Banking Sector is one of the prominent sectors of an economy and often considered as the backbone of the country. Also, market participants are aware of the impact of COVID-19, which is increasing rapidly and affecting the growth of the Australian Economy. However, measures taken by the banks and regulatory authorities are helping the growth of the banking industry.

For instance, in a recent monetary policy decision by Reserve Bank of Australia (RBA), it has slashed the cash rate target to 0.25%. The Board of the RBA would also not expand the cash rate target until there is no headway in the direction of complete employment among people. In the below article, we will look at how the big four banks of Australia are performing amidst COVID-19 and low-interest-rate environment:

- Australia And New Zealand Banking Group Limited (ASX: ANZ)

- Bank of Queensland Limited (ASX: BOQ)

- National Australia Bank Limited (ASX: NAB)

- Commonwealth Bank of Australia (ASX: CBA)

Let us discuss in detail:

Australia And New Zealand Banking Group Limited (ASX: ANZ)

Australia And New Zealand Banking Group Limited (ASX: ANZ) is a well-known bank, which provides banking and financial products and services to individual and business customers.

Recently, The Vanguard Group, Inc. and its controlled entities has made a change to their substantial holdings in ANZ on 17th March 2020. Their current voting power remains at 6.012% as compared to the previous voting power of 5.001%.

Rolled Out COVID-19 Support Package

Recently, the bank has rolled out the COVID-19 support package for small business and home loan customers with the potential to inject an amount of $6 billion into the economy of Australia. This major support package comprises of the following:

- ANZ has lowered fixed rates of 0.80% per annum on new loans in the small business space, as well as 0.49% per annum for home loan consumers.

- The Bank has also reduced variable small business rates to 0.25% pa and variable home loan rates to 0.15% pa.

- Moreover, it has provided an option of a deferral on loan repayments for up to six-months to small and medium business customers as well as its home loan customers.

The stock of ANZ last traded at $15.470 with a fall of 7.365% as on 27th March 2020 with a market capitalization of $47.36 billion while the total shares outstanding of ANZ stands at 2.84 billion. At the same market price, the annual dividend yield of ANZ stood at 9.58%. The stock made a high and low of $29.300 and $14.210 during last 52 weeks. It generated a return of -32.61% and -41.20% during the last three-month and six-month, respectively.

Bank of Queensland Limited

Bank of Queensland Limited (ASX: BOQ) officially got listed on Australian Stock Exchange in 1971, which provides banking, financial and related services.

Recently, the bank has refreshed its five-year strategy in order to fuel improved customer experiences, generate sustainable and profitable growth as well as to create long term value for the shareholder. This refreshed strategy includes of the following:

- Bank of Queensland would insert empathetic culture across all areas of the business for supporting its focus on providing customers with improved experiences, as well as building the capability of its people.

- Under the strategy, the bank would focus on the niche consumer segments, which provides the greatest opportunities for increasing sustainable returns.

- BOQ would maintain its effort on developing into a digital bank of the upcoming times with a personal touch.

- The bank’s strength lies in its simple and insightful business but solid implementation expertise.

- Moreover, it would maintain a strong financial and risk position, with attractive returns.

In order to protect deposit holders, the capital strategy of the bank targets to maintain adequate capital levels. The capital of BOQ is managed and measured in accordance with Prudential Standards circulated by APRA.

As at 30th November 2019, the Common Equity Tier 1 (or CET1) Capital Ratio stood at 9.5% and total Capital Ratio was reported at 12.8%. However, the Board of bank expects the Common Equity Tier 1 Capital in the ambit of 9.0% and 9.5%.

The stock of BOQ last traded at $4.780 with a fall of 3.239% as on 27th March 2020 with a market capitalisation of $2.24 billion, while the total shares outstanding of BOQ stands at 454.34 million. At the same market price, the annual dividend yield of BOQ stood at 15.38%. The stock made a high and low of $9.980 and $4.630 during last 52 weeks. It generated a return of -33.24% and -49.95% during the last three-month and six-month, respectively.

National Australia Bank Limited

National Australia Bank Limited (ASX: NAB) provides banking, financial and related services.

On 24 March 2020, NAB updated the market that NAB Capital Notes that were issued by it on 23rd March 2015 (ASX:NABC) were suspended from official quotation on 11 March this year, and resale of them to be nominated purchaser was concluded on 23 March this year. Those NAB Capital Notes will be eliminated from official quotation w.e.f from the end of the trading session, as on 24 March this year.

The bank, recently, on 23 March 2020 wrapped up the resale of all NAB Capital Notes that were issued on 23rd March 2015 to the NCN nominated purchaser in line with the resale notice issued by NAB on 17 February 2020. The bank paid $100 cash/ NCN to all NCN holders on 23rd March 2020.

Decent Performance in Q1 FY20

During Q1 FY20, the bank reported decent performance in a challenging operating environment along with a low cash rate and subdued lending growth.

- The earnings for Q1 FY20 has experienced a rise of 1% as compared to quarterly average of 2H FY19. Revenue for the period went up less than 1%, which largely reflects a marginal higher net interest margin.

- Higher net interest margin resulted from home loan repricing that are helping to offset the impact of a low interest rate environment.

- Strategic Priority Segments Net Promoter Score has witnessed a decline from -16 in September 2019 to -18 in December 2019 and ranked NAB in first of the major banks.

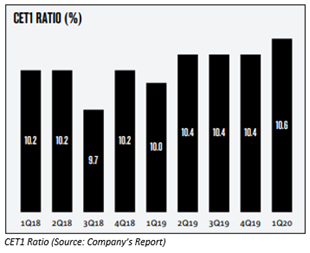

- As at 31st December 2019, the CET1 ratio of the group stood at 10.6% versus 10.4% at September 2019, which consist of $0.7 billion of 2H FY19 Dividend Reinvestment Plan underwrite proceeds.

The stock of NAB last traded at $15.120 with a decline of 6.32% as on 27th March 2020 with a market capitalisation of $48.16 billion, while the total shares outstanding of NAB stands at 2.98 billion. At the same market price, the annual dividend yield of NAB stood at 10.29%. The stock made a high and low of $30.000 and $13.940 during last 52 weeks. It generated a return of -35.26% and -45.97% during the last three-month and six-month, respectively.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX: CBA) is a provider of banking and financial services, which got listed on ASX in 1991.

On 25 March 2020, CBA notified the market that is has ceased to be a substantial holder in DATA#3 Limited effective 23 March 2020.

On the other hand, Commonwealth Bank of Australia and its related bodies corporate has recently become a substantial holder in Carbon Revolution Limited on 23rd March 2020 with the voting power of 1.22%.

The bank has recently on 20 March issued subordinated notes of A$280 million with respect to its U.S. $70,000,000,000 Medium Term Note Programme.

Growth in Net Interest Income

The bank managed to deliver solid result in 1H20 for the period ending 31 December 2019, which has benefitted from its focus on strong execution in the Bank’s core franchise.

- CBA recorded statutory NPAT or net profit after tax to $6,161 million with a rise of 34%. This amount includes gain of $1,688 million from the sale of CFSGAM.

- Volume growth in its core businesses and stable Group NIM has helped the bank in delivering growth of 1.7% in Net Interest Income.

- The reduced cash rate would go on to effect NIM when the advantages of the equity and deposit hedges run away. Moreover, for the half-year period, the Board of the bank announced fully franked interim dividend of $2.00 per share on the back of strength of its balance sheet as well as its surplus capital position.

The stock of CBA last traded at $57.660 with a fall of 6.699% as on 27th March 2020 with a market capitalization of $109.4 billion, while the total shares outstanding of CBA stands at 1.77 billion. At the same market price, the annual dividend yield of CBA stood at 6.81%. The stock made a high and low of $91.050 and $53.440 during last 52 weeks. It generated a return of -23.77% and -23.87% during the last three-month and six-month period, respectively.