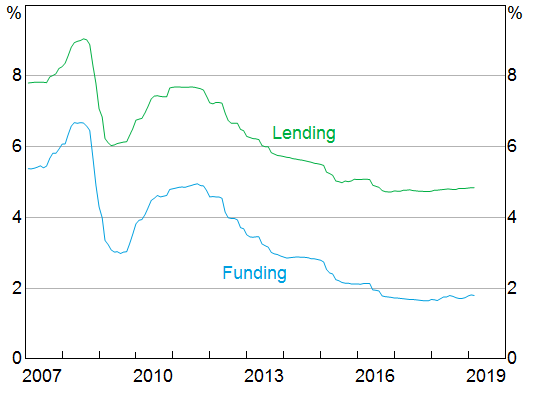

Banking industry in Australia, being a reflection of economy, has seen turbulent times in recent past, led by a housing downturn, banksâ unethical charging of customers, etc. The banks witnessed a little higher funding cost over 2018, led by an increase in the wholesale funding linked to money market rates. However, up to some extent, the rise was offset by a reduction in the cost of retail deposits. At present, funding and lending rates are at the lowest since 2007 as depicted in the below chart.

Major Bankâs Funding Costs and Lending rates (Source: RBA)

Bank of Queensland Limited

Bank of Queensland Limited (ASX: BOQ) is one of the leading regional banks in Australia and is among the few not owned by one of the big banks. Over the years, the bank has emerged from a Queensland focused, traditional retail branch-based bank to a diversified national financial services business with a focus on niche commercial lending segments.

Proceeding by ASIC: The bank very recently, notified that ASIC (Australian Securities and Investments Commission) has initiated proceedings against it in the Federal Court of Australia with the view that the agreements with few small scale businesses, inked between November 2016 and June 2019 by the bank do not contain fair terms. On receiving such intimation, the bank asserted that it has sought to reply in a positive manner and has adopted the necessary steps to address the concerns raised by ASIC. BOQ has begun a review of all such transactions executed from November 2016 and the bank will compensate the adversely impacted clients if any irregularity is found out. With the ongoing review, the bank anticipates that this reimbursement amount will be very limited and is unlikely to have any adverse impact on the financials of the bank.

Leadership Change Update: The bank recently confirmed about the leadership change which was declared on 06 June 2019. The tenure of Anthony Rose as Interim Chief Executive Officer will come to an end on 31 December 2019 and Chief Executive Officer George Frazis will join the bank on 5 September 2019.

Distribution: The bank announced a fully franked ordinary dividend of AUD 0.828400 on BOQPE - CAP NOTE 3-BBSW+3.75% PERP NON-CUM RED T-08-24, for which ex and payment date has been set on October 30, 2019 and November 15, 2019.

Chairmanâs Half Year Letter to Shareholders: With regards to 1H19, bankâs asset quality was strong with adequate capital. The bank is progressing well with its niche business strategy. The period was marked a significant change throughout the sector as Royal Commission came up with its final report in the month of February 2019 on Misconduct in the Banking, Superannuation and Financial Services Industry which had a negative impact on the overall industry. This development forced all the banks in the industry to face increased regulatory requirements and customer expectations. Consequently, the banks will require additional resources and thereby, will see rising costs, resulted from the increased focus on conduct, compliance and meeting customer and community expectations. Banking industry during the period, witnessed a slowdown in credit growth and reduced housing prices, predominantly in capital cities.

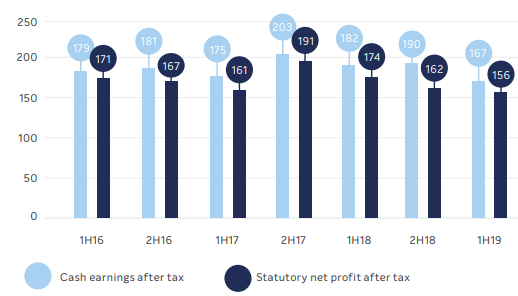

Coming to the performance of the bank during 1H19, cash earnings after tax were down 8% on 1HFY18 to $167 million whereas cash basic earnings per share at 41.8 cents posted a decline of 10% on 1HFY18. Cash return on equity fell 110 basis points (bps) to 8.8%. Lending saw a growth of $500 million during the period, representing an annual rise in balances of 2% in a slowing market. Net interest margin (NIM) during the period saw a decline of 4 bps from 2HFY18 to 1.94%, driven by intense competition seen in new lending, a higher bank bill swap rate and the related impact on hedging costs.

Profit results in $ million (Source: Company Reports)

Profit results in $ million (Source: Company Reports)

At the current market price of $9.210, the stock is available at a price to earnings multiple of 11.380x with annual dividend yield of 7.92%. The stock has corrected ~19.27% in last 1-year and is currently trading at the lower end of its 52-week range of $8.700 - $11.580.

Bendigo and Adelaide Bank Limited

Bendigo and Adelaide Bank Limited (ASX: BEN) is engaged with the provision of a broad range of banking and other financial services including residential, business, consumer, rural and commercial lending, deposit-taking, payments services, treasury and foreign exchange services, wealth management and superannuation.

Proceedings by ASIC regarding Unfair Contract Terms: The bank recently informed that it has been served with court proceedings initiated by ASIC which raised its worries in relation to small business loan agreements by the bank under each of its Delphi Bank and Rural Bank brands within the period of 2016 and June 2019. The signed agreements were updated in the month of July 2019 on account of further guidance provided by ASIC in last year along with the new Banking Code of Practice. The bank intends to help the authority in this regard.

Appointment of non-executive director: The bank recently notified that David Foster has been appointed as a non-executive director. He has 25 years of experience in financial services, most recently with Suncorp Group Limited.

Issue of Securities: The bank also updated that it has issued 41,311 fully paid ordinary shares on converting fully paid unquoted (BENAK- 25,450, BENAA- 10,287, BENAB- 1,363, BENAD- 4,211) to fully paid quoted ordinary shares.

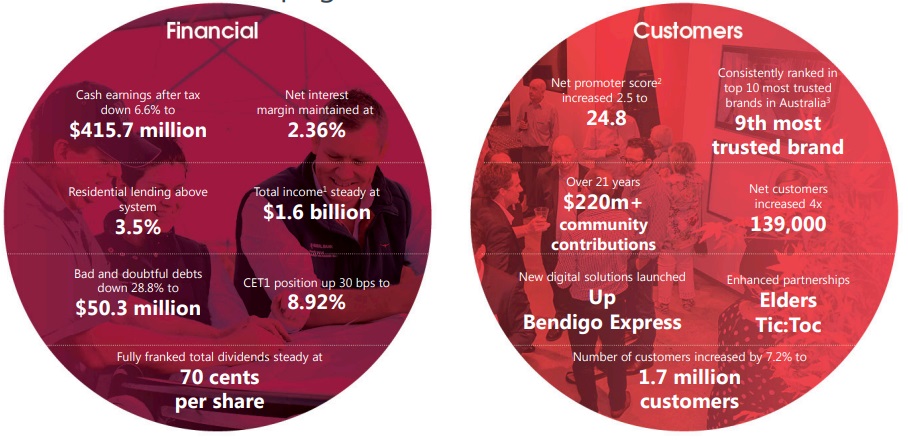

Full Year 2019 Result Highlights: The company recently released its full year results for FY19 wherein statutory net profit at $376.8 million was down 13.3% year over year, mainly due to remediation and redundancy costs and unrealised losses with regards to Homesafe on the back of decline in property valuations in Melbourne and Sydney. Cash earnings after tax was $415.7 million, which was down 6.6% over the previous year. Underlying earnings, excluding remediation and redundancy costs posted a decline of 2.5% to $435.7 million. FY19 NIM came in at 2.36%, steady on a y-o-y basis and increasing 2 bps in 2H19 as compared with 1H19. Total lending posted a growth of 1.1% to $62.1 billion, with meaningful growth of 3.6% in 2H which was well above system growth of 2.6%. Total deposits for FY19 stood at $64.0 billion, posting a growth of 1.5%, with retail deposits growth of 3.3%. The bank has maintained its focus on credit quality which resulted in bad and doubtful debts being down 28.8% to $50.3 million.

Overview FY19 (Source: Company Reports)

On remediation front, the bank has incurred total cost of $16.7 million during FY19. The remediation costs were self-reported to the regulator. These pertained to â (a) Insufficient documentation to establish that services were provided to Bendigo Financial Planning customers according to their service contracts. This business was subsequently disposed off. (b) Products not functioning as per terms and conditions. Operating expenses during the period stood at $954.5 million, posting a growth of 5.9% on prior year, including $16.7 million in remediation costs and $11.9 million in redundancy costs.

At the current market price of $10.950, the stock is available at a price to earnings multiple of 14.120x with annual dividend yield of 6.43% and market capitalization of $5.35 billion. The stock has gained 11.64% in last 6 months and is currently trading toward the higher end of its 52-week trading range of $9.370 - $11.740.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.