After the double whammy of bushfires and the COVID-19 pandemic, the Australian economy has finally begun its journey to recovery.

The Australian government is working on easing restriction in the coming months so that people can return to work in a COVID-19 safe environment. Further, the cabinet has encouraged people to download the COVIDSafe app to ensure the protection of the citizens from the deadly virus.

With the companies resuming operations post the lockdown let us look at some of the ASX-listed stocks and their recent updates.

Bigtincan Holdings Limited (ASX:BTH)

Bigtincan Holdings Limited assists the sales and services team in increasing the win rate and customer satisfaction. The Company’s mobile, sales enablement automation platform powered by Artificial Intelligence, helps to empower representatives to connect with their clients & prospects and urges team-wide adoption more efficiently.

Placement:

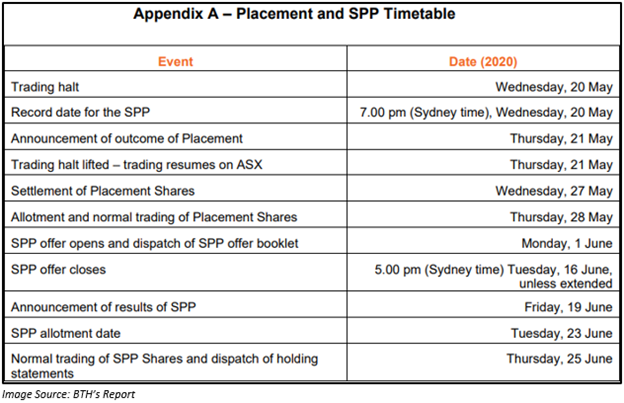

On 21 May 2020, Bigtincan Holdings Limited announced the successful commitments for its AU$35 million institutional placement of new fully paid ordinary shares at an issue price of AU$0.67 per share.

The fund raised from the equity raising would support the Company in accelerating key strategic priorities which were pointed during 1HFY2020 results and are in line with the Company’s strong track merger and acquisition record.

These funds would support the Company in taking advantage of SaaS market tailwinds as the market speed of digitisation as well as mobilisation of work speed up. The funds would be used for growing technology investments to continue product leadership and for the working capital needs.

Share Purchase Plan:

Bigtincan also announced that it would undertake a Share Purchase Plan under which the qualified shareholders in Australia, as well as New Zealand, would be able to apply for up to AU$5,000 of new shares.

Stock Information:

BTH shares, by the end of day’s trade on 21 May 2020, settled at AU$0.730, down 3.947% from the previous close.

Megaport Limited (ASX:MP1)

Megaport Limited is the global provider of Elastic Interconnection services. On 21 May 2020, the Company released an announcement where it highlighted that its Chairman, Mr Bevan Slattery sold 5,000,000 shares.

The shares represent 3.27% of the Company’s issued capital. The sale was underwritten by UBS, AG, Australia at AU$13.00 per share and was distributed to the institutional investors.

After selling 5,000,000 shares, Mr Bevan Slattery now holds 13,037,607 shares in the Company. The funds raised by selling these 5,000,000 shares would be used for ongoing investment opportunities.

Recently, on 7 May 2020, the Company announced the results of the Share Purchase Plan.

Stock Information:

MP1 shares, by the end of day’s trade on 21 May 2020, settled at AU$13.050, down 5.435% from the previous close.

DroneShield Ltd (ASX:DRO)

DroneShield Ltd is a global leader in drone security technology.

On 21 May 2020, the Company announced that the European Union Police had selected DroneShield for its DroneGun TacticalTM product. Belgium Police ran the process with an EU-wide structure.

The sales, training as well as the local support would be taken care of by the Benelux region partner of DroneShield, ForcePro BV.

As per the agreement, DroneShield’s DroneGun TacticalTM would be rolled out across a range of police units across EU. The Company, in its announcement, updated that the contract does not specify the minimum purchase units and the orders would start this quarter. Apart from this, the Company anticipates that this structure to be a stage for sales of its other products, like RfPatrol and its vehicle and fixed site products, to European Union police departments.

Stock Information:

DRO shares, by the end of day’s trade on 21 May 2020, settled at AU$0.170, up 61.905% from the previous close.

Fonterra Shareholders' Fund (ASX:FSF)

Fonterra Shareholders' Fund provides coverage to the performance of Fonterra Co-operative Group Limited.

On 21 May 2020, Fonterra Shareholders' Fund has released an announcement where it highlighted that Fonterra Co-operative Group Limited has announced the business update for Q3FY2020 and has narrowed the range for its 2019-2020 forecast Farmgate Milk Price. FSF also announced an opening forecast price range for the 2020-2021 season.

- Total Group Earnings Before Interest and Tax increased from NZ$378 million to NZ$1.1 billion.

- Total Group normalised Earnings Before Interest and Tax rose from NZ$514 million to NZ$815 million.

- Total Group normalised gross margin soared from NZ$2.2 billion to NZ$2.5 billion.

- Normalised Total Group operating expenditure declined from NZ$1,813 million to NZ$1,665 million.

- Free cash flow during the period was NZ$698 million, up to $1.4 billion as compared to the previous corresponding period (pcp) and net debt decreased by 23%.

Revised 2019/2020 forecast Farmgate Milk Price range:

The Company restricted its 2019-2020 projected Farmgate Milk Price range for the season in between NZ$7.10 - NZ$7.30 per kgMS. With this, the Company would be providing ~NZ$11 billion to NZ’s economy via milk price for the year.

Opening 2020-2021 projected Farmgate Milk Price would lie in between NZ$5.40 to NZ$6.90 for every kgMS.

John Monaghan, the Chairman of Fonterra, stated that Co-op has reduced its price limit & lowered the middle point of the range because of the diminishing demand corresponding to supply which is forcing prices to go down.

The Company’s CEO, Miles Hurrell, stated that despite the coronavirus difficulties, the group normalised EBIT of the Company for nine months to 30 April 2020 was NZ$815 million. It represents a growth of $301 million on pcp.

Stock Information:

FSF shares, by the end of day’s trade on 21 May 2020, settled at AU$3.400, in line with the previous close.

Nickel Mines Limited (ASX:NIC)

Nickel Mines Limited is engaged in nickel pig iron and nickel ore production.

On 21 May 2020, Nickel Mines Limited announced the effective completion of the institutional component of its fully underwritten 1 for 3.6 accelerated pro-rata non-renounceable entitlement offer. The Company via Institutional Entitlement Offer raised AU$179 million, and each share was issued at AU$0.50 per share.

The placement was well supported by the institutional shareholders with a take-up of ~75% & strong demand from the existing Nickel Mines’ shareholders as well as the new institutional investors.

The remaining part of the institutional component which comprises of renounced entitlements as well as entitlements attributable to ineligible shareholders, being oversubscribed.

The funds raised via the Institutional Entitlement Offer would be used for funding the cash consideration payable for Nickel Mines to increase its 60% ownership interests in the Hengjaya Nickel RKEF Project (‘HNI’) as well as the Ranger Nickel RKEF Project (‘RNI’) to 80%.

The cash consideration to be paid to Shanghai Decent related to the Transaction is US$150 million and would be funded by the net proceeds of the Entitlement Offer along with the cash reserves of the Company.

Stock Information:

NIC shares, by the end of day’s trade on 21 May 2020, settled at AU$0.560, down 0.885% from the previous close.