Blue-chip stocks are the stock with brand presence that is widely appreciated in respective domestic territories or maybe globally and includes leading names from the industry. An investor seeks investment in these stocks as these are less volatile relatively and have higher value.

Stocks that have market capitalisation of over $10 billion area generally classified as Blue chips stocks and are considered as the most valuable stocks in the market with the attitude of ‘buy it and forget it’ for a period of minimum five years to ten years.

On the other hand, mid-cap stocks offer a broad range of investment choices for investors and includes companies which have a market capitalisation ranging between $2 billion and $10 billion. The Companies classified as mid-caps are usually undergoing expansion in industries that are likely to experience speedy growth and are not as established as large-cap companies and carry a higher level of risk.

Let us take a look at some of the popular Blue-chip & Mid-caps stocks one by one.

BHP Group Limited (ASX:BHP)

ASX-listed blue-chip stock, BHP Group Limited is a metals & mining player with key business segments including petroleum, copper, and iron ore.

On the basis of exchange rates of AUD/USD 0.70 and USD/CLP 683, the Company’s all production and unit cost guidance remains unchanged for the 2020 financial year; however, due to higher by-product credits, the Escondida unit costs was tracking below full year guidance at the December 2019 half year.

BHP’s operational review for the half year ended 31 December 2019 include the following:

- Group copper equivalent production remained largely unchanged in the six months ended December 2019, with volumes for the whole year projected to be marginally higher than the previous year.

- All major projects under development are tracking to plan with BHP and Woodside entered in a Heads of Agreement (non-binding) to advance the Scarborough gas advancement in petroleum.

- In Copper exploration, Phase III of the drilling program at South Australia’s Oak Dam is in development and is estimated to be completed in the quarter ended June 2020.

Moreover, the Company reported impressive operational results through the entire portfolio in 1H of the financial year 2020, compensating the likely impacts of scheduled maintenance and decline in natural field. Production and guidance for cost remained the same and the company remains on track to provide marginally higher production compared to last year.

- The Company’s six key development projects are advancing well, and it continues to develop its exploration programs in copper and petroleum.

The BHP stock closed the trade on 21 February 2020 at a price of $38.220, down by 0.779%, with a market capitalisation of $ ~113.47 billion.

Washington H. Soul Pattinson & Company Limited (ASX:SOL)

Australia-based investment house Washington H. Soul Pattinson & Company Limited has investments in a diverse portfolio of assets across a range of industries and has never failed to pay dividends to shareholders since its listing on ASX in the year 1903.

Although the Company originated with owning and operating Australian pharmacies, but has expanded beyond that over the years and currently has a much broader investment portfolio encompassing investments in the following:

- Natural resources

- Building materials

- Telecommunications

- Retail

- Agriculture

- Property equity

- Investments

- Corporate advisory

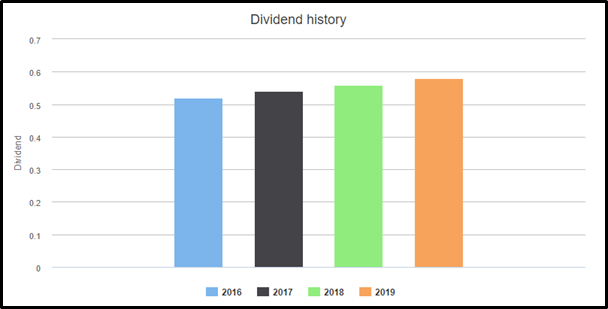

For the last four years, the SOL stock is having a growth trend in its dividend history.

The SOL stock settled in the red zone at a price of $22.370 during its day’s trade on 21 February 2020 with a decline of 3.034%.

Treasury Wine Estates Limited (ASX:TWE)

Being a consumer staples sector player, Treasury Wine Estates Limited is engaged in sourcing and grape growing, wine production, marketing and commercialisation and the company’s business encompasses domestic market of Australia as well as international markets like New Zealand, Americas, Asia, Europe, and Latin America.

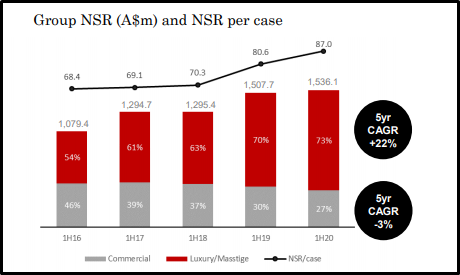

The Company’s financial performance during the half year ended 31 December 2019 includes the following:

- NSR stood at $1,536.1 million, up 2%, led by continued premiumisation and partly offset by volume declines across the Commercial portfolio.

- EBITS stood at $366.7 million, up 6%; up 3% adjusting for constant currency.

- Group EBITS margin was 23.9%, up 0.9ppts.

- NPAT was up 5% at $229.2 million.

- EPS of 31.9 cents per share was up 5%.

- Interim dividend 20 cents per share, fully franked, representing a 63% payout ratio

Source: Company's Report

The business reflected Strong performance across the Asia, ANZ and EMEA regions driven by continued growth in Luxury and Masstige; however, loss of execution momentum and challenging US wine market conditions were a setback to Americas regional performance in 1H20.

The TWE stock settled at a price of $11.980 in 21 February 2020, down by 1.237% with a market capitalisation of $8.73 billion.

Over the period of last five years, the TWE stock has delivered 136.04% return to its shareholders.

Coca-Cola Amatil Limited (ASX:CCL)

Consumer Staples sector player, Coca-Cola Amatil Limited engages into manufacture, distribution and marketing of beverages and has the following segments:

- Alcohol and Coffee Beverages.

- Non-Alcohol Beverages.

During the half-year 2019, the Company registered an impressive growth of 5.2% in revenue for the period, reflecting the results of strategic initiatives across the Company. Also, the Company’s statutory EBIT of $273.5 million, up 4.7%, and statutory NPAT of $168.0 million, resenting an increase of 6.3%.

The Company’s results indicated an impressive performance for the Group, with the revenue growth reflecting the effect of the company’s business ideas throughout the markets along with steady performance in the Company’s New Zealand, Papua New Guinea and Alcohol & Coffee businesses.

The Company believes that it is set to grow in 2020 with

- The completion of further investments in its Accelerated Australian Growth Plan.

- Container deposit schemes in QLD and NSW and considerably embedded by 2019.

The CCL stock settled at a price of $12.880 on 21 February 2020, down by 1.454% with a market capitalisation of $9.46 billion.

Over the last year, the stock has provided 56.91% returns to its shareholders.

The A2 Milk Company Limited (ASX:A2M)

An infant formula company founded in New Zealand, The A2 Milk Company Limited has Australia as most well-established market where the Company has had a continued strong focus since 2007.

The business has grown to toughen with 10.7% revenue growth and a record 11.2% market share, up from 9.8% for the same period a year ago and has achieved the following during the course of its business:

- The Company’s a2 Milk™ grew at the fastest pace among the major fresh milk brand in Australian supermarkets and continues to be the leading premium milk brand and the only brand ranged in all major Australian supermarkets.

- Revenue for a2 Platinum® infant nutrition was up 35.3% and continues as the brand leader in pharmacy and grocery channels.

- The Company remains the top brand advertiser in the milk as well as infant formula categories, that continue to propel growth in consumer loyalty and brand awareness.

The A2M stock declined by 1.512% and settled at a price of $15.630 during the day’s trade on 21 February 2020.

During the last one year, A2M stock has delivered 16.35% returns to its shareholders.