Growth momentum happen on stocks that give higher returns due to competition edge they have due to product, technology etc. as well as they take up major risks, technological upgradation, expansions, mergers & acquisitions. They do have higher P/E ratios as the investors give good valuations to them in anticipation of huge growth of the company in the future.

Further, it has been experienced that growth stocks have performed good during bull run in the markets on the back of rise in the companies’ earnings. Some of the growth companies tend to pay lesser dividends as the company reinvests the revenue for future growth of the company.

Let us now have a look at the ASX listed stocks - WTC, XRO, A2M and BUB:

WiseTech Global Ltd (ASX:WTC)

Reconfirmed the forecast for fiscal 2020:

WiseTech Global Ltd (ASX:WTC) is an Australian company that offers software solutions to the logistics industry, as the company is into the development, sale and implementation of solutions that helps the logistics service providers to track the movement and storage of goods, inventory and information. Over the period of past five years, the company had added approximately 3,500 product enhancements to its global CargoWise platform.

The company has recently obtained Ready Korea, which is a leader in bonded warehouse and trade compliance solutions providing space in South Korea region. This is for the upfront consideration of about $13.2m and has a further multi-year earn-out potential of up to approximately $7.0m, which depends upon the integration of business and product, development of customs, customer conversion and financial performance.

WTC has also acquired SISA Studio Informatica SA (SISA), which is a leader in providing customs and freight forwarding solutions in Switzerland at the upfront consideration of approximately $15.5m and WTC has potential of further multi-year earn-out of up to approximately $8.9m.

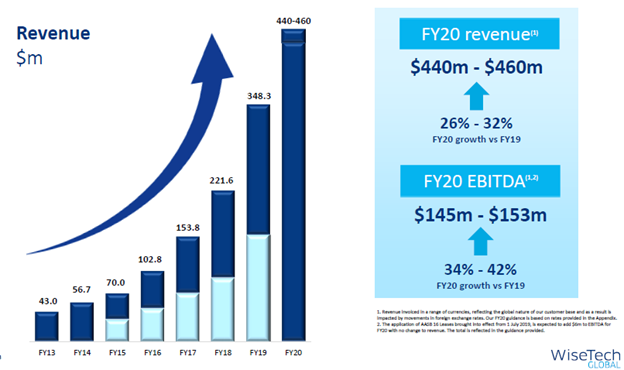

Moreover, the company has reconfirmed the forecast for fiscal 2020. As per the guidance, the revenue is expected to be in the range of $440m - $460m, which represents the revenue growth in the range of 26% - 32% and expects EBITDA to be in the range of $145m - $153m, which represents the EBITDA growth in the range of 34% - 42%.

FY 20 Guidance (Source: Company’s Report)

On 3 February 2020, WTC was trading at $24.970, moving down by 0.24 percent (at AEDT 2:59 PM). Meanwhile, WTC stock has fallen 4.36% in three months as on January 31st, 2020.

Xero Limited (ASX:XRO)

Turnaround Performance in 1H 2020:

Xero Limited (ASX:XRO), a company from New Zealand, that is listed on ASX, provides cloud-based accounting software platform that are meant for small and medium-sized companies. The company provides online solutions related with accounting, automatic bank reconciliation, quotes online training etc.

On 7 November 2019, XRO released its 6-month report for the period ending 30 September 2019. For the first half of 2020, XRO reported 32% increase in the operating revenue to $338.7 million and $29.9 million increase in the net profit after tax to $1.3 million. The company during 1H 20 has delivered 30% increase in annualised monthly recurring revenue (AMRR) to $764.1 million and 30% increase in total subscribers to 2.057 million. The company posted 37% increase in the total subscriber lifetime value to $5.4 billion, as the company had added more than $1 billion in the first half 2020 period. The company during the period has generated the free cash flow of $4.8 million compared to free cash outflow of $9.8 million in the corresponding period last year.

On 3 February 2020, XRO was trading at $85.910, edging up by 0.386 percent (at AEDT 3:36 PM). XRO stock has risen 24.05% in the last three months as on January 31st, 2020.

A2 Milk Company Ltd (ASX:A2M)

Outlook for Fiscal 2020:

Australia based A2 Milk Company Ltd (ASX:A2M) commercialises a2MC branded milk and the associated food items. It also has the ownership of intellectual property, which helps in the detection of livestock required for generating the A1 protein-free milk items. The company sells its products Australia, New Zealand, China, the United Kingdom and USA.

A2M for the first half of 2020 expects revenue to be in the range of $780 million to $800 million, EBITDA margin in 1H20 is projected to be in the range of 31-32% and the FY20 EBITDA margin is projected to be in the range of 29-30%.

On the other hand, Race Strauss has been appointed as the Chief Financial Officer of the company effective 13 January 2020.

On 3 February 2020, A2M was trading at $14.150, falling down by 2.481 percent (at AEDT 3:45 PM). Meanwhile, A2M stock has risen 20.51% in the last three months as on January 31st, 2020.

Bubs Australia Ltd (ASX: BUB)

Second quarter 2020 witnessed 32% decline in sales in China:

Bubs Australia Ltd (ASX: BUB), formerly known as Hillcrest Litigation Services Limited, is into the production and sale of infant milk formula and organic infant food for infants which the company sells it under the BUBS brand.

On 31 January 2020, BUB posted the second quarter 2020 results as the company in China has delivered 32% decline in sales, which forms 15% of the total sales. The sales in China has fallen on the back of the phasing of CapriLac off-take sales pre-Winter after the company delivered strong first quarter period distribution in the Daigou Channel. The company has posted 44 percent rise in China direct sales of Bubs nutrition products, which is done through the Mother and Baby store channel.

In Australia, the company has posted 31% rise in sales, which forms 79% of the total sales. For the second quarter of 2020, the company has reported 21% rise in the total sales to $14.5 million. There has been 118% rise in the revenue from Bubs goat milk infant formula and 77% increase in the revenue from Bubs complete nutritional portfolio in the second quarter 2020.

On 3 February 2020, BUB was trading at $0.725, tumbling down by 10.494 percent (at AEDT 3:55 PM). Also, BUB stock has fallen 28% in three months as on January 31st, 2020.