Summary

- Australia’s agriculture sector plays an essential role in the country’s food security, and the government ensures there is ample supply.

- The food reaching citizens must meet strong Australian food safety standards; there was no evidence of COVID-19 getting transmitted through food.

- HRL holding updated that its business benefited from its ability to operate “essential services” food testing.

Food and dairy industries are two of the most significant rural industries in Australia. The island nation is amongst the most food-secure countries worldwide and produces significantly more food than its people consume. The domestic food consumption is steady while fluctuations can be observed in agricultural exports.

A report from the Australian government shows that 71% of agricultural products that Australia produces are exported. These include sugar, Beef & Veal, Rice, mutton and lamb, Canola, wheat, dairy products, fruit and nuts, pig, and poultry. Australia imports ~11% of its food which is motivated by taste and variety.

The Australian government highlighted the importance of the agriculture sector in one of its updates released on 1 May 2020. During the COVID-19 outbreak, the government has and continues to put earnest efforts to keep its agriculture industries robust and at the same time, protect the environment. To make food available domestically and globally, the government is working to ensure that superior quality products reach the end-users across the globe.

With this backdrop, we would be looking at two ASX-listed companies, HRL Holdings Limited and Beston Global Food Company and see their recent development.

HRL Holdings Limited provides services to various industries, the food industry being one of them, while Beston Global is into the dairy business.

HRL Holdings Limited (ASX:HRL)

HRL Holdings Limited provides services like sampling, lab testing & data management across Australia and New Zealand. The Company aims to be the preferred provider of highly-valued information on which the customers can rely on for their success.

HRL provides services to various industries, including:

- Food, natural products, and environmental testing.

- Occupational Hygiene.

- Construction material testing and geotechnical engineering.

- Data management.

On 11 June 2020, HRL provided an update on COVID-19 and its FY20 guidance.

Business Trading Update:

From late March 2020 through the end of April 2020, there was Alert Level 4 nationwide lockdown in New Zealand, which had an impact on a significant part of HRL’s NZ operations. Only the laboratories “essential services” food and water testing could trade.

During Alert Level 3 in late April 2020, most of the people were able to return to work. However, there were various restrictions on domestic travel as well as site access which impacted trading conditions.

When NZ restrictions were relaxed further to Alert Level 2, all operation in the country started during mid of May 2020. Although trading was improving, still, the volume was below what existed before the COVID-19 outbreak.

While in Australia, during April and May 2020, all operations continued trading without any interruptions following extensive social distancing and sanitisation practices.

FY2020 Guidance:

In FY2020, HRL Holdings expects its revenue to be in the range A$32 million to A$32.7 million and underlying EBITDA in between A$5.5 million to A$5.8 million.

In the fourth quarter of 2020, the trading conditions have profited from the ability of the group to operate “essential services” food testing together with a strict cost control strategy executed across the business.

Stock Information:

On 11 June 2020, HRL shares settled at A$0.105, up 20.69% from the previous close. HRL has a market cap of A$42.93 million and ~493.4 million outstanding shares.

Beston Global Food Company Limited (ASX:BFC)

Beston Global Food Company Limited is engaged in the production of dairy products including milk and cheese. The Company also produces and processes meat products.

Sale of Beston’s dairy farms in Mount Gambier:

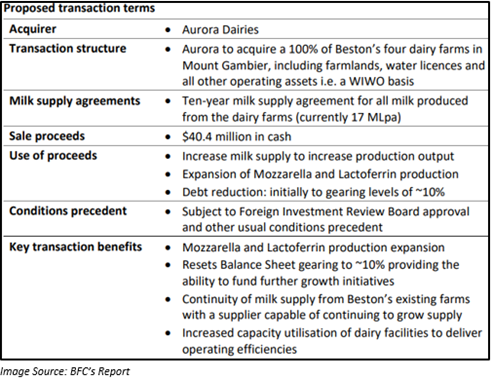

Beston Global Food Company Limited has entered into a deal worth A$40.4 million for the sale of its dairy farms in Mount Gambier to Aurora Dairies.

Under the terms of the proposed transaction, the Company would be receiving milk from farms, presently ~17 million tonnes per annum, over ten years. During this period, Aurora Dairies is expected to grow the production from these farms during the period.

Through this transaction, the Company has met its planned objectives where the realised capital would be re-invested in higher returning dairy factory assets at the same time securing long-term milk supply from the farm.

The proceeds would also support the investment plan at the dairy factories to continue and fast-track the delivery of improved margins & sustainable free cash flow. The proceeds would support in positioning BFC to drive other actions consistent with its five strategic imperatives.

Jonathan Hicks, CEO of Beston Global, had written a letter to the shareholders last month. Following are some of the key highlights:

- Demand for food service witnessed a continuing fall, partially negated by growth in retail sales and a new export contract.

- Dairy Business: Demand was high until 31 March 2020 but saw a decline from April onwards. However, retail demand remained steady with exports also rising during the month with a major contract signed with a Chinese client.

- Milk Supply: The supply for the first quarter of the calendar year 2020 exceeded expectations. Milk prices continue to remain high, and the Company believes the supply is likely to stay resilient.

- Provincial Food Group: Robust retail demand for meat-based products has aided PFG. The group has reached break-even and has a robust order pipeline.

Stock Information:

On 11 June 2020, BFC shares skyrocketed on the ASX and settled at A$0.100, up ~81.82% from the previous close. BFC has a market cap of A$25.91 million and ~471.08 million outstanding shares.