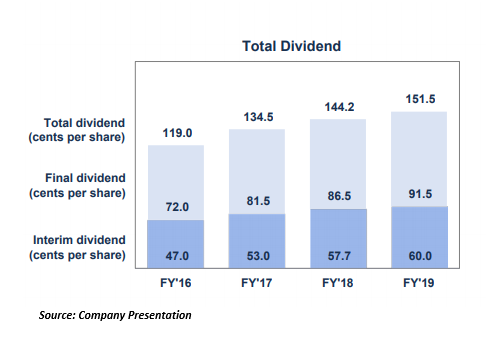

RHCâs Dividend Growth for FY2019

- The Company reported a fully franked final dividend amounting to 91.5 cents, an increased by 5.8% as compared to the previous corresponding period, bringing the full year dividend to 151.5 cents fully franked, a jump of 5.2% on the previous year, which is higher than the growth in Core EPS of 2.1%.

- RHC is expecting that the dividend policy for the future would be modified for the new lease standard AASB16.

- The company would continue to keep the dividend Investment plan suspended.

- The full-year dividend payout ratio was noted 53% of Core EPS, the remaining balance has been reinvested into the business.

Ramsayâs Segment Wise Performance

Australia

- RHCâs business operations in Australia generated revenues of $5.18 billion with an increase of 4.1%. The EBITDA for the given year noted at $950.5 million, an increase of 6.0% compared to the prior-year period.

- In Australia, the Growth from private admissions was noted as higher than the growth from industry, demonstrating RHCâs high quality market leadership, strategically located hospitals and successful investment strategy.

Asia

- In Asia, RHC reported strong operating performance for FY2019 in both Malaysia & Indonesia.

- A growth of 10% reported in admissions.

- In 2019, the companyâs key focus area was on cost controls.

- The equity accounted share of Net profits of joint venture demonstrated a rise of 5%, amounting to $19.4 million

Continental Europe

During the financial year 2019 the company acquired Capio, reflecting a strong growth in Continental Europeâs business performance. This acquisition is in advanced stages of integration, in this region the Company generated a revenue of â¬3.4 billion, up by 51.7% and EBITDAR witnessed a jump of 32.6%, amounting to â¬590.9 million.

United Kingdom

For FY2019, the revenue stood at £444.3 million in the United Kingdom and demonstrated an increase of 4.7%. The EBITDAR stood at £99.8 million, reflecting a decline of 2.8%.

RHCâs Group Strategy

RHC has a focused strategy enabling value creation for shareholders. RHCâs strategy involves driving stronger growth from the core and developing new growth platforms. In terms of efficiency, the company plans to strengthen its core and building a more sustainable organization.

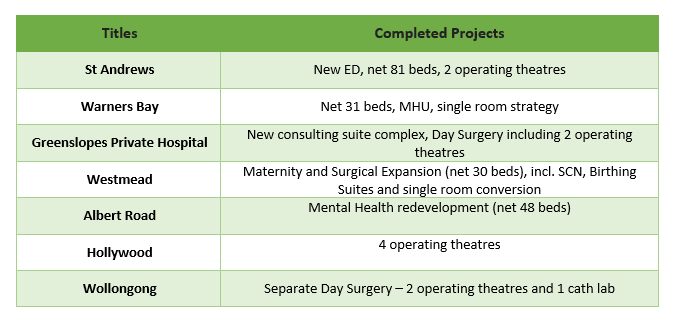

RHCâs Completed Brownfield Projects

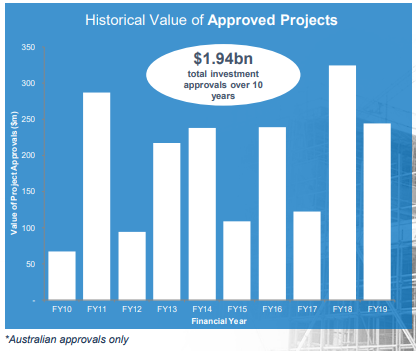

Australian brownfield programme reflected a strong growth with a total of 16 projects completed during the financial year 2019, with a gross capital investment of $242 million.

The company is expecting to complete brownfields projects worth $170 million in FY20, including 85 consulting suites, 254 gross beds, 157 conversions, 97 net beds, and three operating theaters, with more benefits expected in FY2021.

RHCâs Approved Projects in FY2019

During the financial year 2019, RHC received approval for following mentioned projects worth $224 million, which are underway including 51 consulting suites, 306 gross beds, 110 conversions 196 net beds and 10 operating theatres.

RHCâs Approved Projects Historical Value. Source: Company Presentation

Ramsayâs one of the major capital investment scheduled for FY2020 approval is Greenslopes Private Hospital Surgical, Medical & Emergency Centre Expansion. The company is expecting to open this hospital in the financial year 2022. The project includes an investment worth $72.34 million, 66 beds (64 beds and 2 ICU beds), 3 theatres 3 procedure rooms and 13 ED Bays.

Outlook

Ramsayâs FY2019 performance has placed the Company as a top international healthcare service provider having a diversified business portfolio.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.