In our previous articles, we have taken you through the concept of the mutual funds, discussed the advantages of investing in mutual funds, mutual fund types, features, and categories of mutual funds based on the market capitalization and style of investing. We also explained the categories of mutual funds to have a clearer picture of the mutual funds.

In the next article, we provided you with the limitation of the mutual funds and points which an investor needs to keep in mind while investing in mutual funds.

In this article, we would take you through the method to select the best mutual funds. But before we initiate this topic in detail, let us first delve into the previous two articles, in brief, to understand mutual funds in a better context.

Mutual Funds in Brief:

Mutual funds refer to a pool of money collected from various investors, and this pool of money is further invested in stocks, bonds, other fixed-income securities and any other type of instrument. Subscribing to a mutual fund is like buying a small part of the bigger cake. The investor of the mutual fund gets a proportionate share of the fund’s profits, losses, income & expenditure.

Each mutual fund is designed to meet a particular or a specified objective, which is clearly stated in the prospectus with all other relevant details pertaining to that fund. The management of the fund’s portfolio is generally overseen by a fund manager. Thus, it is very important to read fund objectives before purchasing any mutual fund.

A mutual fund is considered ideal for those investors who do not have time to invest in the stock or they do not have a fair idea about the stock market. By investing in a mutual fund, these investors can minimize their risks which otherwise would have prevented them from taking advantage of the portfolio performance.

Now, let’s start with the technique to select the best possible fund:

Selection by Looking at The Rating and Ranking of The Fund:

It is generally seen that an individual who is new to the market of mutual funds look at the rating of any particular fund as well as its ranking. By ranking, we mean how the mutual fund has performed in the past two to three years. Based on these two parameters, an individual selects those funds which have delivered decent returns, usually more than that provided by the benchmark index, which is the best possible fund.

There are many investors in the market who follow the same step and purchase those mutual funds with high ratings and good rankings. As more and more investors subscribe to a particular mutual fund, there is a sudden increase in the money available for investment which also becomes a challenging situation for the fund manager in order to find suitable assets in order to invest the money. In case the market is bullish, i.e. the stocks are trading at increasing prices, a normal stock investor would not buy particularly those stocks for fear of limited upside or reversal of trends. But this is not the case with a fund manager. But the fund manager cannot do that as he is bound by the mandate of the mutual fund to keep a small proportion of the fund in cash and invest the remaining in the various asset classes. It is not in the hand of the fund manager whether he likes any particular stock or not, whether he is comfortable with the stock’s valuation or not, he is bound to invest a certain proportion of the money in a specified asset class. Thus, concentrated positions can impact the performance of these highly-rated funds in the future.

Stock Selection Based on Past Performance:

One should not select funds by seeing only the past two to three years of performance of the fund. It might be possible that in the past two to three years, the stock has performed exceptionally well and has provided outstanding annual returns, which in turn has become the source of attraction for most of these investors. The investors should ideally look at the performance of the fund through a complete business cycle consisting of a period of economic boom followed by stagnation.

The crux of the matter is that returns can be generated via multiple approaches.

Let’s understand this concept with an example. Suppose there are two drivers with different approaches to winning a race. Driver A considers increased speed as a way to achieve its goal. He only concentrates on speed, and other factors are not important for him like the risk of meeting with an accident. As a result, in most of the cases, this driver fails to attain his goal.

On the other hand, driver B targets to finish the race, keeping in mind the risk and safety issues. He slows his speed in case of any risk and accordingly increases his speed when the upcoming pathway is clear.

The objective behind sharing this example is that there are certain mutual funds that are ready to take a huge risk just like driver A and there are occasions where they are faced with losses. But this could also result in huge profits as well.

Thus, investing in high-risk mutual funds is not suited to most investors as they cannot form an estimation of the performance of the fund in the future.

Let’s understand a few things which an investor must have a clear idea about before starting to invest in mutual funds.

Track Record of the Mutual Fund:

Analyze the track record of the funds which you want to purchase. As stated above, we should not get overly influenced by the fund’s rating, ranking and performance within a two to three-year horizon. Instead, the focus should be to check the consistency in the performance of the funds over business cycles. By consistency, we mean that we need to see if the selected fund, though not the top-ranking fund, has maintained its position within the top 10 funds consistently over a long period of time.

Let’s consider a hypothetical fund A.

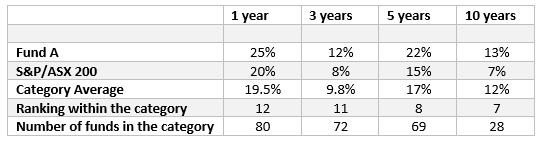

If you look at the past performance of Fund A, you will notice, that Fund A has outperformed its benchmark index in all time periods. Also, if you see the ranking of this fund, if you take a look at the last two rows, it is clearly seen that the fund was amongst the top rankers within its category.

Fund Manager in charge of the Fund:

It might be possible that a particular fund has performed outstandingly in its last 5 years, 10 years, 20 years. To invest in that particular fund, it is also very important to have an idea about the fund manager handling the fund.

It might be possible that the fund manager who used to handle the fund during that time might have changed. So, to have an idea about the present fund manager is very important. If the new fund manager has provided an excellent track record for that particular fund, then he/she is a good fund manager. For example, if the new fund manager is handling four funds and out of those, three have performed well, then he is a good fund manager. On the other side, if only one of the four funds have done well, then one might consider that the performance of the manager is not up to expectations.

Assets Under Management:

It is also important to know about the fund’s AUM. We need to see whether the investors have put in a huge amount of money in the particular fund suddenly or not. If yes, then we must avoid those funds as a sudden increase in the AUM creates a problem for the fund manager as well. To know more you can read here.

Keep a track of risk vs return:

We are aware that more the risk, more is the return. But a good fund manager tries to generate more returns at lesser risks. For example, there is a large-cap fund providing a 20% return for the last 10 years while there is another mid-cap fund which is providing a 21% return in the last 10 years. We know that large-cap funds are less risky than mid-cap funds and if large-cap is providing return close to mid-cap fund, then most of the investors would prefer to go for large-cap fund instead of the mid-cap as they are getting more return by assuming lesser risks.