Due to higher digital penetration, classifieds businesses have emerged as the investor’s priority list in the recent past. Search engines have become the most popular advertising medium as revenues are generate via mobile devices and other digital gadgets.

With the introduction of social media, the online advertisement has become one of the popular modes of revenue generation for the companies. The digital classifieds companies provide texts and images related to their targeted products across the social media platform which gives the users an option to choose among the available products.

Search engine advertisement within the Australia has reported strong growth as compared to the US. The digital market of Australia has similarities with the New Zealand Market and the UK market in respect to the consumer reaction.

Rea Group Ltd (ASX: REA)

Rea Group Ltd (ASX: REA) is a multinational digital advertising business focusing in residential, commercial and share property websites. The business announced a fully franked dividend of $0.55 per share with a payment date of 24 March 2020.

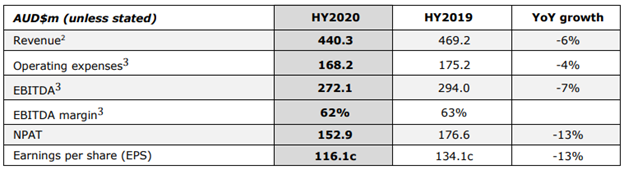

H1FY20 Operational Highlights for the Period ended 31 December 2019: On 7 February 2020, REA announced its six-months operational highlights, wherein the company reported revenue of $440.3 million, down 6% on y-o-y basis. The company reported EBITDA at $272.1 million, down 7% from H1FY19. Net Profit, during the period came in at $152.9 million, down 13% on y-o-y basis.

The company’s result was delivered in ongoing difficult market circumstances with drops in new residential listing volumes and new project originations. As per the macro data, there is a drop in the national residential listings by ~14%. The above results were due to the listing decreases of ~17% across Sydney and ~16% across Melbourne. The period was marked by a 4% decrease in total operating expenses by REA, driven by robust cost management and proficiencies earned from a structural change.

The above realignment has improved the pace and effectiveness of product delivery within the organisation, which continued investment across innovation and expansion programs. The business reported strong revenue growth across Malaysia, India and North America while Joint Venture with 99.co offers prospect for rapid growth within the market share across the Singapore and Indonesia region.

The business reported total customer visit of 84 million, increased 2.95 times while monthly searches stood ~103 million, up 14%. The business reported monthly unique audience at 8.8 million, improved 7%. Within the Australian market, REA reported ~9.5 million of app download and 34.9 million of app launches. The company reported EPS of 116.1 cents, down 13% from previous corresponding period. The company reported a 30% increase in the buyer activity on the company site and witnessed ~1.5 million visits.

Key Income Statement Highlights for H1FY19 (Source: Company’s Report)

Other Business Highlights: The company witnessed an increase in the auction clearance rates, improved home price and growth in the mortgage activity which indicates the Australian property market is on the verge of recovery.

Outlook: The company is focusing on its investment strategies to support its product, technology and data policies to support future expansion prospects. The Management expects recovery across the real estate market led by Sydney and Melbourne while the business is betting in the full year revenue expansion and improved listings conditions during the second half of FY20.

The business is likely to focus on improving its operational efficiency in coming years. Residential revenue reported a decline of 6% to $283.2 million indicating an unfavorable market conditions, which was partially offset by price changes that occurred from 1 July 2019. The business reported continued growth within the Premiere product segment and add on products such as Property Showcase.

Stock update: On 07 February 2020, the stock of REA last traded at $116.900, indicating a rise of 3.105% from its last close, with a market capitalisation of $14.93 billion. The stock has delivered positive returns of 7.52% and 22.07% in the last three months and six months, respectively. The stock is available at a price to earnings (P/E) multiple of 142.260x on its trailing twelve months basis. The stock has delivered an annualised dividend yield of 1.04%. The 52-weeks low and high of the stock stood at $71.540 and $116.500.

Frontier Digital Ventures Limited (ASX: FDV)

Frontier Digital Ventures Limited (ASX: FDV) is engaged in the development of online classified businesses and operates across 13 markets.

On 6 February 2020, FDV confirmed the sale of its full 20% shareholding in Propzy for a price consideration of US$4.7 million or A$7.0 million. The selling price represents a ~300% return to FDV’s shareholders on its US$1.2 million investment in the last ~2.5 years.

Cash Flow Highlights for the Period ended 31 December 2019: FDV released its full year cash flow statement last month wherein, the company reported $15.148 million of receipts from customers and staff costs of $8.307 million. Administration and corporate costs stood at $2.208 million while advertising and marketing came in at $4.801 million during FY19.

Further, the company reported net cash used in operating activities of $4,687 million. Net cash from used in investing activities at $7.712 million, which includes $4.366 million of business acquisition and $2.388 million of investments. Cash from financing activities stood at $5.37 million, while the company reported cash and cash equivalent of $12.458 million as on 31 December 2019.

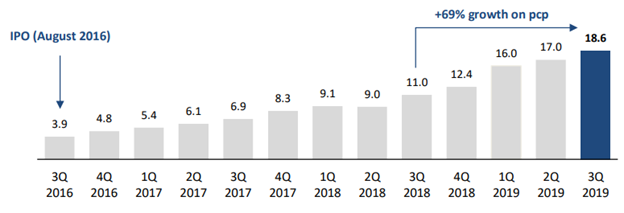

Q3FY19 Quarterly Highlights for the Period ended 30 September 2019: FDV came up with its quarterly results, wherein the company reported revenue of $18.6 million, up 69% on y-o-y basis. During the quarter, Zameen continues to be profitable on year-to-date basis and is self-sustaining from overall business perspective.

The business reported 9 companies to be on track with an annualised revenue of more than $1.0 million based on third quarter FY19 results. The $1.0 million annual revenue is a significant milestone for the business, which would eventually lead to strong shareholder returns in coming years. The quarter was highlighted by record revenue growth and continued progress towards positive EBITDA from the portfolio’s perspective. Moreover, the performances of Infocasas and Propzy delivered exuberant results.

The above two portfolio companies have now outshined the quarterly revenue run-rate of Zameen. The quarter was marked by the company pulling out from its support from Angola (AngoCarra, AngoCasa) in favour of some of its stronger performing companies.

Income Highlights (Source: Company’s Report)

Stock update: On 07 February 2020, the stock of FDV last traded at $1.095, indicating a fall of 6.41% from its last close, and traded with a market capitalisation of $299.6 billion. The stock has delivered healthy return of 45.34% and 40.96% in the last three months and six months, respectively. The 52-weeks low and high of the stock stood at $0.47 and $1.23.