Crude oil prices are moving down recently, and the United States is the major contributor in the downtrend in oil prices. The United States is exerting pressure on crude oil prices in three different ways.

- First, the United States is building their domestic inventory of Crude oil, which in turn, is moving the United States in a strong position to become a net crude exporter, rather than a net importer of oil.

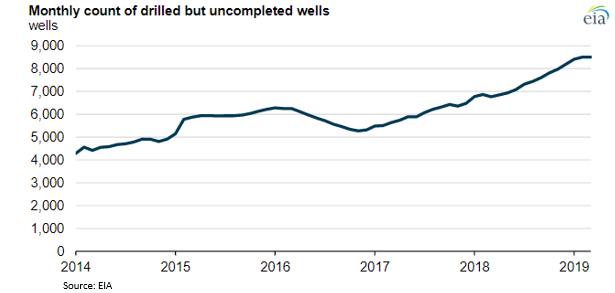

- Second, the number of the uncompleted wells in the United States are increasing drastically, which are drilled but yet not completed in the region of high oil and Natural gas production.

- Third, the actions of the United States president (intention to raise import tariffs from 10% to 25% on $200 billion worth of Chinese imports), is currently pulling down the strings of the global economic outlook further hampering the crude oil prices.

The above mentioned three factors are making the United States a crucial driver of crude oil prices; thus, in turn, the United States is now betting against the OPEC and dragging the crude oil prices down.

Oil production Capacity:

The United States is increasing the number of new-well oil production per rig, which in turn enabling a stronghold of crude for the United States further positioning it in a neck-to-neck situation with the oil producing cartel. As per the data, the new well oil production per rig increased in many states of the U.S., which led to an increase in the number of barrels added to the supply chain per day.

Anadarko region marked an increased production from 396bpd in April 2019 to 404bpdd in May 2019. Niobrara region marked an increase from 1,267bpd in April 2019 to 1,278bpd in May. Permian region, which hosts Permian Basin marked a production increase from 618bpd in April to 650bpd in May. The weighted average of rig increased from 676 in April 2019 to 692 in May.

The number of uncompleted drill wells is also increasing in the United States, and energy investors may keep a close eye on the development of these wells. As once completed, it has the potential to act in favour of the U.S. and support high production.

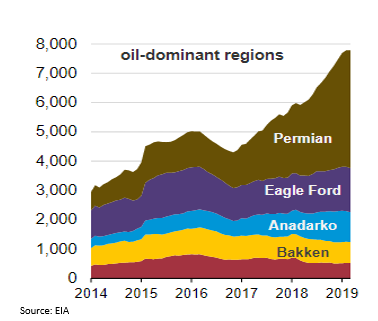

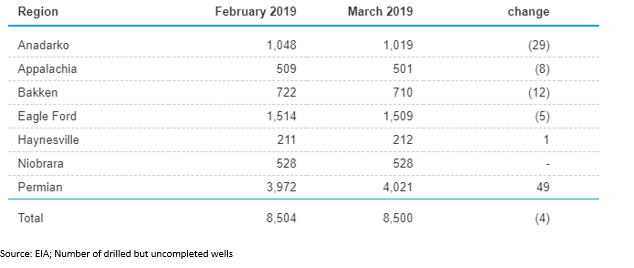

Region-wise breakup of drilled but uncompleted wells (Jan 2014-March 2019) is as follows:

The number of uncompleted drilled wells in the United States marked a decline in March 2019, as compared to February 2019. The decline in such numbers represents the completion of such wells, which in turn, if reduced monthly, could provide ample boost to the crude oil production.

As a result of the boost provided by the production capacity, the inventory in the United States rose significantly in April, which in turn, exerted pressure on crude oil prices.

The last but not the least factor contributed by the United States, which caused the oil prices to fall, was the recent tweet from the U.S. president Donald Trump. The president has mentioned that he intends to increase the tariff on China from the current 10% to 25%, which in turn, jeopardized the progressive trade-talks. The earlier progressive trade talks supported the recovery in the global economic conditions, however the estimation that China might retaliate again questioned the positive outlook on the global economy; which in turn, hampered the oil demand and exerted substantial pressure on the prices.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.