Kogan.com Limited (ASX: KGN) headquartered in Melbourne, Australia is an organization centred in giving services and e-commerce products through digital efficiency in a more feasible and accessible way. The organization serves various sectors such as retail (via dicksmith.com.au and kogan.com), insurance be it life insurance or pet insurance, mobile, travel and health. The company has over eight million active subscribers.

The share price of the company is under tremendous pressure over the past one month with the price dropping by 17%. The company is facing the allegations imposed by the consumer watchdog, Australian Competition and Consumer Commission (ACCC) of engaging in misleading conduct in respect of a tax-time promotion conducted in June last year. Alleged of bluffing the customers by increasing the price of items in a pre-promotion announcement and increasing it post-promotion, ACCC had decided to further issue proceedings against the retailer firm. However, in a recent media release, Kogan strongly condemned ACCC's decision to further go on with the impositions even after explaining all the details of the matter during the investigation.

The firm also said that it has always aimed in providing excellent services for the benefits of their fellow customers incorporating high discounts, admirable delivery services and will continue its path the same way. This matter won't affect the future promotional activities they added.

Also, on 25 June the company informed the market via a release that it is cognizant of a research report that was published which refers to traffic data for the kogan.com website, which suggests visits to Kogan.com were down yoy in Feb 2019 and further down 20% in May 2019. The company stated that the figures reported in the research were inaccurate. Kogan informed in the same release that based on google analytics the companyâs page views and traffic have grown in every month of FY19.

On June 24 2019, Kogan as per the earlier announcements, the company has entered into an agreement with electricity retailer Powershop Australia Pty Ltd (Powershop). Powershop is a subsidiary of Meridian energy limited and boast of being sole Australiaâs electricity and gas retailer to be stamped 100% carbon neutral by the government.

Kogan energy is expected to launch before the termination of 2019 calendar year, Powershop to supply energy and retail services to Kogan energyâs customers and Kogan seeks to undertake sales and marketing activity. Kogan endeavors to simplify the provision of power and gas to its customers and increase the affordability and efficiency of these services through digital efficiency for Australian households.

STOCK PERFORMANCE: Letâs have a look into the stock performance of the firm, the stock has had a good run up in the past six months with returns of over 44%, and it has provided a return of 39.38% in the last 3 months.

On the Australian stock exchange on the day of writing (28 Friday 2019, AEST: 1:28 PM) the stock of Kogan.com opened at A$4.900 with that also being the dayâs high. The stock is trading at A$4.750 down by 3.455 per cent as compared to its previous close price, with a market capitalization of A$461.15 million, with a daily volume of 2482,491. The price to earnings ratio was recorded at 35.890x, while EPS was recorded to be AUD 0.141. Its 52-weeks high price stands at A$7.520 and 52-weeks low price at A$2.610. The annual dividend yield is at 2.48%.

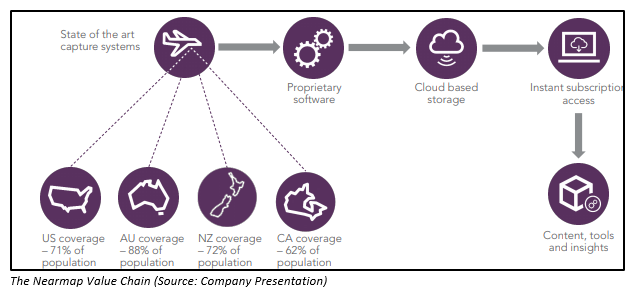

NEARMAP: Nearmap Ltd (ASX:NEA) founded in 2007 and listed on the Australian Stock Exchange, is an innovative location intelligence provider catching a rich informational collection about the real world, giving high worth bits of insights to a diverse range of organizations and government associations. The company is rendering this service with the help of its very own patented camera systems and software. Nearmap provides assistance to a massive number of clients through virtual site visits through high-resolution Photomapping technology. Offering its services in various sectors like that of architecture, insurance, engineering, construction, and the public sector makes it one of the leading companies in the industry of aerial survey.

As per the annual report of 2018 the company reported a total subscription portfolio of $66.2m on 30th June 2018.

On June 6, 2019, Nearmap announced the introduction of its new technological product- Nearmap 3D and the beta version of its AI (artificial intelligence) product. Nearmap 3D will allow its clients to survey the cite in 3D formats giving them the imagery-insights with a 3D experience. The AI beta product developed through its R&D investment, the company has developed a highly accurate machine learning models.

The managing director and the chief executive of the firm Dr Rob Newman also stated that the advancement in artificial intelligence technology would allow their clients to eliminate the manual inspection of sites, identification of specification of parcels and a reduction in time involved in the site foreseeing.

The share prices record a marginal uptick today on the Australian stock exchange (Friday June 28 ,2019, AEST: 01:28 PM) the stock of NEA opened at A$3.870 and trading at A$3.830 up by 0.789 per cent as compared to the previous close withholding the market capitalization of 1.7 billion. Today, it reached dayâs high at $3.900 and recorded dayâs low at $3.820, with a daily volume of 1,002,998. EPS was recorded at a negative of AUD 0.016. Its 52-weeks high price stands at A$4.290 and 52-weeks low price at A$1.105. It's quarterly, and 6-month return has been recorded at 40.74 per cent and +142.04 per cent respectively, while, the year till date return stands at 149.37 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.