Dexus (ASX:DXS) operates as one of the top property groups in Australia and manages a $ 28.9-billion high-quality Australian property portfolio. In Australia, the Group directly owns approximately $ 13.9 billion of office and industrial properties; while it also manages retail, office, healthcare and industrial properties for third party clients that are all valued at around $ 15.0 billion.

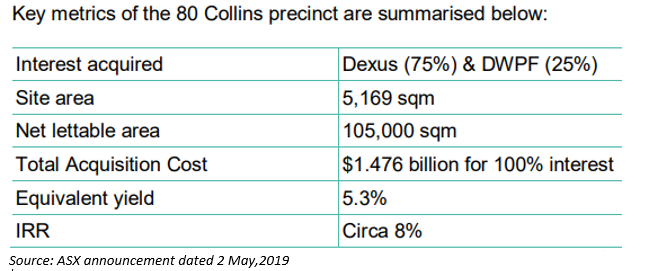

Lately, On May 2nd, 2019, Dexus Funds Management Limited (DXFM), as the responsible entity of Dexus, informed the market that it has agreed to acquire the 80 Collins precinct, alongside Dexus Wholesale Property Fund (DWPF), for a total acquisition cost of $ 1.476 billion from QIC Global Real Estate. While, Dexus will acquire a 75% ownership interest, the remaining 25% would be held by DWPF.

On May 3rd, 2019, the company successfully completed the institutional placement worth $900 million, issuing ~74 million new securities at a price of $12.10 (5.3% discount to the five-day VWAP to 30 Aprilâ19 of $12.78). The funds raised are expected to partly fund the 80 Collins acquisition.

In addition, the company intends to conduct a SPP (subject to a cap of $50 million) wherein eligible security holders can subscribe for up to $15k of new securities per security holder.

The company recently published its Macquarie Australia Conference Presentation on April 30th, 2019, comprising the company overview, the portfolio update to March 31st, 2019 and Australian office sector dynamics along with an outlook for the future.

Of late, the Groupâs development pipeline stands around $ 5.0 billion, of which $ 2.6 billion in under the Dexus portfolio and $ 2.4 billion within the Funds Management business. Besides, there are potential concept opportunities of circa $ 1 billion and a strong balance sheet with gearing of 24.6%.

According to the Groupâs property portfolio operational update for the quarter ended March 31st, 2019, there were various milestones achieved across leasing, development, funds management, transactions and capital management.

During the concerned period, Dexus leased office space covering ~41,874 m2 and office development space covering ~19,225 m2 via 93 transactions leading to a 97.55 rise in the office portfolio occupancy. The industrial portfolio occupancy also increased by 96.9% as the company further leased ~ 46,193 m2 of industrial space through 19 transactions. In the core market, the acquisition of MLC Centre in Sydney was completed jointly with Dexus Wholesale Property Fund (DWPF) for a total price of $ 800 million, which was subsequently settled on April 1st, 2019. An equity raising of approximately $ 340 million was undertaken by DWPF to finance the additional 25% acquisition of MLC centre. The equity raising in turn attracted six new investors and further diversified DWPFâs unitholder base.

In addition, the Group sold its 100% interest in 11 Talavera Road, Macquarie Park for $ 231.2 million and also sold Finlay Crisp Centre, Canberra for $ 62 million via exchange of contracts. These transactions were in accord with Groupâs strategy to divest properties from non-core market and reinvest proceeds to utilise opportunities in the core market.

After the end of the quarter, Healthcare Wholesale Property Fund (HWPF) received a major $ 100-million equity commitment that is still subject to the approval of the Foreign Investment Review Board (FIRB).

The DXS stock last traded at a price of AUD 12.410, down 0.72% as on 3 May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.