While Investing in stock market, everyone comes up with a mindset of getting higher returns with limited amount of investment and in a shorter span of time. This leads them to look for cheaper stocks. However, this practice sometimes fails. Making investment in stock is for a long-term horizon and not for the short-term. You would not be able to make a good amount of money by investing for a short span of time. In the below article we will discuss about penny stocks with their merits and demerits.

What are Penny stocks?

When it comes to searching for low priced stocks, names of penny stocks come into the mind. They cost to the investor as much as pennies and are usually below A$0.500. With regards to earnings from penny shares, the answer is that there is a limited opportunity to earn from them and for significant earnings one must buy a huge quantity of such stocks, which is more often than not a risky affair. Penny stocks are generally high-risk investments with low trading volumes. The companies are generally identified to be those who have recently started their businesses (for example, start-ups as well as small companies with smaller balance sheets and limited resources).

Merits and Demerits of Investing in Penny Stocks

Low price of these stocks happens to be a biggest merit, as there is no requirement of large capital to start investment. Penny shares are difficult to buy because these have limited liquidity available for the general public to buy. These stocks also come under the radar of bargain hunters who can risk putting a small part of their investible corpus for chasing quick windfall gains.

These stocks carry the risk of losing all the investment. These stocks are less liquid, and low liquidity happens to be a major demerit for penny stocks. Penny Stock Investment is also a high-risk investment.

Whitebark Energy Ltd

Whitebark Energy Ltd (ASX: WBE) is involved in the assessment of oil and gas exploration projects in WA. The company is also involved in the production of oil and gas in Alberta, Canada.

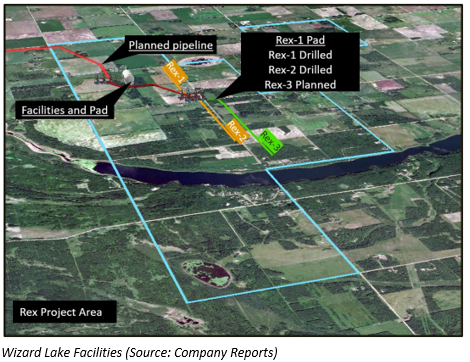

Cleanup and Production Test Commenced at Rex-3

- The company through a release dated 13th December 2019 announced that it has commenced cleanup flows at Rex-3 well. The company added that a significant amount of fracking fluid needs to be recovered before material levels of oil and gas from the reservoir reach the surface of the well.

- WBE also stated that preliminary indications show well flow back rates ahead of Rex-2 well with casing pressure which is already rising.

Expanded land Position

- Whitebark Energy Ltd recently performed an expansion of land position at Wizard Lake with the addition of ? of a section with a 100% interest.

- The new land is situated to the north east of the existing drilling pad of the company. It also ends the gap of land held by subsidiary of WBE, Salt Bush Energy, across the Wizard Lake pool.

A Look at Q1 FY20

- During the quarter ended 30th September 2019, the company has successfully wrapped up capital raising in order to take forward expansion of Wizard Lake infrastructure and Rex-3 drilling, which include placement of $3.8 million in the quarter.

- The company also launched Share Purchase Plan for existing shareholders on 2nd October 2019.

- Also, the company has planned construction of around 3 km gas export pipeline, upgrade of processing facilities to increase oil and gas throughput in the run up to 31st December 2019.

Also Read: Increase of 70% in Wizard Lake Oil Pool Reserves

The stock of WBE closed the dayâs trading at $0.012 per share on 13th December 2019.The company has a market capitalisation of $33.09 million as on 13th December 2019. The total outstanding shares of the company stood at 2.55 billion, and its 52-week low and high prices are $0.003 and $0.015, respectively. The stock has provided a total return of 200% each in the spans of six months and one year.

Red 5 Limited

Red 5 Limited (ASX: RED) having its presence in Metal & Mining Industry, where it is involved in mining of gold and exploration of minerals.

New Resource Drilling Programs

- The company recently announced that it has commenced more than 11,000 m of reverse circulation and diamond drilling program in order to test high-priority gold targets in late December 2019 as part of the companyâs Darlot Mining Hub strategy.

- However, the new drilling programs in total comprise around 50 reverse circulation drill holes for 7,800m and 20 diamond drill holes for 3,300 meters.

- The companyâs Darlot Mining Hub Strategy complements RED 5âs King of the Hills Project, and underpins the companyâs strategy of becoming a multi-asset, mid-tier Australian gold producer.

Key Personnelâs Address to Shareholders

- At the Annual General Meeting of the company, the key personnel of the company stated that the company has entered the FY20 in a strong position.

- At the end of FY19, the free cash inflows from operating activities of the company stood at $23,180,689. While cash receipts from customers reached at $150,396,145, indicating the sale of gold and silver.

- The financial position of the company is robust, with group cash and bullion on hand amounted to more than $40 million as at 30 September 2019.

- In addition, the company possesses working capital facility of $20 million with Macquarie Bank. The company is also having tight cost control throughout the business as well as relatively low corporate overheads for a gold producer of its size.

- The company is also continuing to explore for regional gold deposits surrounding the main KOTH orebody which might be developed as satellite open pits to deliver early mill feed for the proposed bulk mining operation. Regional drilling has already delivered several exciting results.

The stock of RED closed the dayâs trading at $0.275 per share on 13th December 2019.The company has a market capitalisation of $323.72 million as on 13th December 2019. The total outstanding shares of the company stood at 1.25 billion, and its 52-week low and high prices are $0.077 and $0.395, respectively. The stock has provided a total return of 71.88% in the span of six months and provided returns of 208.99% on a YTD basis.

ResApp Health Limited

ResApp Health Limited (ASX: RAP) is involved in the research and development of digital healthcare solutions for respiratory disease.

R&D Tax Incentive Cash Rebate

- The company recently announced that it has received R&D tax incentive cash rebate amounting to $1,798,086 for FY19.

- In addition, the R&D Tax Incentive program of Australian Federal Government provides a cash refund on eligible research and development activities, which have been performed by Australian companies.

Entry into an MOU

- In another update, the company through a release dated 28th November 2019 announced that it has entered a non-binding memorandum of understanding with Coviu, which is a leading telehealth software platform of Australia.

- Under the MOU, integration of the companyâs acute respiratory diagnostic test as well as ResAppDx-EU into Coviuâs owned browser-based telehealth platform is aimed at.

- In addition, this integration will witness ResAppDx-EU to become available to more than 5,500 clinicians who use the Coviu platform currently.

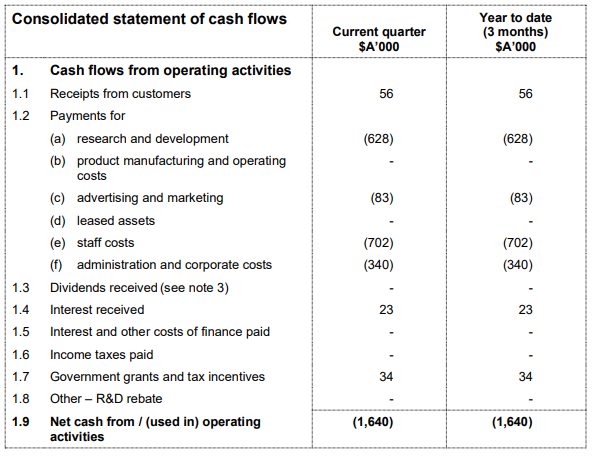

Performance of First Quarter of FY20

- The company recently updated the market about its performance for the quarter ended 30th September 2019 (Q1 FY20). The company has made significant progress in the September quarter by securing important regulatory approvals for ResAppDx-EU in Europe as well as Australia.

- The company also stated that at-home sleep apnoea study has given encouraging results.

- Also, the company announced that it will join, in Munich, the Startup Creasphere Digital Health program.

- As at 30th September 2019, the cash balance of the company stood at $3.8 million, which implies that the company possesses a Strong balance sheet in order to advance the company via commercialization.

Cash Flow Statement (Source: Companyâs Report)

The stock of RAP closed the dayâs trading at $0.250 per share on 13th December 2019.The company has a market capitalization of $189.6 million as on 13th December 2019. The total outstanding shares of the company stood at 790.01 million and its 52-week low and high is $0.069 and $0.415, respectively. The stock has provided a total return of 42.86% in the span of six months and provided returns of 127.27% on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.