Metals X Limited (ASX: MLX) is under pressure for quite some time on the Australian Securities Exchange with the stock trading down by over 90 per cent from its January 2018 peak price of $1.190 and currently trading at $0.115 (as on 26 November 2019 3:10 PM AEST).

The multi-metal miner, mainly copper, Tin, and Nickel, witnessed a fall in net profitability with net income declining for two consecutive financial years of 2018 and 2019 (30 June 2019). The net profit of the company stood -$26.3 million in FY2018, which further declined to stand at -$117.0 million in FY2019.

Despite the steady revenue (as compared to FY2018 of $209.9 million) in FY2019 of $204.7 million, the net income of the company plunged, with $321.7 million overall expense in FY2019 as compared to $236.2 million in FY2018.

Metals X expended a significant tranche of its resources on the exploration at the Nifty Cooper Operations, at which the company suspended the mining activity, in lieu of Nifty Reset Plan.

Nifty Reset Plan

In May 2019, MLX proposed the Nifty Copper Reset Plan to turnaround the operational performance and the plan was followed by a comprehensive evaluation of Nifty, which particularly focused on the geological endowment, cost base, operational constraints, etc.

The business case behind the acquisition of the Nifty Copper Operations was the strong resource base of the prospect with upside exploration potential, for which the company initially planned the work in two phases.

Phase 1 focused on the mine planning, improvement across new production areas and underground infrastructure, to target throughput of 2 million tonnes per annum with an all-in sustaining cost (or AISC) of $6,800 to $7,900 per tonne.

The phase 2 aimed to further increase the throughput to 2.5 million tonnes per annum with an AISC of $6,400 to $6,900 per tonne of copper, with a total expenditure of $162.5 million over the tenure of 3 years.

To Know More, Do Read: Metals X Presents Reset Plan For Nifty Copper Operations

How Did the Nifty Reset Plan Pay-off?

Since the announcement of the plan, MLX focused on accelerating the development outside of the Central Zone, which lifted the development rates. Nifty remained ahead of the planned budget for development during the September 2019 quarter and achieved 1,862m above the target exploration of 1,736 metres.

During the September 2019 quarter, the mill at the prospect operated for 41 days and processed 290,496 tonnes of ore with an average grade of 1.29 per cent of copper, which led to the production of 3,425 tonnes in concentrate, up by approx. 11.50 per cent against the previous quarter production of 3,072 tonnes.

The copper concentrate grades at the prospect demonstrated improvement with average grade increasing from 22.1 per cent to 26.1 per cent during the September 2019 quarter against the previous quarter.

MLX estimated the benefit of each unit per cent increase in concentrate grade to be around 0.8 million due to an increase in copper payable and a reduction in transport and treatment charges.

To assess the geological potential, MLX drilled about 790 holes for 86,500 m since the acquisition (as on 30 September 2019) with additional 220 holes from March 2019 quarter as part of grade control and resource definition programs.

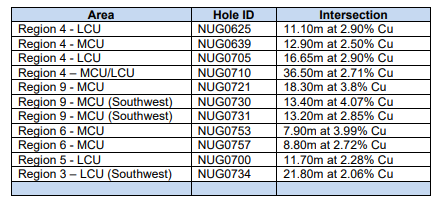

MLX received some significant assay results, with the intersection as high as 4.07 per cent of copper. Some of the intersections of the drill holes are as below:

(Source: Companyâs Report)

As a result of such encouraging outcomes, the Mineral Resources and Ore Reserves of the Nifty prospect surged with total Nifty Sulphide Measured, Indicated and Inferred Resource (JORC 2012) of 36.28 million tonnes at an average grade of 1.50 per cent for 545,600 tonnes of contained copper.

Out of 36.28 million tonnes of resources, 30.55 million tonnes remained under Measured and Indicated category (as per the JORC 2012 Classification Code) with an average grade of 1.58 per cent for 482,500 tonnes of contained copper.

The total Nifty Sulphide Proved and Probable Reserve of the prospect stands at 11.10 million tonnes with an average grade of 1.45 per cent or 161,200 tonnes of contained copper. Another significant milestone was that the company received 90 per cent of the defined resources outside the historical Central Zone of the prospect.

Despite such impressive outputs, the fall in copper prices in the international market coupled with the increased mining cost and slower rates played some part in the decision of the company to suspend the mining activities at the Nifty Copper Operations.

Metals X mined 245,523 tonnes of ore during the September 2019 quarter, which remained over 10.14 per cent lower as compared to the previous quarter. The company produced 3,425 tonnes of copper during the quarter from the operations and sold 4,120 tonnes, both up from the previous quarter.

However, the average realised price for the quarter stood at $7,531, down by over 2 per cent against the previous quarter. The copper prices plunged in the international market over the geopolitical issues surrounding the U.S-China bilateral trade dispute.

The prices of copper futures fell from its January 2019 peak of USD 7,279.75 to the present level of USD 5,865.75 (as on 26 November 05:09 PM AEST), which marked a drop of over approx. 19.50 per cent.

Apart from the fall in copper prices, the C1 Cash Cost per tonne of the company surged almost 22.50 per cent to stand at $10,469 per tonne against $8,548 per tonne in June 2019 quarter.

The all-in sustaining cost surged by 17 per cent to stand at $11,655 per tonne during the September 2019 quarter; however, MLX took some cost-cutting measures.

In a recent announcement to the stakeholders, MLX mentioned that the expected increase in mining rates are yet to be realised, and the production for the December 2019 quarter has been negatively impacted amid delay in bringing targeted stopes online along with lower underground productivity and planned equipment reliability.

As the Nifty Reset plan remained unable to meet the desired outcomes along with the increased uncertainty, MLX decided to suspend the mining activities at the prospect.

How Did the Market React?

The market reacted negatively to the companyâs announcement with the stock opening over 4.34 per lower against its previous close. The stock traded in the red territory during the trading hours of the day with prices falling to register a low of 0.100, down by 25 per cent from its previous high.

However, the price recovered at the end of the trading session on ASX, which could be accounted for many reasons, such as profit-booking by short-sellers, the interest of bulls, etc., and the stock managed to close at $0.115, unchanged against the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.