Stock selection is a basic requirement before investing in the stock market, which is filled with speculations. In this article, we would discuss four diversified stocks, which could benefit investors as most of these companies have outperformed in their respective and recent earnings reports.

Letâs get know more about these players:

Flight Centre Travel Group Limited

Flight Centre Travel Group Limited (ASX: FLT) is involved in the travel retailing business and caters to the leisure and corporate travel sectors as well as in-destination travel experience businesses, which include tour operators, hotel management, destination management companies and wholesaling.

Issue of Shares

- Recently, the company issued 3,808 fully paid ordinary shares, which include 47 matched shares.

- The shares have been issued with respect to Employee Share Plan for the September 2019 contribution shares and 47 matched shares were issued under the terms of the companyâs Employee Share Plan.

- The issue price of 3,761 shares was $47.54 per share, while 47 matched shares were issued at nil value per share.

100% Acquisition of Ignite Travel Group

- On 20 September 2019, the company updated the market that it acquired 100% interest in Ignite Travel Group, strengthening its Australian leisure business.

- Previously, FLT held a 49% stake in Ignite Travel Group, a rapidly growing Gold Coast-based award-winning company.

- Both the parties (FLT and Ignite) have strategically agreed to bring forward the full purchase of Igniteâs Australian and New Zealand businesses in order to capitalise on its highly successful âreadymadeâ holiday package model.

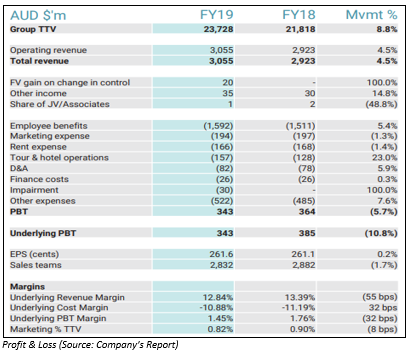

A look at FY19 Results

- FLT updated the market participants with the results for the year ended 30 June 2019, wherein it achieved another year of record sale and a profit within its targeted range for the period.

- The total transaction value stood at $23.7 billion, a new milestone as the company surpassed the FY18 record by almost $2 billion.

- Robust results in key overseas markets as well as continued out-performance in the corporate travel sector globally supported the FY19 results (underlying $343.1 million worth profit before tax).

The stock of FLT was trading at $47.370 on 2 October 2019 (AEST 12:53 PM), down 0.295% from its previous close. The stock has generated return of 15.06% and 10.10% during the last three months and six months, respectively.

Webjet Limited

Webjet Limited (ASX:WEB) is in the business of online sales of travel products, including flights and hotel rooms.

Change in Directorâs Interest

The company recently announced that Don Clarke, one of its directors, made a change to holdings WEB by acquiring 3,000 fully paid ordinary shares at a consideration of $34,230 on 26 September 2019.

Impact of Thomas Cook

On 23 September 2019, WEB notified about the impact of Thomas Cookâs compulsory liquidation, a customer of the companyâs WebBeds B2B business, stating that following impact would be witnessed in FY20:

- Loss of TTV - Webjet previously indicated that it expects to earn $150 to $200 million in Total Transactional Value from Thomas Cook in FY20

- Unpaid receivables exposure - as at 23 September 2019, Thomas Cook owed Webjet approximately EUR 27 million in outstanding receivables.

- It added that there would be no impact on over 3,000 hotel contracts Webjet acquired from Thomas Cook in August 2016, which are wholly owned by WebBeds and available for sale to all WebBeds customers.

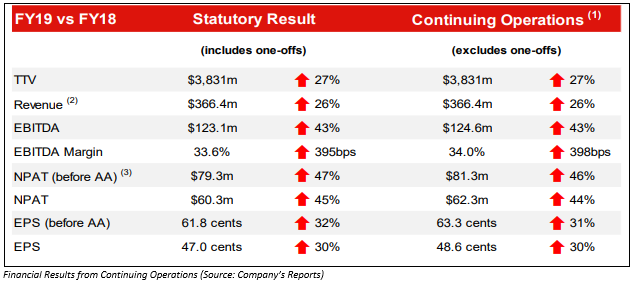

Financial Summary

- WEBâs WebBeds business is the leading business throughout bookings, TTV and EBITDA after the acquisitions of both JacTravel and Destinations of the World.

- The company stated that FY19 had been a year of profitable growth wherein WEB transacted an amount of $3.8 billion in TTV and reported record profit for its underlying business.

The stock of WEB was trading at $10.370 per share on 2 October 2019 (AEST 12:56 PM), down 1.426% from its previous close. The stock has generated return of-19.25% and -25.07% during the last three months and six months, respectively.

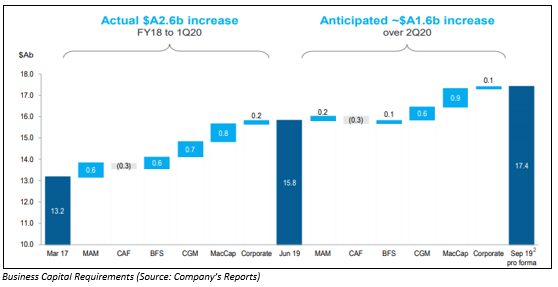

Macquarie Group Limited

Macquarie Group Limited (ASX:MQG) is a non-operating holding company for the consolidated entity, which provides financial services like banking, advisory, etc.

Issue of Shares

- Recently, the company announced that it issued 5,660,150 fully paid ordinary shares at an issue price of $120.00 per share on 30 September 2019.

- The objective behind the issue of shares was the Share Purchase plan. The issue would provide flexibility to invest in new opportunities while maintaining an appropriate level of capital considering continuing regulatory change.

Ceasing of Substantial Holder

- Macquarie Group Limited and its controlled bodies corporate listed in Annexure A ceased to become a substantial holder in CSR Limited on 17 September 2019.

- As per another update, Macquarie Group Limited and its controlled bodies corporate listed in Annexure A ceased to become a substantial holder in oOh!media Limited (ASX:OML) on 17 September 2019.

Outlook

On 28 September 2019, MQG provided a short-term outlook, which was affirmed at the Groupâs Annual General Meeting on 25 July 2019:

- MQG anticipates growth of around 10% in results of 1H FY20 as compared to 1H FY19 and down on a strong 2H FY19. Additionally, increased contributions from the markets-facing businesses boosted the company.

- The Groupâs short-term outlook for both 1H FY20 and FY20 primarily remains subject to

- The completion of transactions and period end reviews, and

- Market conditions

The stock of MQG was trading at $130.040 per share on 2 October 2019 (AEST 12:58 PM), down 1.477% from its previous close. The stock has generated return of 8.72% and 1.05% during the last three months and six months, respectively.

Nearmap Ltd

Nearmap Ltd (ASX:NEA) is engaged into aerial photomapping through its subsidiaries. The market capitalisation of the company stood at $1.2 billion as on 2 October 2019.

Issue of Shares

- The company issued 93,750 fully paid ordinary shares on 27 September 2019 at a consideration of $0.40 per share.

- The shares have been issued on the conversion of ESOP Options.

Appointment of Director

- On 27 August 2019, the company notified that it had appointed Tracey Ann Horton as an independent non-executive director.

- An experienced company director, Ms Hortonâs term was effective from 1 September 2019.

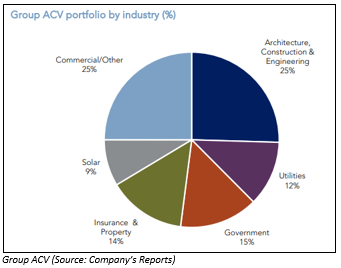

Operational and Financial Performance

In its financial results for the year ended 30 June 2019, NEA notified about its operational and financial performance:

- The company witnessed a growth of $24.0 million in annualised contract value, and the figure stood at $90.2 million.

- There was a rise of 45% in statutory revenue, which amounted to $77.6 million.

- The group customer churn declined to 5.3%, with FY19 customer churn lower in dollar terms as compared to FY18.

- As at 30 June 2019, the cash balance of the group stood at $75.9 million, excluding the capital raise initiatives, core business cash balance of $17.8 million, an increase of $0.3 million.

- The group possessed a strong net operating cash inflow of $24.9 million, as the business benefits from continuing operational leverage.

The stock of NEA was trading at $2.605 per share on 2 October 2019 (AEST 01:00 PM), down 2.068% from its previous closing price. The stock has generated return of -32.46% and -9.79% during the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.