Poseidon Nickel Limited

Poseidon Nickel Limited (ASX: POS) is an Australian Securities Exchange listed nickel producer and explorer. The business portfolio of the company includes various projects such as Lake Johnston Project, which contains around 10 Exploration Licences (EL) and two general purpose licences along with 10 mining leases. The other projects of the company are Mt Windarra and Black Swan. The Black Swan operations cover an open pit mine-Black Swan, an underground mine-Silver Swan and a Black Swan sulphide concentrator.

Latest Update:

Poseidon Nickel Limited announced on 12th June 2019 that the company intersected high-grade nickel sulphides at Silver Swan, which in turn, signifies the continuation of high-grade nickel intercepts at the underground mine.

Such results from Silver Swan Underground Mine are important for the company, as they provide the basis for resource revisions for the Silver Swan project in August 2019. Moreover, Silver Swan is important for a restart of the operations at Black Swan. Silver Swan, which historically delivered some of the highest-grade nickel sulphide assays in the world, is scheduled for completion in June 201, with the remaining assays set for release in July 2019.

POS recently completed initial drilling activities at the Black Swan deposit. The company plans to consider the completed program with the outcomes of Silver Swanâs current 3,000-metre drilling program, as part of the mine-life extension and optimisation of the restart program.

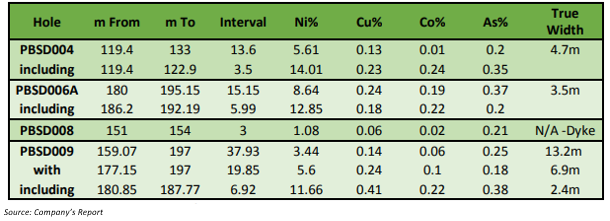

Drill Results:

The significant results received by the company are as:

Stock Actions and Return Metrics:

The shares of the company are in a downtrend since July 2009 or from the level of A$0.440 (high in June 2009). The prices took a rebound in February 2013 to the level of A$0.300 (high in February 2013); however, the shares again plunged till the present level of A$0.038 (closing price on 12th June 2019).

POS delivered a return of -9.52 per cent in one year (as per yesterdayâs close), and the YTD (Year-to-date) return on the companyâs share stands at -11.63 per cent. However, the one-month returns are positive and are at 2.70 per cent.

Raiden Resources Limited

Raiden Resources Limited (ASX: RDN), a copper and gold explorer and miner, presented historical trench and drill data on Vuzel Project in Bulgaria reviewed by the company. An exploration program conducted by Gramex generated the data. The program included geochemical soil sampling and geological and alteration mapping. Apart from that, the program contained small drilling coupled with a channel rock chip sampling over the outcropping mineralisation areas.

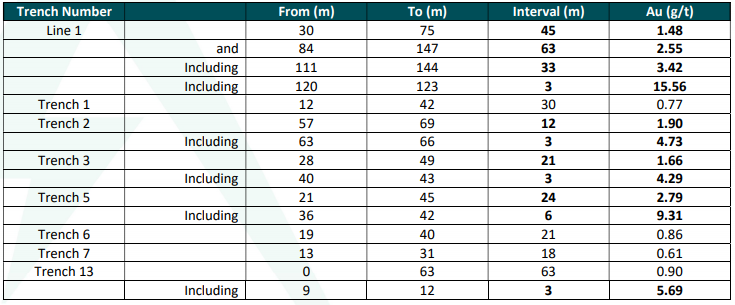

The significant results of channel rock chip sampling include:

Line 1 intercepted 45m @ 1.48g/t of gold and 63m @ 2.55g/t of gold, which further includes @ 3.42 g/t of gold and 3m @ 15.46g/t of gold.

Trench 5 intercepted 24m @ 2.79 g/t of gold, which further includes 6m @ 9.31 g/t of gold.

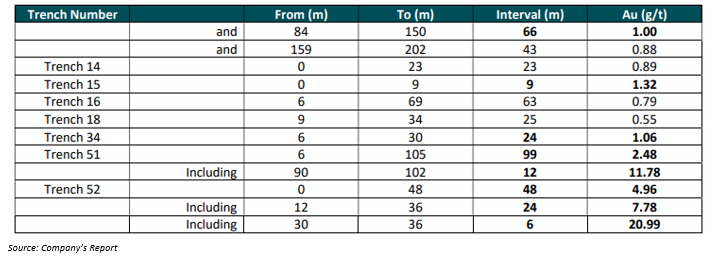

Trench 13 intercepted 66m @ 1 g/t of gold.

Trench 51 intercepted 99m @ 2.48 g/t of gold, which further includes 12m @ 11.78 g/t of gold.

Trench 52 intercepted 48m @ 4.96 g/t of gold, which further includes 24m @ 7.78 g/t of gold and 6m @ 20.99 g/t of gold.

The other results from various trenches are as:

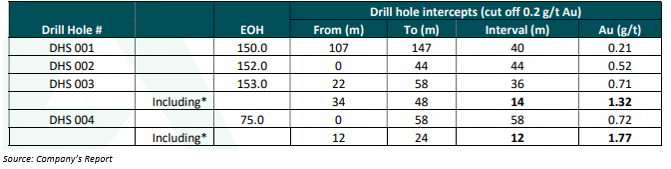

Historical Gramex Drilling:

Gramex drilled four holes, which accounted for a total of 530 metres. The four holes intercepted mineralisation and encouraged the company to confirm that the mineralisation by the surface sampling (as shown under rock ship sampling) extends to depth.

However, the drilling did not intercept significant results, and as per the company, it was due to the vague positioning of the drill collars, as they were not positioned in positions that adequately test the highest-grade zone as defined in the trenching.

The results of four drill holes are as:

Raiden recently entered a gold project purchase agreement concerning Vuzel project.

Stock Actions and Return Metrics:

RDNâs shares are moving in a downtrend from the level of A$0.047 (Dayâs high on 14th March 2018) to the present level of A$0.009 (closing price on 12th June 2019). The company delivered a negative return of 60 per cent in one year (as per yesterdayâs closing). The shares delivered a return of -11.11 per cent on a monthly basis (as on 12th June 2019).

Anson Resources Limited

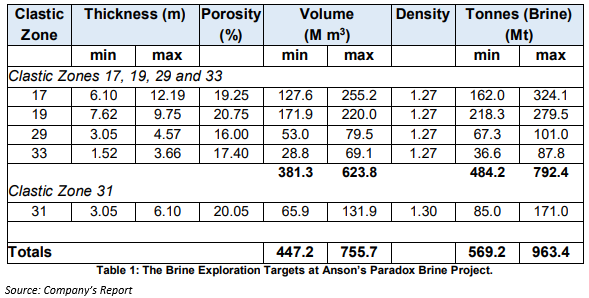

Anson Resources Limited (ASX: ASN), a lithium chemical developer and the host of Paradox Brine Project, announced on 12th June 2019 on ASX that the company calculated exploration targets of 484 million to 792 million tonnes of brine for four Clastic Zones sampled by ASN during the drilling at its Paradox Brine Project.

The estimated grades of these targets are 50 to 150 parts per million of lithium and 50 to 400 parts per million of boron, while the grade of bromine and iodine stands at 2,500 to 4,000 parts per million and 30 to 100 parts per million.

As per the company, the targets are conceptual in nature as the exploration is insufficient to classify the target as per the JORC code.

The results of the four clastic zones are as:

The zone identified as 17 presented a porosity of 19.25 per cent with 6.10m minimum and 12.19m maximum thickness, which would account for 162.0 to 324.1 million tonnes of brine.

The zone identified as 19 presented a porosity of 20.75 per cent with 7.62m minimum and 9.75m maximum thickness, which would account for 218.3 to 279.5 million tonnes of brine.

The zone identified as 29 presented a porosity of 16.00 per cent with 3.05m minimum and 4.57m maximum thickness, which would account for 67.3 to 101.0 million tonnes of brine.

The zone identified as 33 presented a porosity of 17.40 per cent with 1.52m minimum and 3.66m maximum thickness, which would account for 36.6 to 87.8 million tonnes of brine.

The detailed results are as:

Stock Actions and Return Metrics:

The shares of the company are moving down from its Julyâs high of A$0.185 to the present monthâs low of A$0.054 (Dayâs low and close on 12th June 2019).

ASN delivered a return of 25.58 per cent in one year (as per yesterdayâs close), and the YTD (Year-to-date) return on the companyâs share stands at -29.87 per cent. The monthly returns are at -10.00 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.