iOSâ¦Siriâ¦iCloud...AirPlayâ¦AirDropâ¦FaceTime and now Liquid Retina display, the company loves its jargons and users of the Apple productsâ area are very well familiar with them all. Incorporated in 1977, Apple, Inc. (NASDAQ:AAPL) is an American tech multinational engaged in the design, manufacturing and marketing of smartphones, PCs and portable digital music players. Over the years, the brand has carved out a niche for itself across the global consumer landscape and released a string of hot products, MacBook, iPhone series, iMac to name a few.

With a market capitalisation of $ 1.025 trillion, the stock price of Apple has gone up by more than 43% since the onset of 2019, which is twice the gains delivered by the S&P 500 Index.

In September 2019, the technology giant announced the launch of its new generation of iPhones including iPhone 11 Pro, iPhone 11 Pro Max and iPhone 11, featuring iOS 13 and a beefed-up battery life, in addition to Apple Watch Series 5, which arrived in stores around the globe on 20 September. Since that time, the Apple stock price has rallied around 4%. The better than anticipated positive response from the iPhone fanatics to the new Apple products is expected to bring greater potential gains to the stockâs valuation, as per market analysts at the backdrop of a thriving services industry worldwide.

Last year, on the other hand, when the iPhone X was released, the sales did not meet Appleâs sky-high expectations as the company took the plunge to reinvent the model and deliver a totally new design, a never-before-seen Face ID system, and a four-figure price tag. The company was hoping that its loyal customers would show trust in its design and go the extra mile to adapt. But then, it was one of the most substantially expensive iPhones in the history of consumer electronics and the sale of fewer units was quite inevitable as the users adopt to the exorbitant pricing. Thus, iPhone X too gained a lot of attention; however, on a comparative basis, it was an underrated masterpiece.

This year has been a good one for the company in general and the upcoming launch of Apple TV+ in November 2019 could further give the stock an uplifting push. In light of the recent developments, Canada-based Canaccord Genuity recapitulated its buy rating for Apple, raising its target to $ 260.00 from $ 240.

On 11 October 2019, the shares of AAPL stock settled the market trading at a market price $ 236.21, gaining approximately 2.66% from the previous close of $ 230.09. AAPLâs P/E ratio is 19.35 and the stockâs 52-week high is $ 237.64. Another noteworthy observation for 2019 is that Apple has been the best performing stock of the whole FAANG family which includes Facebook, Inc. (NASDAQ:FB), Apple, Inc. (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Netflix, Inc (NASDAQ:NFLX), and Google parent Alphabet Inc. (NASDAQ:GOOG).

Several mutual funds like Fidelity 500 Index Fund, Vanguard Growth Index Fund, SPDR S&P 500 ETF and Vanguard 500 Index Fund along with individual businesses being BlackRock Fund Advisors, The Vanguard Group, Inc., Berkshire Hathaway, Inc. BlackRock Investment Management hold Apple shares.

The wild success of the new models has prompted market analysts to forecast major improvements in the earning for the September quarter that could most likely hit the high end of the guidance range prescribed by Apple. This is despite some near-term headwinds from consumer willingness to wait for the 5G iPhones to be rolled out in 2020 and the ongoing US-China trade and tech dispute.

Due to the stronger initial demand for the iPhone 11 series, the market participants are of the view that Apple would most definitely be successful in upholding its market share leadership of premium-tier smartphones, as has been the phenomenon for years.

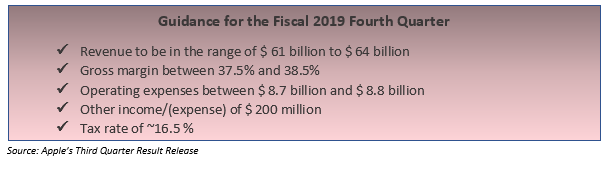

As per the financial results for its fiscal 2019 third quarter ended 29 June 2019, Apple posted quarterly revenue of $ 53.8 billion, depicting an increase of 1% on the prior corresponding period (PCP), and quarterly earnings per diluted share of $ 2.18, down 7% on PCP. The international sales for the period accounted for 59% of the quarterâs total revenue.

Apple had the best June quarter in its financial history. The record result was driven by several factors including accelerated growth in sales of wearables and strong performance from iPad and Mac. Some of the other factors that contributed towards the result were significant improvement in iPhone trends and record revenue from services.

The improved business performance also resulted in net positive cashflow of $ 11.6 billion from operating activities and the company returned more than $ 21 billion to shareholders during the quarter, which included $ 17 billion through open market repurchases of approximately 88 million common stock shares, and $ 3.6 billion paid in dividends and equivalents. The company has consistently paid increasing dividends over the years.

Appleâs CEO Tim Cook added that the results for the third quarter has been promising across all the geographic segments and the company is highly optimistic about the way ahead.

A cash dividend of $ 0.77 per share on the companyâs common stock was also paid out to shareholders by Appleâs Board on 15 August 2019. As at 29 June 2019, cash, cash equivalents and restricted cash totalled $ 52.15 billion.

This yearâs iPhone cycle has been better than was being feared and the remaining of the calendar year 2019 is expected to be an exciting period for Apple with major launches on all of the platforms, new services and several new products lined up.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.