Energy Sector:

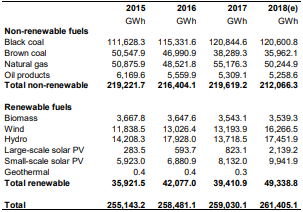

In Calendar Year 2018, the total electricity generation in Australia was estimated at 261,405.1 gigawatt hours (GWh). Electricity from non-renewables in CY2018 was estimated at 212,066.3 GWh, which is ~81% of total electricity contribution, while ~19% of total electricity contribution for the period was from Renewable energy sources.

Under the Non-Renewable sources, contribution from black coal for electricity generation for CY18 was maximum at ~57%, whereas contribution from oil products was the least at ~2.5%. Under Renewable sources, electricity generation contribution from Wind and Hydro for CY18 were close at ~33% and ~35%, respectively, whereas contributions from Biomass and Large-scale solar PV (Photovoltaic) stood at ~7.2% and ~4.3%, respectively.

Australian Electricity Generation Data (Source: Department of Environment and Energy)

As per the States and Territories, electricity generation/consumption in New South Wales for CY18 was estimated at 72,472.1 GWh, which is ~27.7% of the total Australian electricity generation. In Victoria, contribution for CY18 was 47,337.6 GWh (~18.1%), Queensland 70,481.7 GWh (~26.9%), Western Australia 41,113.5 GWh (~15.7%), South Australia 14,174.9 (~5.42%), Tasmania 12,293.8 GWh (~4.7%), and Northern Territory 3,531.5 GWh (~1.35%).

There are significant number of listed energy companies in Australia ranging from blue chips such as Woodside Petroleum Ltd to the companies with market capitalisation within ~10 million. The energy companies can be segmented into explorers, producers and developers, with various companies covering the entire spectrum. Energy sector is capital intensive and usually the gestation periods are longer, however its significance is indispensable. Few prominent players in the energy space are Woodside Petroleum Ltd (ASX:WPL), Santos Limited (ASX:STO), Beach Energy Limited (ASX:BPT), Cooper Energy Limited (ASX:COE) and WorleyParsons Limited (ASX:WOR).

Woodside Petroleum Ltd

Woodside Petroleum Ltd (ASX:WPL) is involved in the hydrocarbon exploration, evaluation, development, production and marketing. The company recently updated the market that it declared fully franked interim dividend of USD 0.36 per share (AUD 0.53238687), with record date and payment date on August 27, 2019 and September 20, 2019, respectively. On August 25, 2019, WPL informed the market about the first oil from the Greater Enfield Project, from its Ngujima-Yin floating production storage & offloading vessel.

H1FY19 Financial Highlights: Net profit after tax for the period was reported at $419 million. Production in the first half was reported at 39.0 MMboe and operating revenue was reported at $2,260 million. Strong credit ratings of Baa1 and BBB+ were reaffirmed by Moodyâs and S&P Global, respectively with a stable outlook.

H1FY19 Key Metrics (Source: Company Reports)

On the stock information front

On August 30, WPL settled the dayâs trade at $32.130 up 1.61%, with the market cap of ~$29.6 Bn. Its 52 weeks high and 52 weeks low stand at $39.380 and $29.330, respectively.

Santos Limited

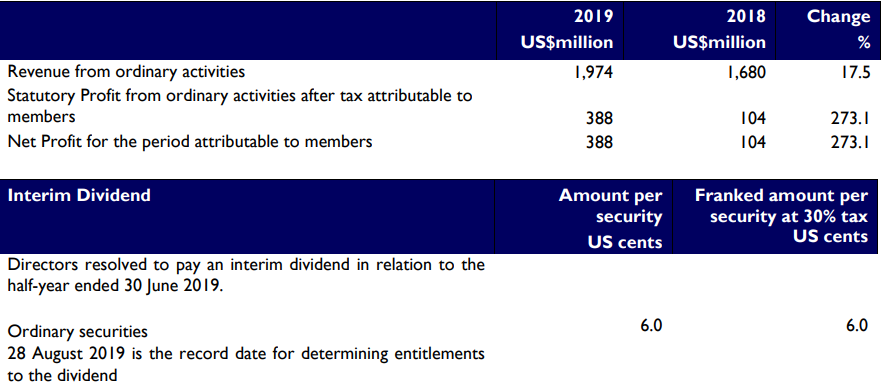

Santos Limited (ASX:STO) is involved in the exploration, development, production, transportation and marketing of hydrocarbons. On August 22, 2019, the company published its half yearly report wherein it highlighted that its product sales increased by 18% to US$1,974 Mn on pcp. Earnings before interest, tax, depreciation, depletion, exploration, evaluation and impairment (EBITDAX) for the period increased by 43% on pcp to US$1,260 Mn. Underlying profit for the period increased by 89% on pcp to US$411 Mn and the NPAT increased by 273% on pcp to US$388 Mn. Free cash flow for the period increased by 74% on pcp to US$638 Mn. The Board of Directors declared (fully franked) interim dividend of US 6 cents per share, with record date and payment date on August 28, 2019 and September 26, 2019, respectively.

H1FY19 Key Metrics (Source: Company Reports)

On the stock information front

On August 30, STO settled the dayâs trade at $7.210 up 2.70%, with the market cap of ~$14.62 Bn. Its 52 weeks high and 52 weeks low stand at $7.490 and $5.145, respectively.

Beach Energy Limited

Beach Energy Limited (ASX:BPT) is involved in the oil and gas, exploration and production company headquartered in Adelaide, South Australia. The company acknowledged the announcement made by Cooper Energy (ASX:COE) that it has successfully concluded the three well appraisal programs at the Parsons oil field, Copper Basin, South Australia by the PEL 92 Joint Venture. Cooper Energy and Beach Energy (operator) holds stake of 25% and 75%, respectively, in the PEL 92 JV.

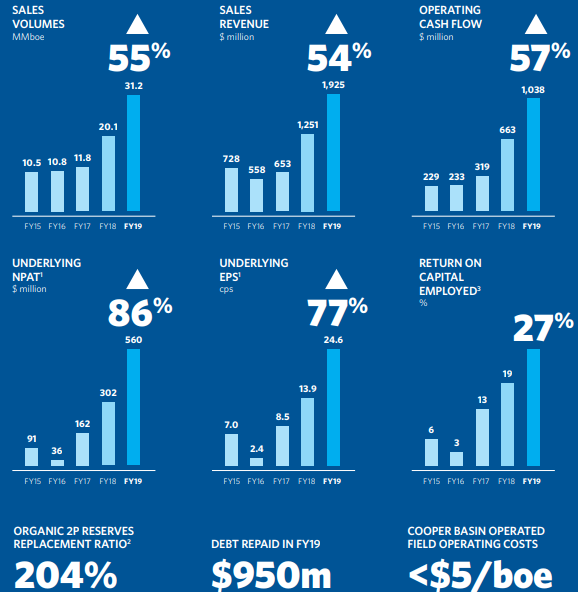

FY19 Key Highlights: Underlying EBITDA increased by 80% to $1,375 million on the previous year. Underlying NPAT increased by 86% to $560 million on the previous year. Return on Capital Employed (ROCE) for the period was reported at 27% as compared to 19% in FY18. The Board of Directors declared (fully franked) final dividend of 1 cps, with record date and payment date on August 30, 2019 and September 30, 2019, respectively.

FY19 Key Metrics (Source: Company Reports)

On the stock information front

On August 30, BPT settled the dayâs trade at $2.450 up 5.1%, with the market cap of ~$5.31 Bn. Its 52 weeks high and 52 weeks low stand at $2.450 and $1.275, respectively.

Cooper Energy Limited

Cooper Energy Limited (ASX:COE) is an upstream oil and gas exploration and production company and is involved in securing, finding, producing and selling hydrocarbons. The company on August 22, 2019, informed the market that it has successfully concluded the three well appraisal programs at the Parsons oil field, Copper Basin, South Australia by the PEL 92 Joint Venture. Cooper Energy and Beach Energy (operator) holds stake of 25% and 75%, respectively, in the PEL 92 JV.

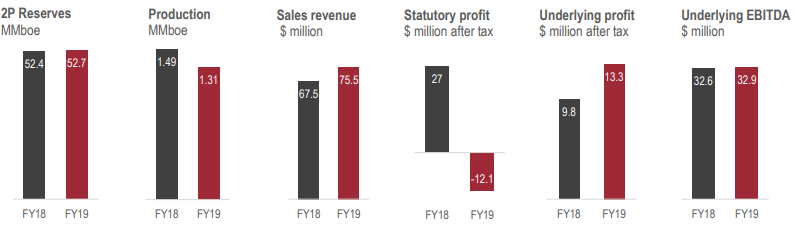

FY19 Key Highlights: Statutory net loss after tax for the period was reported at $12.1 million, as compared to net profit after tax of $27.0 million in the previous year. Underlying profit after tax was reported at $13.3 million, which is an increase of 36% as compared to $9.8 million in FY18. Underlying EBITDA for the period increased by 1% to $32.9 million, as compared to $32.6 million in FY18. Gas sales revenue increased by 28% on previous year.

FY19 Key Metrics (Source: Company Reports)

On the stock information front

On August 30, COE quoted $0.575 and traded flat with the market cap of ~$932.39 Mn. Its 52 weeks high and 52 weeks low stand at $0.595 and $0.390, respectively.

WorleyParsons Limited

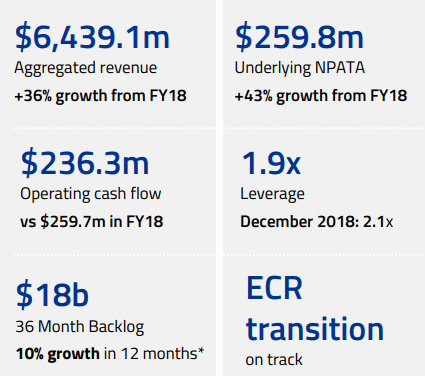

WorleyParsons Limited (ASX:WOR) is involved in the providing engineering design and project delivery services, including providing maintenance, reliability support services and advisory services in energy, chemicals and resources. The company on August 21, 2019, published its FY19 annual report wherein it highlighted that its aggregate revenue increased by 36% to $6,439.1 million. Its underlying EBITA increased by 32% to $412.8 million. Its underlying NPATA increased by 43% to $259.8 million. The operating cash flow decreased by $23.4 million to $236.3 million. Backlog increased by 10% to $18 billion from $16.4 billion (on proforma basis). On Statutory basis, the revenue increased by 43% to $6,924.3 million and NPATA increased by 137% to $172.3 million. The Board of Directors declared final dividend of 15.0 cents per share, with record date and payment date on August 28, 2019 and September 25, 2019, respectively.

FY19 Key Metrics (Source: Company Reports)

On the stock information front

On August 30, WOR settled the dayâs trade at $12.290 down 0.081%, with the market cap of ~$6.38 Bn. Its 52 weeks high and 52 weeks low stand at $20.028 and $10.720, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.