Since the second half of 2019, housing markets have been a hot topic, owing to a rise in housing prices across the country, following a period of doom in the housing markets. While some areas may be causing affordability issues, the subdued supply and potential rate cuts might support dwelling values in the near term.

Revival continues

In its January 2020 issue, CoreLogic noted that national home value index was up by 0.9 per cent in the first month of the year 2020, indicating that the housing revival has continued to 2020. The annual growth rate recorded in January was the highest pace of annual growth on record since December 2017.

In the latest issue, housing prices were on the rise in each capital city of the country, and the case was the same in the rest-of-state region, except for regional South Australia.

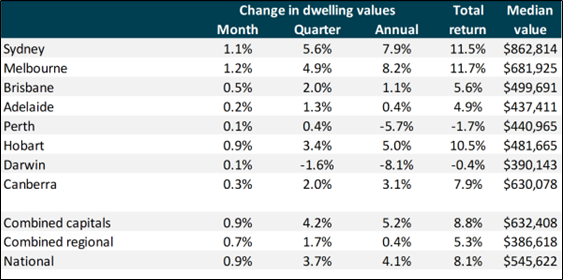

Figure 1: Index results as at 31 January 2020

Source: CoreLogic

Evidently (figure 1), Sydney and Melbourne led the gains during the month, rising 1.1 per cent and 1.2 per cent, respectively. Perth and Darwin recorded the lowest monthly gains with 0.1 per cent each.

On an annual basis, the dwelling values are trending negative in Perth and Darwin, with sharp rises in Sydney and Melbourne at 7.9 per cent and 8.2 per cent, respectively. Also, the combined capital region has seen a rise of 5.2 per cent with combined regional at 0.4 per cent.

For homeowners in Perth, the monthly marginal rise in housing assets came after a period of five and a half-year while recording a rise of 0.4 per cent on a rolling quarter basis for the first time since May 2018. Since 2014, Darwin had witnessed severe falls in housing prices.

Moreover, it appears that the housing turmoil has bottomed out throughout the major cities in the country, as green shoots have appeared in the lagging cities.

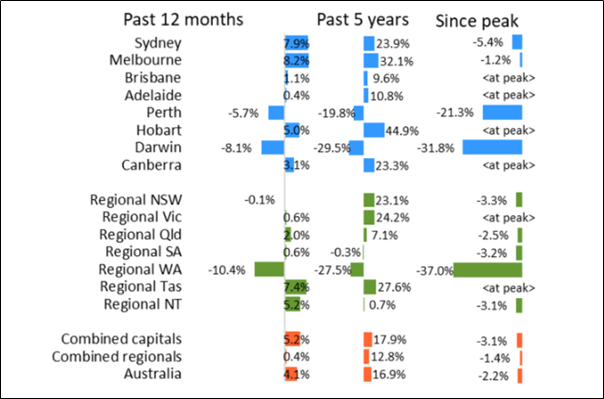

Figure 2: Change in dwelling values

Source: CoreLogic

It was noted that since June 2019, the housing values had recovered 6.7 per cent nationally, but housing values are 2.2 per cent lower when compared to the October 2017 peak level.

When considering the past five years (figure 2), the housing values are down substantially in Perth and Darwin with 19.8 per cent and 29.5 per cent downside, respectively. Also, the housing values are down substantially since the peak in Perth and Darwin.

CoreLogic noted that regional markets have been slow relatively, and the housing values in the regional markets have increased 0.4 per cent in the past year to January 2020 as against a 5.2 per cent rise in combined capitals.

Rentals in Hobart have recorded the highest rise of 5.8 per cent over the past twelve months, with Adelaide and Perth next to Hobart, recording rental gains of 2 per cent and 1.9 per cent, respectively.

Despite rising housing values across the country, the pace of rental increments has not in line with the increase in housing prices, thus compressing gross rental yields. In January, the gross rental yield across all capital cities was noted at 3.5 per cent, which is 11 bps far from record lows.

In Sydney, the gross rental yields were tracking at just 3 per cent, while better rental yields were recorded in cities where rental conditions fared better than housing values, according to CoreLogic.

Darwin, which has a relatively weaker housing market conditions, has the highest gross rental yields at 5.8 per cent. It was noted that gross rental yields and mortgage rate are lower.

At the end of December 2019, the average three-year fixed rate for an investor mortgage was 3.48 per cent, indicating that paying off a mortgage is more affordable than paying rent in many areas.

Interest rate cuts & subdued supply pick-up to support dwelling values

Tim Lawless, CoreLogic’s Head of Research, noted that seasonal challenges dropped the sales activity during January 2020; however, February 2020 could depict some better trends as activity returns to normal levels.

It was reported that the pace of rising housing values in Sydney and Melbourne are moderating, despite m-o-m increases of around 1 per cent, thus the conditions are unsustainable as household income growth is sluggish, and housing affordability challenges are deteriorating.

Although the affordability challenges persist in the capital cities, smaller cities and regional markets might offer affordability. Additional interest rate cuts augmented with population growth are likely to support housing demand.

On the supply side, the new housing construction activities remain on a decline in spite of dwelling approvals in recent months. As a result, there could be supply-side pressures, possibly supporting housing values in the near term.

Second order affects may follow soon

With the conditions indicating that paying mortgage maybe economically viable than paying off rent; it may lead to two scenarios wherein the households are paying off mortgage prepayments in an effort to become debt-free earlier than expected, and the second being that those households with no personal housing property might be vying for own house.

In either scenario, there could be additional demand from both households.

The existing debt coming down when mortgage prepayments are ongoing would enable households to spend on other discretionary needs. As for households buying a new house, the demand may arise from the requirements of housing goods, including furniture, fixtures, and appliances.

However, the above assumptions may need households to be employed and earning a wage that tackles the affordability challenges. In the meantime, the first home loan deposit scheme is likely to help ambitious first-time buyers to get a loan and thus a house.

If household demand revival is to be seen in the near term, the underlying conditions of unemployment and wage growth should be tackled in the first place. And, this might require additional fiscal measures to establish a skilled workforce, which meets the expectations of the employers.

In addition, government spending, as well as private investments, needs to pick up, which is likely to boost further employment and wage growth. However, given the unknown duration of the coronavirus outbreak, the demand from China may witness weakness, thus adding pressure to the Australian economy due to its dependence on the Chinese demand and economic activity.