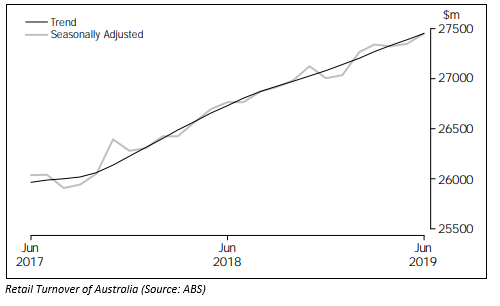

As per the recent figures released by the Australian Bureau of Statistics in June 2019, the trend estimates pertaining to the Retail turnover was up by 0.2 % during June this year, following the suit of prior months - April and May. The seasonally adjusted estimates for Australian Retail turnover were up by 0.4 per cent in June, after a rise of 0.1 per cent in May and fall of 0.1 per cent in April. The original estimate for Australian Retail turnover was down by 1.5 per cent in June. The rising industries comprised of clothing, personal accessory retailing, food retailing, footwear and department stores, to name a few.

In this article, we have chosen three ASX-listed Retail stocks with the intention to acquaint the reader about their respective current affairs in terms of operations and stock performance:

Adairs Limitedâs FY19 Results

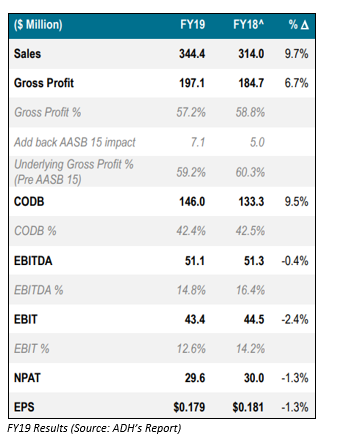

Adairs Limited (ASX:ADH) announced its FY19 Results on 26 August 2019, stating that its Sales were up by 9.7 per cent to $344.4 million and total store count was 165. The Gross Profit rose up by 7.7 % standing at $204.2 million. The EBIT was down by 2.4 per cent to $43.4 million and NPAT was down by 1.3 per cent to $29.6 million. ADHâs net debt was down by $4 million to $8.2 million.

As a part of the announcement, a fully franked Final FY19 dividend of 8.0 cps was announced, taking the total FY19 dividend up by 7.4 per cent to 14.5 cps. This would be paid on 25 September 2019 to the shareholders. It has an ex date of 10 September this year and a record date of 11 September this year.

Cementing the rise of virtual businesses across the country, ADHâs online sales were up by 41.7 per cent to $58.8 million, representing 17 per cent of total sales. However, the Gross Margin fell 110bps to 59.2 per cent, catalysed by the increased freight and distribution costs, increased freight and distribution costs and decline in underlying trading gross profit margin.

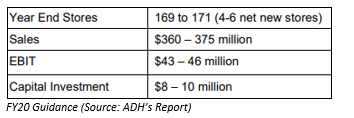

On the outlook front, the company expects the top line revenue growth to be strong. In the first seven weeks of FY20, the company generated like for like sales growth of 4.8 per cent. ADH would open 4-6 net new stores in FY20. The weakness in the Australian dollar is expected to remain a headwind in FY20 as well.

The guidance for FY20 period is provided below:

Kathmandu Holdingsâ Trading Update

Kathmandu Holdings Limited (ASX:KMD) is investorsâ eye-candy and they await the release of its audited results for the 12 months ended 31 July 2019, scheduled on 18 September 2019.

On 8 August 2019, KMD reported an update on its sales and earnings for FY19, stating that it is expecting total sales of NZ$545 million, up by 9.6 per cent and its SSS growth of +0.6 per cent at constant exchange rates. The Normalised EBIT is expected to be reported within the bracket of NZ$82.5 m and NZ$84 m. On the other hand, the Normalised NPAT is expected to be reported within the bracket of NZ$55.5 million and NZ$57 million. KMD is expecting a net debt amounting to NZ$19.2 m.

Satisfied with the second half operations and functionality of the company, MD and CEO Mr Xavier Simonet stated that Oboz, which was acquired in April last year, had delivered strong sales and EBIT growth in the second half, and the company expects the progress to continue in FY20 and beyond.

An Oboz Product (Source: KMDâs Report)

Noni Bâs Trading Update

Initially owned by Noni Broadbent and later purchased by Mr Alan Kindl and a partner, Noni B Limited (ASX:NBL) has established a true market niche in Australia. Investors are keenly anticipating NBL to declare its report for the financial year closed 30 June 2019, scheduled on 27 August 2019.

NBLâs Product (Source: NBLâs Website)

On 12 June 2019, the company released FY2019 Trading Update, which was preliminary and subject to finalisation and review by the companyâs auditors. As per the NBL, the Underlying EBITDA was almost $45b million, in-line with guidance and up by 21 per cent on pcp. The Total sales grew to approx. $864 million for the 12 months ended 30 June 2019. The store network ended on 1,379 stores. The online sales represented 9.8 per cent of total sales and continued to grow. The like-for-like sales for the period were reported at -4.3 per cent, in line with management and integration plan expectations.

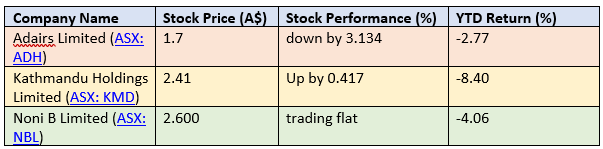

Let us now browse through the stock performance and YTD return generated by the companies under discussion, during the trading hours on the Australian Securities Exchange on 27 August 2019, AEST 3:18 PM:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.