National and local governments play a primary role in the registration and recognition of a legal identity, without which official recognition, authenticity of an individualâs identity may lack a formal or legal basis.

As a matter of concern, the inability to credibly prove oneâs identity can be a source of economic, political and social exclusion, especially in the financial sector, where it hinders access to basic services such as bank accounts and loans.

In the modern-day global scenario, governments are adopting and encouraging electronic means of cash transfer to streamline processes and prevent leakages in financial transactions.

Digital IDs are said to substantially strengthen the efficiency and effectiveness of the governments in providing critical services such as Government to Person (G2P) payments and supporting the provision of humanitarian aid.

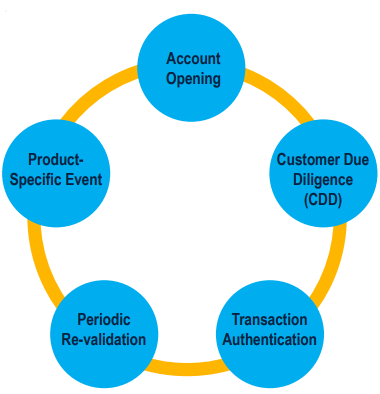

Applications for digital identity in financial services are depicted in the picture below:

Figure 1 (Source: G20 Argentina 2018)

The different processes described in the above figure can be broadly categorised into account opening; ongoing authentication and customer consent; and back-office processes which includes a focus on

- Account opening;

- Customer due diligence;

- Authentication;

- Transforming payment services for FSPs and also government-to-person (G2P) and humanitarian assistance;

- Critical impact of the effectiveness of credit reporting systems;

- Facilitates digital signatures;

- Facilitates insurance schemes;

- Small business development by improving the identification of firms and employees.

The list is not exhaustive but is aimed at those elements of financial services that are most pertinent to financial inclusion.

âWith the increasing digital life we are witnessing a transformation in the way we transact and interact further posing challenges for the traditional concepts of identity, trust and privacy, therefore generating the need for a new model.â

With the above view, mastercard recently introduced the initial test of a new digital service that has the ability to verify an individualâs identity on the go in a safe and secure manner both, digitally as well as in the physical world.

The initial in-market pilot study is expected to take place in Australia in two distinct attempts with Australia Post and Deakin University.

The pilot program is expected to test a new hassle-free way for individuals to prove their identity without carrying multiple documents.

Moreover, the model is anticipated to allow the data to rest with its user (or the rightful owner), and shall further stimulate a distributed model that would combine the information saved in the mobile device of an individual and validated through added reference points, like userâs bank or concerned government organizations.

While the consumer-centric approach of Mastercard outlined earlier prioritized the privacy-by-design, this model is further expected to eradicate the need for a centralized identity database.

About the initial phase of the pilot in collaboration with Deakin University, Mastercard further mentioned that the pilot comprised of the student volunteers who tested the process for identity verification for student registration and digital exams at the campuses of Burwood and Geelong in Victoria.

With a view to backing its identity efforts and integrate the existing Digital iD solutions of Australia Post, Mastercard further entered into a distinct partnership with Australia Post for broadening the capability for Australians to identify themselves easily while accessing services.

Mastercard believes that post these initial efforts; the Company expects additional partnerships and pilots to be introduced throughout a number of markets during the year 2020.

But why is the Digital ID important?

G20 Digital Identity Onboarding, G20 Argentina 2018 lists down several points of importance along with sighting the convenience for the consumers.

A legal digital ID for those forcibly displaced not only provides them with a sense of identity but also supports efficient benefit distribution reducing fraud and duplication while allowing them to participate in the real economy.

Digital IDs are important to broaden public policy, especially for financial inclusion and can help bring more MSMEs into the formal financial sector.

Three characteristics of an identification system that matter most for financial services are:

- Legal basis

The role of National and local governments is imperative in issuing legal identity documents which are recognized as providing proof of legal identity in accordance with national law.

The worth of an identity credential may lack a formal or legal basis without such official recognition, therefore making it unreliable for Customer Due Diligence (CDD) checks in the financial sector.

The most basic of financial services required by the jurisdictions from an individual is to have a form of legal ID to open and operate a transaction account, failing which the access to the wider financial ecosystem contributing to financial exclusion may be restricted.

- Uniqueness

The characteristic of being âuniqueâ as an identity credential is preferable for use by the Financial Service Providers (FSPs), i.e. no individual (or entity) will have the same identifier, and that there is an only single identifier associated with a single individual.

The characteristic of uniqueness in an ID allows for a particular financial institution to have a single view of the customer in their internal system and also across the total financial ecosystem.

- Ability to exist in a digital format

When an individualâs attributes can be captured and stored electronically and issued on digital credentials that can uniquely identify a person, the identity is referred to as digital ID.

The extensive use of mobile devices in developing countries, can be leveraged for the purpose of developing digital IDs, which can help to gain benefits beyond the financial sector, such as in enhancing gender equality.

The various characteristics of the Digital IDs highlight variable levels of quality and sophistication, while having important implications on access to financial services, customer oversight, and the efficiency of financial service provision.

Each of these characteristics impacts the sustainability, affordability and reach of financial services affecting financial inclusion objectives. The lack of legal, unique ID captured consistently across institutions hinders the efforts to gain a complete view of the customer, therefore, limiting the services available to the individual.

From the regulatorsâ perspective, the lack of a unique, digital ID, limits the ability to gauge household credit exposure which can further the inefficiencies and costs as all verifications might be done manually along with maintaining paper trails.

In addition to the above, seven policy measures suggested for the governments to be considered in order to have an identity effective ID system that meets the needs of the financial sector, are as follows:

- Ensure an integrated identity framework;

- Consider the appropriateness of the regulatory framework to capture the challenges related to digital ID, and risks to its appropriate implementation, deliberate updates to the regulatory framework including the issuance of new regulations where necessary;

- Establish a reliable oversight model to include stakeholders beyond the traditionally regulated financial institutions who can introduce risks to digital identity systems;

- Build authentication and service delivery systems that protect user privacy, and provide individuals with the right to access their data and oversight over how their data is shared;

- Establish clear and well-publicized procedures for citizen redress, including defining where the onus of responsibility lies in the event that errors emerge or that the security of a personâs identity is compromised;

- Support and empower the development of private sector-led services to leverage the legal ID infrastructure for building out digital layers. In doing so, the public authorities should ensure that these services are safe, reliable and efficient; these services are interoperable; and that the market is competitive;

- New approaches to ID are constantly emerging, and public authorities should closely monitor these developments with a view to share knowledge and establish common legal frameworks at both the domestic and international level.

Bottom line

Digital IDs are Important to Public Policy and Service Delivery and Require Significant Support and Investment while being a Critical Enabler for Financial Inclusion. Digital IDs Can Help Bring More MSMEs into the formal financial sector and as well support the establishment of KYC registries. Digital IDs help financial service providers streamline their business operations.

Since collective effort is a requisite for digital identity, it is imperative for mastercard to develop its strategic partnership with Microsoft and work alongside a variety of industry players.

With its commitment to facilitate the network and support in defining the rules and governance, mastercard believes that a collective effort can help to transform digital engagement in a convenient and secure manner.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.