The Oil industry divided into upstream, midstream and downstream sector, together is one of the largest and also the most complex industry on the planet. Apart from the extraction of the crude oil & the nature of the oil, What else decides the price of the final end product?

Let’s have a glance on it-

The oil downstream sector is focussed on the production of higher value products from lower value crude oil feed. The crude oil chemistry includes hydrocarbons of varying complexity and lengths, so the basic and the initial crude refining includes the segment the crude oil cuts as per their boiling temperature. General thumb rule is the longer the hydrocarbon chain, the higher is the boiling temperature.

A Typical Distillation Column Source: Energy Education Canada

These distillate cuts are further processed using physical and chemical processes either to improve or change their properties to produce higher quality products.

Demand for Distillate Products Down: What’s happening in the downstream sector ?: Must Read

The conversion units in a refinery includes Hydrocracking, catalytic, thermal, and Coking. These conversion units are used to optimise the production of certain products depending on the final demand of the products. Example: The production of propylene product could be varied by the use of FCC unit. The ZSM-5 (Zeolite Socony Mobil 5) catalyst run FCC units could be used when the demand for polypropylene or acrylonitrile, which are produced from propylene, is on a surge. Therefore, the conversion units and the operating conditions such as pressure, temperature or even catalysts of it may change the nature and quantity of product streams.

Further, the conversion units also could change the quality of the final products such as for the cracking gasoline, product could vary with the feed crude oil and the cracking conditions and may not produce the gasoline of same octane number every time.

The sophistication and flexibility in the processing feed affects the complexity and the capital intensity of an oil refinery. Refining complexity and its estimation has become vital for a refinery’s cost estimation, sales price models and basically managing the operating margins.

The conversion products may require additional treatment to refine them further to meet the required specification. Example: A hydrotreating unit is used to control the content of sulphur in the final products as required by the regulatory authorities.

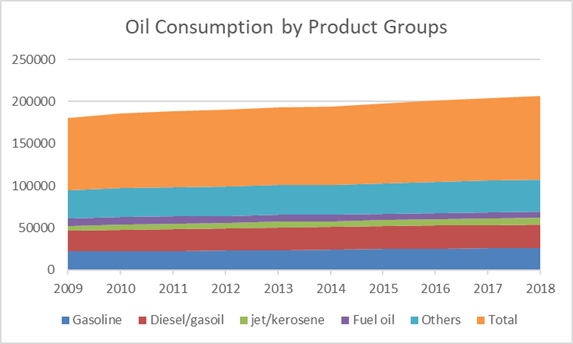

Source: BP Statistical Review 2019

The requirement of the products may also depend on the weather or the market geography. A usual trend has been observed that, the US refiners produce higher proportion of motor gasoline while the European & Asian refiners produce higher proportion of diesel and fuel oil and lesser gasoline. The trend may differ from time to time and also depends on the season. The demand for heating oil surges in winter due to higher demand from Japan for heating purpose. This year the demand has fallen for the heating oil, mostly due to warmer than normal winter in Asia. Therefore, a refiner needs to be prepared to vary its output as per the market conditions, geography, type & source of the crude oil.

Refinery complexity: The Quantified Indicator

The processing units of a refinery describe the production capacity, technology application and the capital expenditure in reference to construction and acquisition of a refinery. A refinery includes multiple process units with differing functions and technologies and since, no two refineries have similar configuration or apply all the same technologies, it is difficult to compare them.

The feedstock, process flow and the degree of integration of any two refineries would differ their end products. Therefore, there is a requirement of refineries to be compared on the basis of sophistication and their processing complexities.

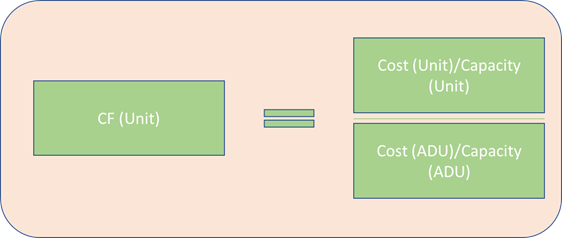

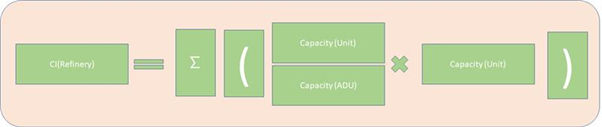

Wilbur Nelson, in order to quantify the complexity to provide better estimate of the grassroot construction in respect to the atmospheric distillation unit (ADU), came up with the following formula-

The following formula to calculate the Nelson Complexity Factor (CF) is calculated for each processing units of the refinery in respect to the Atmospheric Distillation Unit (ADU)

Nelson applied the unit complexity factor to describe the complexity and sophistication of a refinery. Therefore, each processing unit could be assigned a complexity factor depending on the operating time period and could be compared depending on the geographical location.

The refinery complexity index is an indicator of the sophistication and flexibility of the refinery. In a way, it could also be said that more complex the refinery is, the more capital investment is required to build it. Though, it does not mean that the large refineries (one with greater oil throughput capacities) are more complex than smaller peers, but the refiner’s conversion capacity tend to be more correlated to the Nelson’s complexity index. Also, constant upgradation of technology may increase the Nelson’s index of an existing refinery in future.

A typical refinery with fluid catalytic cracker, alkylation, reforming, alkylation and hydrotreating units will have a higher figure on the Nelson’s complexity index as compared to others.

US refineries rank on the higher end of the complexity index, though an Indian refinery, Jamnagar refinery, also, the World’s largest integrated oil refinery, has a Nelson complexity index of ~14. Globally, the modern refineries operate at a Nelson's complexity index in the range of 7-9.

A high Nelson complexity index enables:

- The refinery to process varied or even inferior quality crude, measured by API gravity and Sulphur percentage in the crude

- Enables to produce an improved refinery product slate with low percentage of heavy distillate products at the end

- Facilitates production of higher quality fuel products with regulatory restrictions

- Enables the refinery to maintain higher refinery margins even during higher crude oil prices

Therefore, a high complexity index leads the refinery to create new products and vary its product share during the seasons to cater to the changing demands from markets across multiple geographies.

Jet Fuel-Gasoil Cash Premiums; How has the Downstream sector been affected: Read Here

How the Industry perceives the complexity Index?

Capital investment in the refinery is dependent upon its complexity. More build in capital for more complex refinery also leading to higher the expense to insure or replace it.

Nelson Complexity Index is used in industry in many different ways and for varying purposes-

- Applied in the calculation of the insurance premiums of the refinery by underwriters

- Used for the valuation of the refineries in case of merger or acquisition as part of the due-diligence

- Used by technical experts to understand variation in feed oil and the output products

- Used in sales price and replacement cost models

- Included in the credit research reports as an indication of a downstream firm’s product flexibility and asset quality

To sum up: Refinery complexity factors play an important role in the refinery and is used throughout the oil & gas industry by technical and financial experts to value the sophistication and flexibility of the downstream processes.