Iron ore prices inched up slightly again, which marked an increase in prices of the commodity for a third consecutive day. The prices of Iron ore fines 62% Fe (CME) climbed up from the level of $93.24 (Dayâs close on 30th May 2019) to the level of $93.65 (Dayâs high on 1st May 2019). The factor which is supporting the iron ore prices currently in the global market is the demand of the raw material from the steelmaking mills in China.

China is now on holidays till the 5th of May and the domestic mills have restocked the iron ore for the holidays. The prices previously rose amid re-stocking of iron ore by Chinese mills.

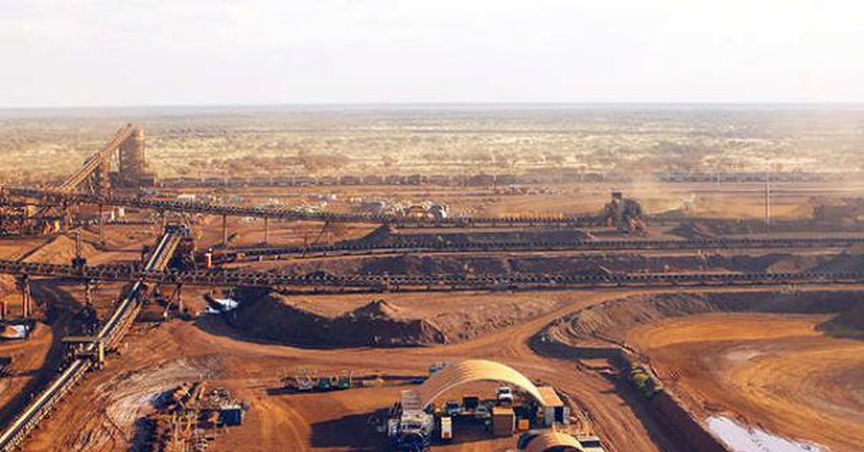

The current demand and supply dynamics of the iron ore market is favouring the prices as the demand in China is relatively high as compared to the current supply ability of global iron ore suppliers such as Australia, Russia, etc. The mills in China are procuring the iron ore aggressively to fill the shortage in domestic steel inventory in China, which led the prices of steel high and prompted mills to raise output to take advantage of high steel prices in China.

Apart from the low steel inventory, the high demand for steel is also supporting the raw material prices. The current demand for steel in China is high as the consumer sector is picking up. Chinaâs stance to curb the environmental pollution led suspension of millsâ activities across various provinces in China from time to time. However, in the recent event, China adopted a policy of relocation and quality improvement, which in turn, is addressing the issue of the temporary suspension on millsâ activities.

On the supply side, the global production loss created a supply panic at the times of high steel demand in China, which in turn, led the iron ore prices high on the global front. However, the supply chain is again building strength, albeit, it is consumed by the current demand. In the long run it should be closely watched by the investors to reckon the price direction ahead.

The iron ore prices are pulling off the charts, but the miners such as Rio Tinto, BHP, Fortescue Metals are plunging on ASX.

Rio Tinto (ASX: RIO)

The share of the company is moving in a continuous downtrend from past one week. The prices took a stall from the level of A$102.830 (Dayâs high on 16th April 2019) to the present level of A$94.450. The share prices have lost approx. 7% in value from the recent high to the current level.

BHP Billiton Limited (ASX:BHP)

The share of the company is mirroring the movement of Rioâs share; the prices are moving in a continuous downtrend from the level of A$40.130 (Dayâs high on 9th April 2019) to the present level of A$37.020. The drop-in share prices accounted for a loss of almost 7.5%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.